The financial markets are rather steady as the week is heading for close. Euro remains the strongest major currency for the week even though it’s losing some upside momentum. In particular, there is some selling seen in the common currency after ECB press conference yesterday. And on the other hand, Sterling is picking up momentum in Asian session and could overtake Euro’s place. Japanese Yen and commodity currencies are generally weak. Canadian dollar got a brief lift on news that US is staying with NAFTA earlier this week. But renewed selling in crude oil is dragging down the Loonie again. Dollar is trading mixed for the moment as markets found little inspiration from US President Donald Trump’s tax plan.

In other markets, DJIA closed up 0.03% at 20981.33 overnight. S&P 500 rose 0.06% to close at 2388.77. NASDAQ extended its record run and closed up 0.39% at 6048.94. While DJIA and S&P 500 lost some momentum ahead of record highs, both are still on course to extend the long term up trend. As noted before, the corrective pattern in DJIA from 21169.11 should have completed at 20379.55 already. And we’d anticipate a break of this record high soon, possibly in reaction to Q1 GDP report to be released today.

Yesterday, ECB left the monetary policy and the QE program unchanged. That is, the main refi rate, marginal lending rate and the depo rate stayed unchanged at 0%, 0.25% and -0.40%, respectively. Meanwhile, the asset purchase program would be continued at the pace of 60B euro per month from this month, through to the end of December 2017, or beyond, if necessary. Policymakers acknowledged the increasingly solid economic recovery in the Eurozone. The key message about the economy was that the recovery in the bloc is strengthening and broadening, whilst risks are diminishing. Yet, they refrained from discussing about potential tapering, likely due to concerns over subdued core inflation. More in ECB More Confident on Growth, but Inflation Remains an Overhang

Released from Japan, National CPI core was unchanged at 0.2% yoy in March. But Tokyo CPI core improved to -0.1% yoy in April. Retail sales rose 2.1 yoy in March. Household spending dropped -1.3%. Unemployment rate was unchanged at 2.8%. Industrial production dropped -2.1% mom. From Australia, PPI rose 0.5% qoq in Q1. New Zealand trade balance turned to NZD 332m surplus in March, building permits dropped -1.8% mom.

A number of key economic data will be featured today. UK Q1 GDP will be the main focus in European session. Eurozone will release April CPI flash, M3 money supply. German will release retail sales and import price index. France will release Q1 GDP too. Swiss will release KOF leading indicator. In US session, Q1 GDP will be featured with Chicago PMI. Canada will also released GDP and IPPI & RMPI.

USD/CAD Daily Outlook

Daily Pivots: (S1) 1.3568; (P) 1.3568; (R1) 1.3647; More….

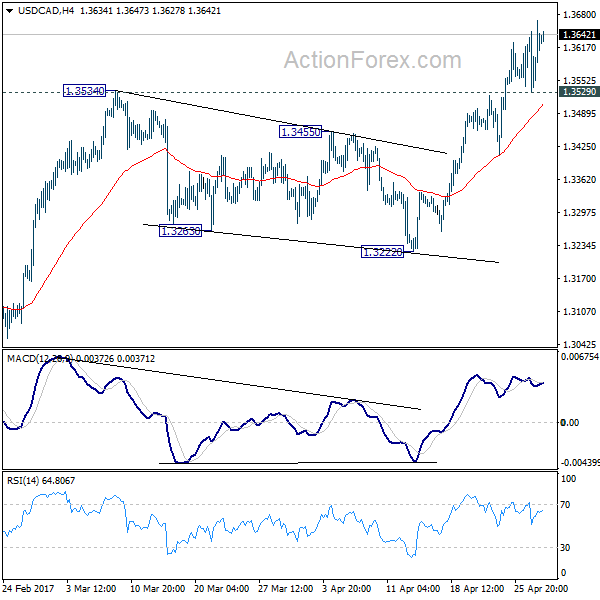

USD/CAD’s rise resumed after brief consolidation and reaches 1.3669 so far. Intraday bias is back on the upside. Whole medium term rise from 1.2460 is still in progress and should target next medium term fibonacci level at 1.3838. On the downside, below 1.3529 minor support will turn bias neutral and bring consolidation before staging another rise.

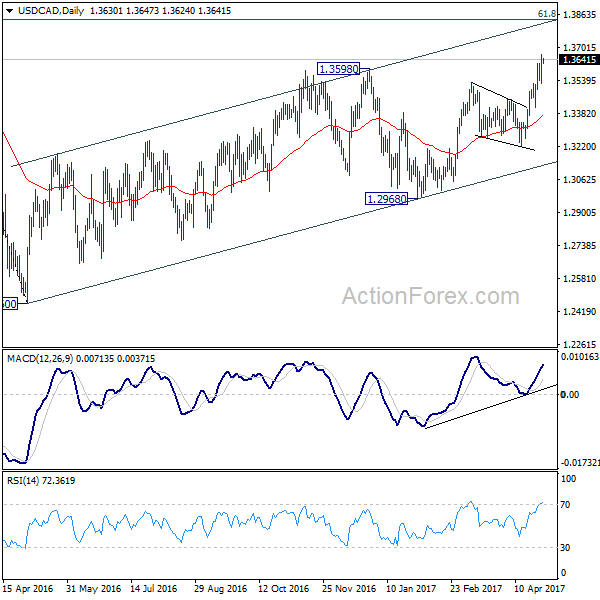

In the bigger picture, price actions from 1.4689 medium term top are seen as a correction pattern. The first leg has completed at 1.2460. The second leg from 1.2460 is likely still in progress and could target 61.8% retracement of 1.4689 to 1.2460 at 1.3838. We’d look for reversal signal there to start the third leg. However, break of 1.2968 will argue that the third leg has already started and should at least bring a retest of 1.2460 low. Meanwhile, sustained trading above 1.3838 would pave the way to retest 1.4689 high.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 22:45 | NZD | Building Permits M/M Mar | -1.80% | 14.00% | 17.20% | |

| 22:45 | NZD | Trade Balance (NZD) Mar | 332M | 375M | -18M | -50M |

| 23:01 | GBP | GfK Consumer Confidence Apr | -7 | -7 | -6 | |

| 23:30 | JPY | Jobless Rate Mar | 2.80% | 2.90% | 2.80% | |

| 23:30 | JPY | Household Spending Y/Y Mar | -1.30% | -0.50% | -3.80% | |

| 23:30 | JPY | National CPI Core Y/Y Mar | 0.20% | 0.20% | 0.20% | |

| 23:30 | JPY | Tokyo CPI Core Y/Y Apr | -0.10% | -0.20% | -0.40% | |

| 23:50 | JPY | Retail Trade Y/Y Mar | 2.10% | 1.50% | 0.10% | 0.20% |

| 23:50 | JPY | Industrial Production M/M Mar P | -2.10% | -0.80% | 3.20% | |

| 1:30 | AUD | PPI Q/Q Q1 | 0.50% | 0.30% | 0.50% | |

| 5:00 | JPY | Housing Starts Y/Y Mar | -2.60% | -2.60% | ||

| 5:30 | EUR | French GDP Q/Q Q1 A | 0.40% | 0.40% | ||

| 6:00 | EUR | German Retail Sales M/M Mar | 0.00% | 1.80% | ||

| 6:00 | EUR | German Import Price Index M/M Mar | -0.10% | 0.70% | ||

| 7:00 | CHF | KOF Leading Indicator Apr | 107.5 | 107.6 | ||

| 8:00 | EUR | Eurozone M3 Y/Y Mar | 4.70% | 4.70% | ||

| 8:30 | GBP | BBA Mortgage Approvals Mar | 42.1K | 42.6K | ||

| 8:30 | GBP | GDP Q/Q Q1 A | 0.40% | 0.70% | ||

| 8:30 | GBP | Index of Services 3M/3M Feb | 0.50% | 0.60% | ||

| 9:00 | EUR | Eurozone CPI Estimate Y/Y Apr | 1.80% | 1.50% | ||

| 9:00 | EUR | Eurozone CPI – Core Y/Y Apr A | 1.00% | 0.70% | ||

| 12:30 | USD | Employment Cost Index Q1 | 0.60% | 0.50% | ||

| 12:30 | CAD | GDP M/M Feb | 0.10% | 0.60% | ||

| 12:30 | CAD | Industrial Product Price M/M Mar | 0.10% | |||

| 12:30 | CAD | Raw Materials Price Index M/M Mar | 1.20% | |||

| 12:30 | USD | GDP (Annualized) Q1 A | 1.10% | 2.10% | ||

| 12:30 | USD | GDP Price Index Q1 A | 2.00% | 2.10% | ||

| 13:45 | USD | Chicago PMI Apr | 56.7 | 57.7 | ||

| 14:00 | USD | U. of Michigan Confidence Apr F | 98 | 98 |