Sterling falls sharply today even though BoE delivers the highly anticipated rate hike. Selloff comes in after the dovishness as seen in the inflation report is confirmed by Carney’s press conference. Australian Dollar and New Zealand Dollar follow as the second weakest on risk aversion. The stock markets are in deep worry over further escalation in US-China trade tension. On the other hand hand, Yen is the clear winner today on risk aversion. Dollar follows as the second strongest as it always benefits from heat up in trade war.

In other markets, European indices are all in red today. FTSE is trading down -0.92% at the time of writing, DAX Is down -1.55% and CAC is down -0.63%. Earlier today, China Shanghai SSE closed down -2.0% at 2768.02. 2700 is now back in radar. Hong Kong HSI lost -2.21% and Nikkei dropped -1.03%. The usually resilient Singapore Strait Times also declined -1.28%. US futures point to lower open and DOW could lose triple digit in initial trading. WTI crude oil is back at 67.27 after failing to sustain above 70. Gold edges lower today but is still staying above 1211.65 support, July’s low. At the time of writing, 10 year yield is trading at 2.988 and a point to watch is whether is will regain 3% handle again.

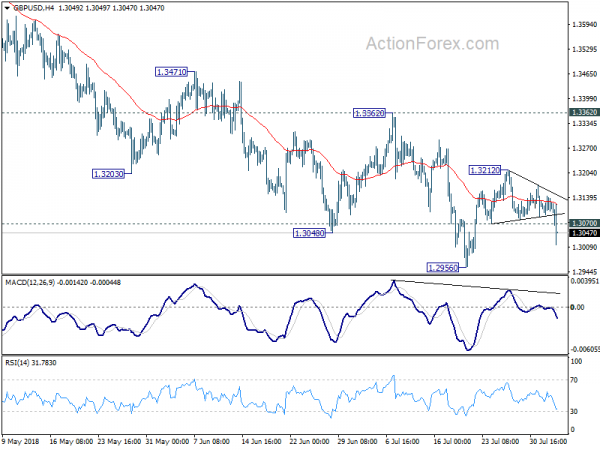

Technically, GBP/USD’s sharp fall and break of 1.3070 finally indicates completion of recent corrective rebound from 1.2956, at 1.3212. Deeper fall should now be seen back to 1.2956 low. GBP/JPY’s break of 145.25 resumes recent fall from 149.30 for 143.18/76 key support zone. While Dollar is strong, it’s still held in range of 1.1574/1790 in EUR/USD, 0.7309/7483 in AUD/USD. And even GBP/USD is holding above 1.2956 low. More is needed to trigger an upside breakout in the greenback. Probably, non-farm payrolls tomorrow is the one that makes it.

BoE hikes but delivers dovish projections, Carney said policy needs to walk not run

BoE announced to raise Bank Rate by 25bps to 0.75% today, as widely expected. While the voting was unanimous 9-0, the overall announcement is seen as dovish, which is later confirmed in Governor Mark Carney’s press conference. BoE maintained tightening bias and said “ongoing tightening of monetary policy over the forecast period would be appropriate”. However, the pace of rate hike will be gradual and limited.

The new projections in the quarterly Inflation Report suggests that after this rate hike, there would be a lot of room for BoE to wait and see. And, there could be only one more hike within the forecast horizon through Q3 2021. That’s how “gradual and limited” the rate path can be.

In the current conditioning path, the Bank rate will hit 0.9% in Q4 2019 1.1% in Q4 2020 and stay there till Q3 2021. In May’s conditioning path, the Bank rate will reach 1.0% already in Q3 2019, and then 1.2% in Q3 2020 and stays there till Q2 2021. That is, the current path argues that the next hike could happen in Q1 2020, instead of Q3 2019. And there could be no more rate hike in the forecast horizon.

Also, with such conditioning path, GDP (exclude backcast) is projected to growth faster by 1.5% in the four-quarter to Q3 2018, and 1.8% in the four-quarter to Q3, 2019. But GDP growth in the four-quarter to Q3 2020 is unchanged at 1.7%. Inflation will return to target later at 2.0% in Q3 2021, instead of Q3 2020. But, at 2.2% in Q3 2019 and 2.1% in Q3 2020, it’s reasonably close to target.

In the press conference, Carney said that tightening would be gradually as “structural factors that have pushed down the trend equilibrium real rate are likely to persist.” It will be limited because “domestic short-term factors (particularly headwinds from uncertainty and fiscal drag) will fade slowly.” Also also R* is expected to rise only gradually, and “policy needs to walk – not run”.

UK PMI construction rose to 55.8, impressive turnaround of the construction sector

UK PMI construction rose sharply to 55.8 in July, up from 53.1 and beat expectation of 52.8. Markit noted the robust and accelerated rise in construction activity Housing building expanded as the fastest pace since December 2016. Also, rates of new order growth and job creation gain momentum. Tim Moore, Associate Director at IHS Markit hailed that “July data reveal an impressive turnaround in the performance of the UK construction sector, with output growth the strongest for just over one year.”

Also release in European session, Eurozone PPI rose 0.4% mom, 3.6% yoy in June. Swiss PMI manufacturing rose 0.3 to 61.9 in July. Swiss retail sales rose 0.3% yoy in June. Swiss SECO consumer confidence dropped sharply to -7 in July.

China condemns US for playing two-handed strategy in trade war

In a rather un-speedy way, China issued a rather strong statement in response to Trump’s initiative to impose 25% tariffs on USD 200B in Chinese imports. The Ministry of Commerce criticized the US for playing a “two handed” strategy. Firstly, the US spread rumors of re-engagement. Secondly, it announced the above tariff intention. the MOFCOM condemned the US for “disregarding the interests of the whole world, as well as those of the common Americans, businessmen and consumers”. And China emphasized that such practice will have “no effect on China”.

MOFCOM also pledged that China is “fully prepared for counter-measures to defend the country’s dignity and the interests of the people, defend free trade and the multilateral system, and defend the common interests of all countries in the world”. And it reiterated the stance on resolving differences through dialogue, “but only under the principal of equality and keeping promises”.

The reactions in China stocks to renewed trade war threat are loud and clear. The Shanghai SSE composite closed down -2.0% at 2768.02. The breach of 2753.83 support affirmed our view that rebound from 2691.02 has completed at 2915.29, ahead of 55 day EMA and key well inside medium term falling channel. The index should revisit the key support zone between 2016 low of 2638.30 and 2700. This is an area which could prompt serious government intervention.

DIHK: US-China trade conflicts have huge impact on German companies

A survey by the German DHIK Chambers of Industry and Commerce warned that escalating US-China trade conflict is already hurting German companies.

41% of German companies doing business in China said they were affected by higher tariffs when exporting to the US. And 46% said highest cost importing from the US.

57% of German companies doing business in the US said there were negative effects exporting to China. 75% reported higher costs when importing from China.

DIHK trade chief Volker Treier said “the dangerous trade dispute between the U.S. and China is also hitting German companies doing business in the two countries.” He added, “the impact is huge: nearly half of the imports from German companies are directly or indirectly affected by the new tariffs, for example because they source raw materials or components from the other country.” He also warned that “a further escalation of the dispute would be a threat to world trade as a whole.”

GBP/USD Mid-Day Outlook

Daily Pivots: (S1) 1.3098; (P) 1.3122; (R1) 1.3148; More…

GBP/USD’s strong break of 1.3070 minor support indicates that corrective rise from 1.2956 has completed at 1.3212 already. Intraday bias is back on the downside for 1.2956 short term bottom first. Decisive break there will resume larger decline from 1.4376 for 1.2874 fibonacci level next. For now, the consolidation pattern from 1.2956 could still extend with another rebound through 1.3212. But even in that case, upside should be limited by 1.3362 resistance to bring larger decline resumption eventually.

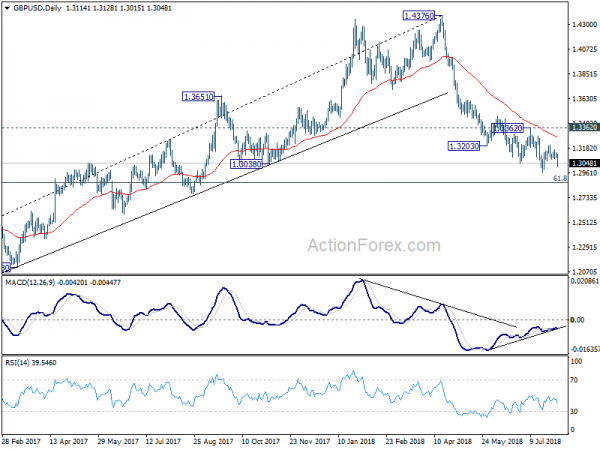

In the bigger picture, whole medium term rebound from 1.1946 (2016 low) should have completed at 1.4376 already, after rejection from 55 month EMA (now at 1.4179). Fall from 1.4376 should extend to 61.8% retracement of 1.1946 (2016 low) to 1.4376 at 1.2874 next. Decisive break of 1.2874 will raise the chance of long term down trend resumption through 1.1946 low. On the upside, break of 1.3362 resistance is needed to be the first indication of medium term bottoming. Otherwise, outlook will remain bearish even in case of strong rebound.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:50 | JPY | Monetary Base Y/Y Jul | 7.00% | 7.30% | 7.40% | |

| 01:30 | AUD | Trade Balance (AUD) Jun | 1.87B | 0.91B | 0.83B | 0.73B |

| 05:45 | CHF | SECO Consumer Confidence Jul | -7 | 2 | 2 | |

| 07:15 | CHF | Retail Sales Real Y/Y Jun | 0.30% | 0.00% | -0.10% | 0.40% |

| 07:30 | CHF | PMI Manufacturing Jul | 61.9 | 60.9 | 61.6 | |

| 08:30 | GBP | Construction PMI Jul | 55.8 | 52.8 | 53.1 | |

| 09:00 | EUR | Eurozone PPI M/M Jun | 0.40% | 0.30% | 0.80% | |

| 09:00 | EUR | Eurozone PPI Y/Y Jun | 3.60% | 3.50% | 3.00% | |

| 11:00 | GBP | BoE Bank Rate | 0.75% | 0.75% | 0.50% | |

| 11:00 | GBP | BoE Asset Purchase Target | 435B | 435B | 435B | |

| 11:00 | GBP | MPC Official Bank Rate Votes | 9–0–0 | 8–0–1 | 3–0–6 | |

| 11:00 | GBP | MPC Asset Purchase Facility Votes | 0–0–9 | 0–0–9 | 0–0–9 | |

| 11:00 | GBP | BoE Inflation Report | ||||

| 11:30 | USD | Challenger Job Cuts Y/Y Jul | -4.20% | 19.60% | ||

| 12:30 | USD | Initial Jobless Claims (28 JUL) | 218K | 221K | 217K | |

| 14:00 | USD | Factory Orders Jun | 0.70% | 0.40% | ||

| 14:30 | USD | Natural Gas Storage | 39B | 24B |