Australian Dollar jumps broadly today after much stronger than expected job data. But upside against Dollar is capped so far. After all, RBA is clear that it’s next move is likely a hike, yet there is no strong case for a near term movement. In rather directionless trading, Yen and Euro follows as the second strongest for today. Meanwhile, New Zealand Dollar is paring inflation data triggered gains and trades broadly lower, followed by Canadian Dollar. Over the week, Sterling remains the weakest one after selloff on Brexit worries and weaker than expected inflation reading. Focus will turn to today’s UK retail sales.

In other markets, DOW closed up 0.32% at 25199.29 as it’s crawling back to 25402.8 resistance. NASDAQ closed down -0.01% as it’s possibly losing some momentum on the current record run. S&P 500 closed up 0.22% at 2815.62. A notable development is the rebound in treasury yields at the long end. 10 year yield gained 0.011 to 2.875. 30 year yield rose 0.18 to 2.989. 30 year yield may have a attempt at 3.0 handle later in the week or next.

Asian markets are mixed with Nikkei reversed earlier gains and is down -0.1%. Hong Kong HSI is flat. China Shanghai SSE is down -0.54% at 2772.14, moving further away from 2800. Singapore Strait Times is strong though, up 0.96%. In other markets, WTI crude oil is back at 68.7 after failing to regain 69. Spot gold remains weak at around 1225.

Technically, EUR/AUD’s strong break of 1.5696 minor support could be a sign of near term reverse that’s worth some attention. Dollar’s rally attempt yesterday somewhat failed as there was no follow through buying. USD/CAD’s break of 1.3126 minor resistance originally looked promising but it quickly reversed after hitting 1.3258. More corrective trading is likely in the greenback in near term. Main focus will be on how deep Sterling would fall to.

Australian Dollar jumps as employment data strong on all front

Australian Dollar surges broadly as June employment data came in strong on all front. Headline job grow jumped to 50.9k seasonally adjusted , well above expectation of 16.6k. Prior month’s figure was also revised slightly up by 12k to 13.5k. Full time jobs grew 41.2k while part time jobs also rose 9.7k. Together with the surge in full time jobs, total hours worked rose 0.6%

Unemployment rate remained unchanged at 5.4%. But without rounding, it’s actually the at its lowest since November 2012. Labor force participation rate rose 0.2% to 65.7%. Employment to population ratio also rose 0.2% to 62.1%.

Also from Australia, NAB Quarterly Business Confidence dropped to 7 in Q2.

Japan logged JPY 721.4B surplus in June, exports grew 19th straight month

Japan trade balanced turned back into surplus at JPY 721.4B in June, above expectation of JPY 534.2B. Total exports rose 6.7% yoy, slightly below expectation of 7.0% yoy. But imports rose just 2.5% yoy, below expectation of 5.3% yoy.

Total exports logged a 19th straight month of growth. Rising trade tension with the US is not having much realized impact so far. Exports to China rose 11.1% yoy, to EU rose 9.3% yoy. Meanwhile, exports to US dropped -0.9% yoy.

Japan is still facing impacts from US steel and aluminum tariffs and threats on auto tariffs. The the blockbuster trade deal with EU just signed earlier this week should provide enough optimism to offset those threats.

Fed Powell repeated his warning on protectionism

Overnight, Fed Chair Jerome Powell’s second day of Congressional Testimony, at the House Financial Services Committee, contained no surprise as expected. On inflation, He said that Fed is “just about reached a symmetric 2 percent objective”. And, “from this point forward the risks are roughly balanced” even though he’s still “slightly more worried about lower inflation.” On employment, he said that the US is “close to full employment” but “maybe not quite there yet”. And he added “we need more people who are going to fill these jobs that are going to be coming open.”

Powell also refrained from commenting on the administration’s trade policy directly. But he still noted that “the bottom line is, a more protectionist economy is an economy that’s less competitive, it’s less productive.” And he warned that “you want to be careful to walk along this path because it may not be so easy to get off it,”

EU Moscovici urges a gateway out of spiral of trade tension escalation

European Commissioner for Economic and Financial Affairs Pierre Moscovici warned in a newspaper interview that trade tension between the US and EU would hit the financial markets. He said “an escalation – no matter from which side – would have serious consequences for the economy, including for the financial markets, which would hurt all sides.”

He urged “that’s why we need a gateway to get out of this spiral that ultimately damages the global economy and pulls everyone down with it.”

Swiss FM Maurer: We’d like EURCHF at 1.2 but 1.16 is liveable

Switzerland’s Finance Minister Ueli Maurer said yesterday that the Swiss Franc is still overvalued relative to Euro. He noted that “we like more 1.20 but at the moment we have 1.16”. Nonetheless, “we can live with this, I think.”

Maurer sounds he’s still unhappy with the huge balance sheet of SNB. He noted that “of course with all this intervention, we have a big, big balance sheet, but that’s a result of the policy of the last year and the pressing of the Swiss franc and the weakness of the euro.” But overall, Maurer said he believed the central bank and it had “made good policy”.

Looking ahead

UK retail sales will be the main focus today. Swiss will release trade balance. US will release jobless claims, Philly Fed survey and leading indicator.

AUD/USD Daily Outlook

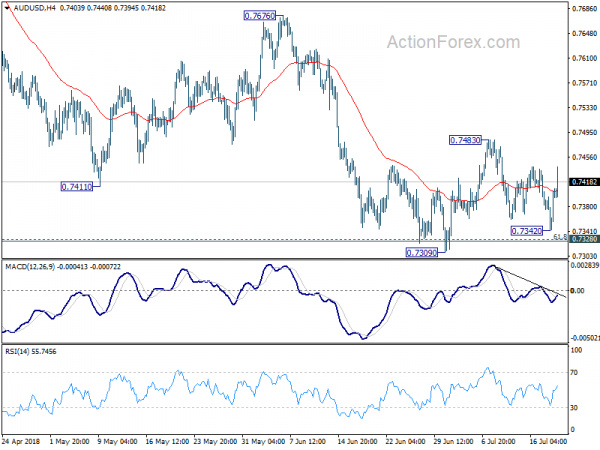

Daily Pivots: (S1) 0.7357; (P) 0.7383; (R1) 0.7423; More…

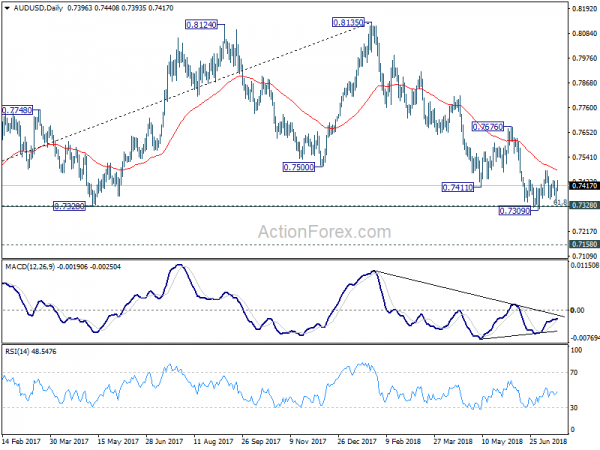

AUD/USD rebounded strongly after hitting 0.7342, supported well above 0.7309 low. The development suggests that consolidation from 0.7309 is extending with another rise. Intraday bias is mildly on the upside for 0.7483 minor resistance or above. But still, upside should be limited below 0.7676 resistance to bring larger fall resumption. On the downside, break of 0.7309 and sustained trading below 0.7328 cluster support (61.8% retracement of 0.6826 to 0.8135 at 0.7326) will extend the fall from 0.8135 to 0.7158 support next.

In the bigger picture, medium term rebound from 0.6826 is seen as a corrective move that should be completed at 0.8135. Deeper decline would be seen back to retest 0.6826 low. This will now remain the favored case as long as 0.7676 resistance holds.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:50 | JPY | Trade Balance (JPY) Jun | 721.4B | 534.2B | -578.3B | -580.5B |

| 01:30 | AUD | NAB Business Confidence Q2 | 7 | 7 | 8 | |

| 01:30 | AUD | Employment Change Jun | 50.9K | 16.6K | 12.0K | 13.4K |

| 01:30 | AUD | Unemployment Rate Jun | 5.40% | 5.40% | 5.40% | |

| 06:00 | CHF | Trade Balance (CHF) M/M Jun | 3.22B | 2.76B | ||

| 08:30 | GBP | Retail Sales M/M Jun | 0.20% | 1.30% | ||

| 12:30 | USD | Initial Jobless Claims (JUL 14) | 221K | 214K | ||

| 12:30 | USD | Philadelphia Fed Business Outlook Jul | 20.6 | 19.9 | ||

| 14:00 | USD | Leading Index Jun | 0.50% | 0.20% | ||

| 14:30 | USD | Natural Gas Storage | 51B |