Sentiments somewhat stabilized slightly in Asia as markets digest trade war triggered losses. China’s Shanghai composite is losing -0.59% at the time of writing. But Nikkei and Hong Kong HSI are up 0.36% and 0.41% respectively. DOW lost -287.26 or -1.15% to close at 24700.21, but it has already pared much losses after hitting as low as 24567.75 overnight. S&P 500 closed down -11.16 pts or -0.40% at 2762.59. NASDAQ lost -21.44 pts or -0.28% to 7725.59, still the better performing one. In the currency markets, Australia, Canadian and New Zealand Dollar recover mildly today while Yen retreats. But for the week, Yen remains the strongest one, followed by Swiss Franc. Sterling is the weakest one ahead of BoE rate decision, followed by Aussie and then Canadian.

The economic calendar remains light today. Australia Westpac leading index dropped -0.2% in May. Germany will release PPI and UK will release CBI trends total orders in European session. US will release current account and existing home sales. Nonetheless, there are some big guns due to speak at the ECB forum, including panel discussion with ECB President Mario Draghi, BoJ Governor Haruhiko Kuroda, RBA Governor Philip Lowe and Fed Chair Jerome Powell.

Asian business sentiments deteriorated on trade war risks

Sentiments of Asian Business deteriorated in Q2 according to a survey by Thomson Reuters and INSEAD, over June 1-15. The sentiment index, representing six-month outlook from 61 firms, dropped -5pts to 74 in Q2. It hit a seven-year high of 79 in Q1. That’s also the first decline since September 2017 even though reading above 50 still indicates a positive outlook.

Antonio Fatas, a Singapore-based economics professor at global business school INSEAD, said in the released that “Trade war is not a risk but a reality.” He added that “U.S. tariffs are going up against China but also against some of its traditional allies, such as Canada and the European Union. They are all about to retaliate and today we do not see an easy way out.” Fatas also said “companies can try to go around tariffs by moving production to other countries, this is costly and inefficient. It is a short-term solution but not optimal.”

Among responses, worries of global trade war, higher interest rates, rising oil/commodity prices and foreign exchange fluctuation are see as the biggest perceived risks to business outlook.

China vows to fight as concessions will not appease Trump’s blood lust

China stepped up its rhetoric against US threat of tariffs through an English editorial in the official China Daily. There it warned that “faced with this heightened intimidation from the US, China has no choice but to fight back with targeted and direct measures aimed at persuading the US to back off, since it appears that any concessions it makes will not appease the Trump administration, which wants to suck the lifeblood from the Chinese economy.”

And, “Beijing will have to ensure that Washington is aware that there will be heavy price to pay every action it strikes against China if it is to avoid being a victim of the Trump administration’s growing blood lust.” “Those US companies and workers that feel the brunt of China’s retaliation should pass the word to Washington, that despite the pronounced aim of the Trump administration being to protect domestic industries and workers, the injuries that will be done them will be because of its actions.”

On other hand, White House trade adviser Peter Navarro warned China “may have underestimated the strong resolve of President Donald J. Trump.” And, “if they thought that they could buy us off cheap with a few extra products sold and allow them to continue to steal our intellectual property and crown jewels, that was a miscalculation.”

Suggested readings on trade war:

- US Companies Doomed to Suffer from Trump’s Protectionist Policy

- US-China Trade: Trade War Becomes A Reality As Trump Pushes Further

- Potential U.S. Auto Tariffs: Canadian Scenario Analysis

- US-China Trade: From ‘Grand Bargain’ Towards Trade War?

- Who Would Feel the Pain from American Auto Tariffs?

- Weighing the Impact of U.S. Steel and Aluminum Tariffs on Canada

BoJ minutes: Timing of reaching inflation target was merely a projection

BoJ released minutes of the April 26-27 meeting today. The only surprise out of that meeting was that BoJ dropped the time frame it set for achieving the 2% inflation target. The minutes provided more details on the discussions. Many members believed that the timing of reaching the 2% inflation was “merely a projection”. At the some time, “some market participants perceived this projection as a deadline for achieving 2 percent inflation, linking changes in said timing to policy adjustments, and this view was deeply entrenched among them.”

Some members expressed that “attracting excessive attention merely to forecast figures would not be appropriate from the perspective of communication with the markets”. And, most members expressed that ” it was appropriate to cease providing a description on the projected timing of achieving the price stability target”. And that was with the aim to clarify that the timing was “not a specific deadline” for meeting inflation target. Nonetheless, one member expressed the concern that dropping the time frame could “weaken the effects of the commitment” of BoJ to hit target.

BoE to stand pat tomorrow, August hike uncertain

BoE will most likely keep the Bank Rate unchanged at 0.50% tomorrow. Known hawks Ian McCafferty and Michael Saunders are expected to vote for rate hike while others would vote for standing pat. There will be no inflation report but just the meeting minutes. And attention will on whether the minutes give any hint on an August hike.

According to the latest Bloomberg survey, only 55% of respondents forecast a hike in August. That’s even down from 60% in a similar survey in May. The economists projected UK economy to growth 1.4% in 2018, better than May projection of 1.3%, after some positive economic data. Inflation forecast was unchanged at 2.5% yoy in 2018 and 2.1% yoy in 2019.

One side note to mention is that McCafferty will end his term on August 31. He will be replaced by Jonathan Haskel, an professor of economics at Imperial College Business School. At this point, it’s unsure how the replace with reshape the MPC.

GBP/USD Daily Outlook

Daily Pivots: (S1) 1.3125; (P) 1.3199; (R1) 1.3249; More…

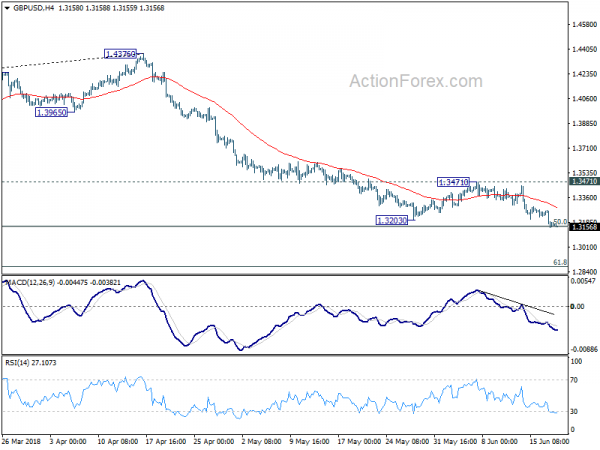

Intraday bias in GBP/USD remains on the downside for the moment. Decline from 1.4376 is in progress. Sustained break of 50% retracement of 1.1946 to 1.4376 at 1.3161 will pave the way to 61.8% retracement at 1.2875 next. On the upside, break of 1.3471 resistance is now needed to indicate short term bottoming. Otherwise, outlook will remain bearish in case of recovery.

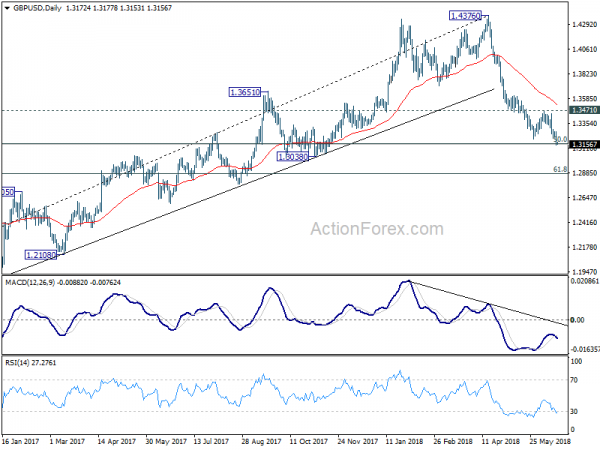

In the bigger picture, current development suggests that whole medium term rebound from 1.1936 (2016 low) has completed at 1.4376 already, with trend line broken firmly, on bearish divergence condition in daily MACD, after rejection from 55 month EMA (now at 1.4177). 61.8% retracement of 1.1936 (2016 low) to 1.4376 at 1.2874 is the next target. We’ll pay attention to the reaction from there to asses the chance of long term down trend resumption. For now, outlook will stay bearish as long as 55 day EMA (now at 1.3527) holds, even in case of strong rebound.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:50 | JPY | BOJ Minutes | ||||

| 00:30 | AUD | Westpac Leading Index M/M May | -0.20% | 0.20% | ||

| 06:00 | EUR | German PPI Y/Y May | 0.30% | 2.00% | ||

| 06:00 | EUR | German PPI M/M May | 2.50% | 0.50% | ||

| 10:00 | GBP | CBI Trends Total Orders Jun | 1 | -3 | ||

| 12:30 | USD | Current Account Balance Q1 | -129B | -128B | ||

| 14:00 | USD | Existing Home Sales May | 5.55M | 5.46M | ||

| 14:30 | USD | Crude Oil Inventories | -4.1M |