The forex markets are struggling to find a clear direction today despite all the high profile events. US headline CPI jumped to 6 year high in May while core CPI also accelerated. But Dollar is getting no lift from it. UK wage growth missed expectation even though the overall job report is solid. Sterling dipped just briefly but there was no follow through selling. And, let’s not forget the Singaporean funded reality show of Kim and Trump. It’s a good show overall, but it’s totally shrugged off by the markets.

Trades are probably getting more cautious ahead of tomorrow’s FOMC rate decision and economic projections. There could lie the clues on how many more times Fed is going to hike this year. UK CPI is another key event tomorrow and let’s hope it won’t disappoint traders again. Meanwhile, some might also look through to Thursday’s ECB press conference for clues on when the asset purchase program would be ended.

Technically, there are quite a few levels to watch for the rest of the days. GBP/USD’s day low at 1.3341 is one. EUR/USD”s 1.1713 minor support is another. Break of these levels will finally suggest some Dollar strength. For Sterling, selling could come live if 0.8844 in EUR/GBP is taken out. Also, break of 130.26 in EUR/JPY and 148.10 in GBP/JPY could prompt more Yen selling.

Trump backed down from verifiable, irreversible denuclearization request, and conceded to stop “war game”

The highly anticipated Kim-Trump summit in Singapore just resulted in a symbolic agreement without details. There North Korean leader Kim Jong-un just “reaffirmed his firm and unwavering commitment to complete denuclearization of the Korean Peninsula.” Trump said he expected the denuclearization process to start “very, very quickly” but that’s just his own expectation. Trump also backed down from insisting the verifiability and irreversibility of denuclearization.

Later in a press conference, Trump said that US should stop war games with South Korea, referring to the military exercise. He said that would save the US a “tremendous amount of money”. Trump also said those exercises are “provocative”. He now has a “very special bond” with Kim, a “very smart”, “talented” man.

The comments triggered a lot of concerns from South Korea. South Korea’s Presidential Blue House said it needed to “to find out the precise meaning or intentions” of Trump’s statement. But it was willing to “explore various measures to help the talks move forward more smoothly.” However, Reuters quoted an unnamed South Korean official saying that “I was shocked when he called the exercises ‘provocative,’ a very unlikely word to be used by a U.S. president.”

Also, it’s pointed out that Trump’s unilateral announcement of stopping the military exercise might have come before consulting South Korea. And there are concerns that “America first” Trump only look after US interests only, like what he is doing with G7.

US CPI jumped to 6 year high, but Dollar shrugs

US headline CPI accelerated to 2.8% yoy in May, up from 2.5% yoy and beat expectation of 2.6% yoy. The headline number is the fastest in six years since 2012. Core CPI also accelerated to 2.2% yoy, up from 2.1% yoy and met expectations. Nonetheless, reaction in the US Dollar is rather muted. It’s continuing to trade mixed for the day.

OECD: German robust expansion sets to continue

OECD Secretary-General Angel Gurría said in presenting a report in Berlin that “Germany’s recent economic performance is remarkable, and the robust expansion appears set to continue.” Also, “unemployment is at record low levels and Germany is providing jobs, and better lives, to hundreds of thousands of immigrants.” However, he also urged that “More must be done now to ensure that today’s strong economic and social results are sustained and extended to all.”

In the latest economic projections, Germany economic growth is expected to slow after a great year in 2017 but remains robust ahead. Unemployment rate is also projected to drop further as the economy improves. The more important part is that core inflation is expected to surge from 1.3% in 2018 to 2.0% in 2019.

OECD projects German economic growth to slow from 2.5% in 2017 to 2.1% in 2018 and maintain the same pace in 2019. Exports growth is expected to slow from 5.3% in 2017 to 4.5% in 2018 and 4.5% in 2019. CPI is projected to be unchanged at 1.7% in 2018 and climb further to 2.0% in 2019. Core CPI is also expected to be unchanged at 1.3% in 2018 and rose to 2.0% in 2019. Unemployment rate is projected to drop from 3.7% in 2017 to 3.4% in 2018 and then 3.3% in 2019.

German ZEW dropped to -16.1. Trade war, Italy and data weighed

German ZEW economic sentiment dropped to -16.1 in June, down from -8.2, below expectation of -14.6. Current situation index dropped to 80.6, down from 87.4, below expectation of 85.0. Eurozone ZEW economic sentiment dropped to -12.6, down from 2.4, below expectation of 0.1. Current situation index dropped -16.2 to 39.9.

ZEW President Achim Wambach noted in the release that “recent escalation in the trade dispute with the United States as well as fears over the new Italian government pursuing a policy which potentially destabilizes the financial markets have left their mark on the economic outlook for Germany” And, “German industry has been reporting worse than expected figures for exports, production and incoming orders for April.” Hence, economic outlook for the next six months has worsened considerably.”

Sterling looks through job data to CPI

UK claimant count dropped -7.7k in May, better than expectation of 11.3k rise. Unemployment rate was unchanged at 4.2% 3 months to April, met expectation. Average weekly earnings, including bonus, slowed to 2.5% 3moy in April, below expectation of 2.6% 3moy. Prior month’s reading at 2.6% 3moy. Average weekly earnings including bonus slowed to 2.8% 3moy, below expectation of 2.9% 3moy. Prior month’s reading at 2.9% 3moy. Sterling shrugs off slightly weaker than expected wage growth data today. Instead it’s turning the focus to tomorrow’s CPI release.

Australia NAB Business confidence dropped to 6, no RBA hike till May 2019

Australia NAB business condition dropped -6 pts to 15 in My. Business confidence dropped -5 pts to 6. Both reversed the improves from March to April. NAB chief economist Alan Oster noted that despite easing, business conditions “remain robust” well above average across most states and industries. Though, there is a divergence seen as confidence is “highest in trend terms in Tasmania and Western Australia. But New South Wales and Victoria “lag the other states at below average levels”.

Oster added that the indicators continue to suggest a pickup in growth and unemployment rate would fall towards 5%. Pickup in wages remain key for RBA monetary policy. But a rate hike will not occur until May 2019. Oster said while the survey continues to point to a growing economy, strength in employment and a decline in the unemployment rate, these factors are yet to materialise in a significant pick-up in wages.”

Also released in Asian session, Japan BSI large manufacturing dropped to -3.2 in Q2. Domestic CGPI rose 2.7% yoy in May.

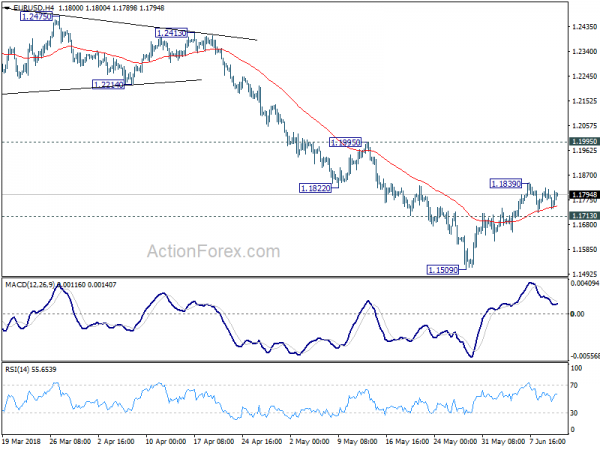

EUR/USD Mid-Day Outlook

Daily Pivots: (S1) 1.1762; (P) 1.1792 (R1) 1.1815; More…..

EUR/USD continues to stay in sideway trading below 1.1839 and intraday bias remains neutral. Corrective recovery from 1.1509 could extend higher. But upside should be limited by 1.1995 resistance to bring reversal. On the downside, break of 1.1713 minor support will likely resume larger fall from 1.2555 through 1.1509 to 50% retracement of 1.0339 to 1.2555 at 1.1447.

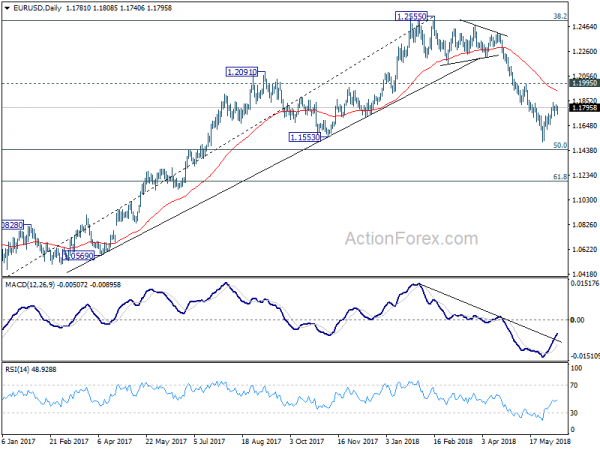

In the bigger picture, current development suggests that EUR/USD was rejected by 38.2% retracement of 1.6039 (2008 high) to 1.0339 (2017 low) at 1.2516. And, a medium term top was formed at 1.2555 already. Decline from there should extend further to 61.8% retracement of 1.0339 to 1.2555 at 1.1186 and below. For now, even in case of rebound, we won’t consider the fall from 1.2555 as finished as long as 1.1995 resistance holds.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:50 | JPY | BSI Large Manufacturing Q/Q Q2 | -3.2 | 3.2 | 2.9 | |

| 23:50 | JPY | Domestic CGPI Y/Y May | 2.70% | 2.10% | 2.00% | 2.10% |

| 01:30 | AUD | NAB Business Conditions May | 15 | 18 | 21 | |

| 01:30 | AUD | NAB Business Confidence May | 6 | 9 | 10 | 11 |

| 01:30 | AUD | Home Loans M/M Apr | -1.40% | -1.70% | -2.20% | -2.30% |

| 04:30 | JPY | Tertiary Industry Index M/M Apr | 1.00% | 0.60% | -0.30% | |

| 08:30 | GBP | Jobless Claims Change May | -7.7K | 11.3K | 31.2k | 28.2K |

| 08:30 | GBP | Claimant Count Rate May | 2.50% | 2.50% | ||

| 08:30 | GBP | Average Weekly Earnings 3M/Y Apr | 2.50% | 2.60% | 2.60% | |

| 08:30 | GBP | Weekly Earnings ex Bonus 3M/Y Apr | 2.80% | 2.90% | 2.90% | |

| 08:30 | GBP | ILO Unemployment Rate 3Mths Apr | 4.20% | 4.20% | 4.20% | |

| 09:00 | EUR | German ZEW Economic Sentiment Jun | -16.1 | -14.6 | -8.2 | |

| 09:00 | EUR | German ZEW Current Situation Jun | 80.6 | 85 | 87.4 | |

| 09:00 | EUR | Eurozone ZEW Economic Sentiment Jun | -12.6 | 0.1 | 2.4 | |

| 12:30 | USD | CPI M/M May | 0.20% | 0.20% | 0.20% | |

| 12:30 | USD | CPI Y/Y May | 2.80% | 2.60% | 2.50% | |

| 12:30 | USD | CPI Core M/M May | 0.20% | 0.20% | 0.10% | |

| 12:30 | USD | CPI Core Y/Y May | 2.20% | 2.20% | 2.10% | |

| 18:00 | USD | Monthly Budget Statement May | -119.0B | 214.3B |