Japanese Yen is trying to recover in Asian session today but remains the weakest one for the week. Risk appetites have been be strong as risk of trade war is shrugged off by investors. DOW rose 346.41 pts or 1.40% to 25146.39. S&P 500 rose 023.55 pts or 0.86% to 2772.35. NASDAQ gained 51.38 pts or 0.67% to 7689.24. That was also a record close in NASDAQ. At the time of writing, Nikkei is up 0.84% while HSI is up 0.55%.

10 year yield also closed up 0.056 to 2.975 and is on track to 3.000 handle again. But Dollar lagged behind and continues to trade as the second weakest for the week, just next to slightly better than Yen. Euro remains the strongest one for the week as ECB is preparing to debate end of QE at next week’s meeting. Australia Dollar follow as the second strongest for the week.

The economic calendar is rather light today and markets should continue to trade with the current theme. Focuses will more be on trade as G7 summit in Canada on June 8-9 looms.

French Macron and Canadian Trudeau united on strong multilateralism

French President Emmanuel Macron and Canadian Prime Minister Justin Trudeau expressed their unified stance on the push for “strong multilateralism” after meeting in Ottawa yesterday, head of the G7 summit. In a joint statement, they pledged to “support a strong, responsible, transparent multilateralism to face the global challenges.”

Macon hailed the meeting as “an opportunity to talk about the relations between Canada and France that are going very well, but also to highlight the challenges that we are going to have around the G7 table, and to make sure we are aligned.”

The G7 meeting is set to be a confrontation between G6 versus the US on a range of issues, in particular, the US steel and aluminum tariffs on its closest allies. Trudeau said there will be ” frank and sometimes difficult discussions around the G7 table, particularly with the US president on tariffs.”

German Merkel hints at no joint G6+1 statement

German Chancellor Angela Merkel warned yesterday that there will be difficult discussions at the G7 summit in Canada. She told the parliament that “it is apparent that we have a serious problem with multilateral agreements here, and so there will be contentious discussions.” She, though, pledged to go into the meeting with “goodwill”.

But Merkel also emphasized that there “must not be a compromise for the sake of a compromise” and there was “no sense in papering over divisions.” That’s taken as a sign of risk that G7 summit could end without a joint statement first ever, as US will likely clash with all other G6 nations, at least on trade.

Meanwhile, it’s reported that Macron has warned the US that he will not sign a joint statement out of the G7 summit if there is no progress on tariffs, Iran nuclear deal and the Paris climate accord.

On the data front

Australia trade surplus narrowed to AUD 0.98B in April versus expectation of AUD 1.03B. Japan leading indicator rose to 105.6 in April. Swiss will release unemployment rate and foreign currency reserves today. Germany will release factor orders while Eurozone will release Q1 GDP final. US will release initial jobless claims later in the day.

USD/JPY Daily Outlook

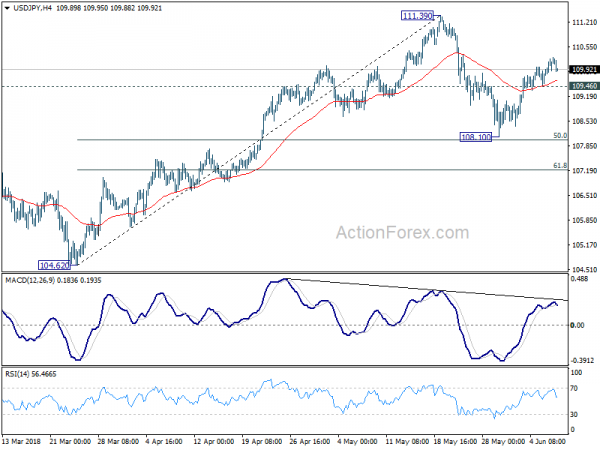

Daily Pivots: (S1) 109.88; (P) 110.08; (R1) 110.38; More…

USD/JPY lost some upside momentum after hitting 110.26. But still, rebound from 108.10 is expected to continue with 109.46 minor support intact. Further rally would be seen back to retest 111.39 resistance. Break will resume the rebound from 104.62 and target a test on 114.73 key resistance level. However, on the downside, below 109.36 minor support will delay the bullish case and turn bias to the downside for 108.10 support again.

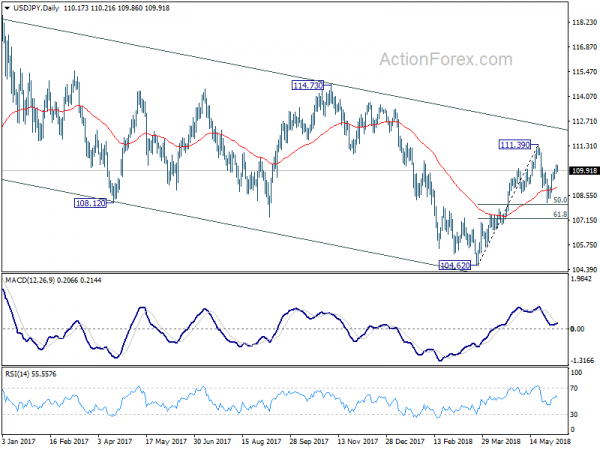

In the bigger picture, at this point , we’re slightly favoring the case that corrective decline from 118.65 (2016 high) has completed with three waves down to 104.62. Above 111.39 will affirm this view and target 114.73 for confirmation. However, it should be noted that USD/JPY is bounded in medium term falling channel from 118.65 (2016 high). Sustained break of 61.8% retracement of 104.62 to 111.39 at 107.20 will likely resume the fall from 118.65 through 104.62 low.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 1:30 | AUD | Trade Balance (AUD) Apr | 0.98B | 1.03B | 1.53B | 1.73B |

| 5:00 | JPY | Leading Index CI Apr P | 105.6 | 105.6 | 104.4 | |

| 5:45 | CHF | Unemployment Rate May | 2.60% | 2.70% | ||

| 6:00 | EUR | German Factory Orders M/M Apr | 0.70% | -0.90% | ||

| 7:00 | CHF | Foreign Currency Reserves (CHF) May | 757B | |||

| 7:30 | GBP | Halifax House Prices M/M May | 1.10% | -3.10% | ||

| 9:00 | EUR | Eurozone GDP Q/Q Q1 F | 0.40% | 0.40% | ||

| 12:30 | USD | Initial Jobless Claims (2 JUN) | 225K | 221K | ||

| 14:30 | USD | Natural Gas Storage | 96B |