Australian Dollar is back in the driving seat today as GDP beat market expectation. The Aussie is trading as the strongest one for today and for the week. But strength is so far limited as RBA has made its neutral stance very clear again yesterday. While Canadian Dollar follows higher in Asian session, it’s near term outlook is more mixed due to NAFTA uncertainty and falling oil price. On the other hand, Yen is staying as the weakest one in the markets. Dollar is back under some pressure as rebound in treasury yields failed to extend.

Technically, GBP/JPY’s break of 147.04 resistance now indicates near term reversal and there is prospect of climbing back to 150 and above in near term. A focus in on whether GBP/JPY would take EUR/JPY higher today. On the other hand, USD/JPY’s rebound from 108.10 is disappointing as it quickly lost momentum again.

Australia GDP grew 1.0% qoq in Q1, led by exports growth

Australia GDP grew 1.0% qoq in Q1, above expectation of 0.8% qoq. Q4’s figure was also revised up from 0.4% qoq to 0.5% qoq.

Chief Economist for the ABS, Bruce Hockman said in release that “growth in exports accounted for half the growth in GDP, and reflected strength in exports of mining commodities.” Mining industry Gross Value Added grew 2.9% during the quarter. Production of coal, iron ore and liquefied natural gas showed strong increases.

Meanwhile, private non-financial corporations profits increased by 6.0%. Hockman added that “the rise in profits was consistent with the strong increase in mining exports coupled with a lift in the terms of trade this quarter.”

Trump’s bilateral NAFTA idea shunned immediately by Canada and Mexico

It’s reported that US Treasury Secretary Steve Mnuchin urged President Donald Trump to exempt Canada from the steel and aluminum tariffs at a meeting with director of the National Economic Council Larry Kudlow, Commerce Secretary Wilbur Ross, Trade advisor Peter Navarro, trade representative Robert Lighthizer and chief of staff John Kelly. But Mnuchin’s recommendation met opposition from some others in the meeting.

Separately, Kudlow said in on Fox News that Trump is trying to negotiate with Mexico and Canada separately, in bilateral way. But Kudlow emphasized that Trump is “not going to leave NAFTA”, but just “going to try a different approach”. But the idea was shunned by NAFTA counterparts quickly.

Canada International Trade Minister Francois-Philippe Champagne said “We want a trilateral agreement – we’ve always said this.” And, “we know it works, we know it underpins a very integrated supply chain. So, when you talk about this issue you have to look at reality – the reality is that over the last 24 years we have built a very integrated supply chain, which has been good for (the) economy, good for consumers, good for workers on all sides.”

Mexico’s Economy Minister Ildefonso Guajardo said NAFTA “has to be a trilateral accord, given the conditions of integration in North America.” And, “it must be that way.

Bundesbank Weidmann: Tragic to roll back EU reforms and fiscal consolidations

German Bundesbank President Jens Weidmann said that the Euro currency union is not yet “crisis proof in a durable way”. He pointed to the recent financial market turbulence in Italy as it “illustrates” that.

Weidmann also said it would be “tragic” in the reforms and fiscal consolidations achieved during the global financial crisis are rolled back. He supports some of the proposals of German Chancellor Angela Merkel and French President Emmanuel Macron. They include common backstop for failing banks. However, Weidmann disagree to joint insurance for deposits, until the balance sheets are cleaned up.

The reforms will be discussed as a EU summit on June 28-29.

Looking ahead

Swiss will release CPI in European session and Eurozone will release retail PMI. Canada will release trade balance, building permits and Ivey PMI later today. US will release trade balance and non-farm productivity.

AUD/USD Daily Outlook

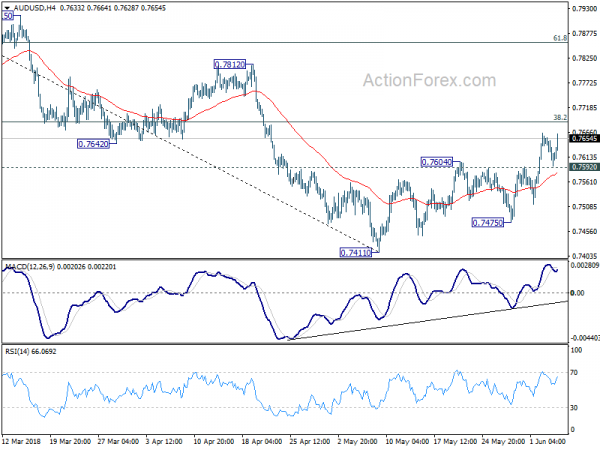

Daily Pivots: (S1) 0.7588; (P) 0.7622; (R1) 0.7650; More…

Despite today’s rebound in AUD/USD, 4 hours MACD is staying below sign line. Intraday bias is turned neutral first. As noted before, rebound from 0.7411 is seen as a correction. Hence, upside should be limited by 38.2% retracement of 0.8135 to 0.7144 at 0.7688. On the downside, below 0.7592 minor support will turn bias to the downside for 0.7475 first. Break there will likely resume larger fall through 0.7411 to 0.7328 cluster support (61.8% retracement of 0.6826 to 0.8135 at 0.7326). However, sustained break of 0.7688 will dampen our bearish view and target 61.8% retracement at 0.7585 instead.

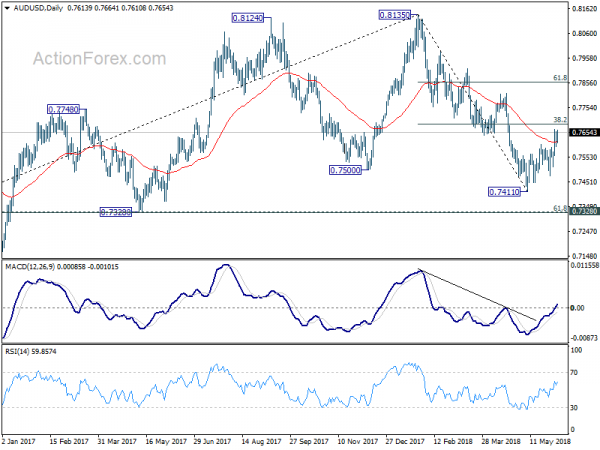

In the bigger picture, medium term rebound from 0.6826 is seen as a corrective move. Prior break of 0.7500 key support suggests that such correction is completed at 0.8135. Deeper decline would be seen back to retest 0.6826 low. In case of another rise, we’d expect strong resistance from 38.2% retracement of 1.1079 to 0.6826 at 0.8451 to limit upside to bring long term down trend resumption eventually.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 00:00 | JPY | Labor Cash Earnings Y/Y Apr | 0.80% | 1.40% | 2.10% | 2.00% |

| 01:30 | AUD | GDP Q/Q Q1 | 1.00% | 0.80% | 0.40% | 0.50% |

| 07:15 | CHF | CPI M/M May | 0.00% | 0.20% | ||

| 07:15 | CHF | CPI Y/Y May | 0.80% | 0.80% | ||

| 08:10 | EUR | Eurozone Retail PMI May | 48.6 | |||

| 12:30 | CAD | International Merchandise Trade (CAD) Apr | -4.1B | |||

| 12:30 | CAD | Building Permits M/M Apr | 2.80% | 3.10% | ||

| 12:30 | USD | Nonfarm Productivity Q1 F | 0.70% | 0.70% | ||

| 12:30 | USD | Unit Labor Costs Q1 F | 2.70% | 2.70% | ||

| 12:30 | USD | Trade Balance Apr | -50.0B | -49.0B | ||

| 14:00 | CAD | Ivey PMI May | 69.7 | 71.5 | ||

| 14:30 | USD | Crude Oil Inventories | -3.6M |