Sterling is so far the strongest major currency today. Better than expected UK services PMI raised the chance of an August BoE hike. But there is no follow through buying in the Pound yet. BoE’s decision will be heavily data dependent, and there are still two more months of data to go. Meanwhile, Australian Dollar continues to pare back this week’s gain as RBA statement provided little inspiration. The Aussie will turn to Q1 GDP to be released in the upcoming Asian session.

Canadian Dollar follows Aussie as the second weakest one. Today’s decline in oil price is a factor that’s weighing on the Loonie. Bloomberg reported that the US has requested OPEC to raise output by 1m barrels a day. Talking about the US, dollar is trading mixed for the moment. Rebound in treasury yields gave the greenback a lift yesterday. And Dollar will look into yields for some more fuel again today.

UK PMI services rose to 54.0, up the odds of BoE August hike

UK PMI services rose to 54.0 in May, up from April’s 52.8, above expectation of 52.9. Markit Chief Business Economist Chris William said in the release that the three PMI surveys indicate that GDP looks set to rise by 0.3-0.4% in Q2. And, signs of rebound in growth in Q2 will likely “up the odds of the Bank of England hiking interest rates again in coming months, likely August”. Though, he warned that “forward looking indicators suggesting that the economy could relapse, a rate rise is by no means assured.”

Eurozone PMI composite hit 1.5 year low, outlook darkened dramatically

Eurozone PMI services was finalized at 53.8 in May, revised down from 53.9, vs April’s 54.8. PMI composite was finalized at 54.1, down from April’s 55.1, hitting one-and-a-half year low. Markit’s Williamson noted in the released that “the region is on course for its worst quarter since 2016”. Though, Eurozone growth would still hit 0.4-0.5% in Q2. He added that “with the economic indicators turning down at the same time as political uncertainty has spiked higher, the eurozone’s outlook has darkened dramatically compared to the sunny forecast seen at the start of the year.”

Also from Eurozone, Italy services PMI rose to 53.1 in May, up from 52.6. France services PMI was finalized at 54.3, unrevised. Germany services PMI was finalized at 52.1, unrevised. Eurozone retail sales rose 0.1% mom in April, below expectation of 0.5% mom.

Italy PM Conte pledges to eliminate the gap in growth between Italy and the EU

Confidence votes on the new Italian government is set to take place in the upper house today and the lower tomorrow. New Prime Minister Giuseppe Conte addressed the upper house today and expressed he’s proud of the “radical change”, referring to the anti-establishment coalition.

Conte also pledged to reduce public debt, but by growth of the economy, not through austerity. The government’s objective is to eliminate the gap in growth between Italy and the EU and he emphasized that must be followed in a framework of financial stability and the trust of markets. He added that Italian debt is fully sustainable today but reduction must still be pursued.

Conte promised to put an end to the immigration business which has grown out of control. This echoed comment by Interior Minister Matteo Salvini, head of eurosceptic right-wing league that Italy “can’t be transformed into a refugee camp”.

RBA stands pat and maintains neutral stance

RBA left the policy rate unchanged at 1.50% today as widely expected, and made no change to the monetary policy guidance. The central bank remained confident over the global economic outlook. Indeed, it has so far not commented about the slowdown in economic activities in the Eurozone, UK and Japan, etc. At home, the members continued to expect growth to pick up and average a bit above 3% in 2018 and 2019.

Meanwhile, the sluggish improvement in wage growth and inflation would continue to some time. An interesting reference RBA made was that “while there may be some further tightening of lending standards, the average mortgage interest rate on outstanding loans is continuing to decline”. This appears to be a response to those proposing a rate cut to offset the current tightening in credit condition. In short, the RBA should leave the policy rate unchanged for the rest of the year.

More in RBA Left Cash Rate Unchanged, Affirmed that Credit Condition Remained Accommodative.

NZ Treasury: Q1 growth may fall short of 0.7% forecast

In the Monthly Economic Indicator report published today, New Zealand Treasury noted that the tracking of March quarter data suggested real GDP growth may fall short of 0.7% as forecast in the Budget Economic and Fiscal Update (BEFU) 2018. Nonetheless, June quarter activity indicators have been “a little more positive”. Subdued wage pressures are likely contributing to low inflation, and the expectation that RBNZ will keep OCR at 1.75% “for some time to come”.

Risks are skewed to the downside as led by international developments. In particular, the Treasury noted slowdown in Japan, Eurozone and UK in Q1. And it warned that political instability in Italy will drag Eurozone growth further. Nonetheless, the outlook for China and the US “remains relatively positive”.

GBP/USD Mid-Day Outlook

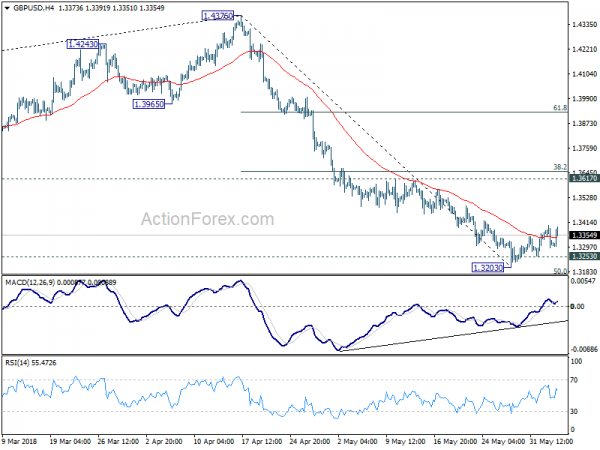

Daily Pivots: (S1) 1.3272; (P) 1.3335; (R1) 1.3376; More…

GBP/USD rebound notably today but it’s limited below yesterday’s high at 1.3397 so far. Outlook remains unchanged too. Above 1.3397 will extend the corrective rise from 1.3203. But upside should be limited by 1.3617 resistance to bring reversal. On the downside, break of 1.3253 minor support will likely resume the fall from 1.47376 through 1.3203 for 50% retracement of 1.1946 to 1.4376 at 1.3161 first, and 61.8% retracement at 1.2875 next.

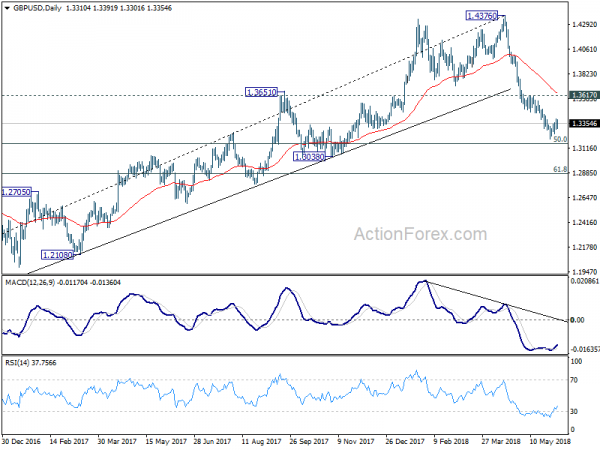

In the bigger picture, current development suggests that whole medium term rebound from 1.1936 (2016 low) has completed at 1.4376 already, with trend line broken firmly, on bearish divergence condition in daily MACD, after rejection from 55 month EMA (now at 1.4223). 61.8% retracement of 1.1936 (2016 low) to 1.4376 at 1.2874 is the next target. We’ll pay attention to the reaction from there to asses the chance of long term down trend resumption. For now, outlook will stay bearish as long as 55 day EMA (now at 1.3648) holds, even in case of strong rebound.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:01 | GBP | BRC Retail Sales Monitor Y/Y May | 2.80% | -4.20% | ||

| 23:30 | JPY | Household Spending Y/Y Apr | -1.30% | 0.80% | -0.70% | |

| 1:30 | AUD | Current Account (AUD) Q1 | -10.5B | -9.9B | -14.0B | -14.7B |

| 1:45 | CNY | Caixin PMI Services May | 52.9 | 53 | 52.9 | |

| 4:30 | AUD | RBA Rate Decision | 1.50% | 1.50% | 1.50% | |

| 7:45 | EUR | Italy Services PMI May | 53.1 | 52.9 | 52.6 | |

| 7:50 | EUR | France Services PMI May F | 54.3 | 54.3 | 54.3 | |

| 7:55 | EUR | Germany Services PMI May F | 52.1 | 52.1 | 52.1 | |

| 8:00 | EUR | Eurozone Services PMI May F | 53.8 | 53.9 | 53.9 | |

| 8:30 | GBP | Services PMI May | 54 | 52.9 | 52.8 | |

| 9:00 | EUR | Eurozone Retail Sales M/M Apr | 0.10% | 0.50% | 0.10% | |

| 12:30 | CAD | Labor Productivity Q/Q Q1 | 0.30% | 0.20% | ||

| 13:45 | USD | US Services PMI May F | 55.7 | 55.7 | ||

| 14:00 | USD | ISM Non-Manufacturing Composite May | 57.4 | 56.8 |