Trade war is the dominate theme for the market at the moment after US starts to impose steel and aluminum tariffs on its closest allies in Canada, Mexico and the EU. The move drew strong criticism from these countries and retaliation measures are on the way. Italy took a back seat as the populist government is finally formed. Giuseppe Conte could sworn in as soon as today. While clash between the eurosceptic government and EU is inevitable, at least for a short while, the turmoil is solved. US non-farm payroll and UK PMI manufacturing are still the main focuses of today. But trade tensions and development could remain the driver.

Reactions to the trade war between the US and its own allies were “relatively” mild. DOW closed down -251.94 pts or -1.02% only. S&P 500 lost -18.74 pts or -0.69% while NASDAQ was down -20.33 pts or -0.27%. Nikkei is indeed trading up 0.06% at the time of writing while Hong Kong HSI is down just -0.15%.

In the currency markets, Sterling is surprisingly trading as the weakest one for the week, down against all other major currencies. And, it’s followed by Australian Dollar as the second weakest. On the other hand, New Zealand Dollar is the strongest one for the week, followed by Yen. For today, Dollar is broadly higher as it’s paring some of the losses earlier this week. Aussie is the weakest one.

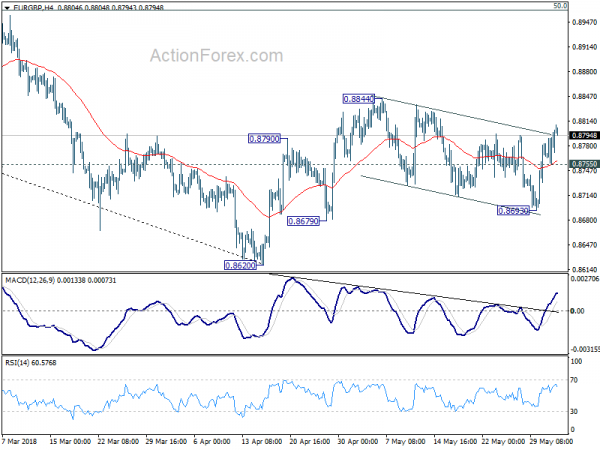

Technically, a notable development was EUR/GBP’s break of near term falling channel resistance. That indicates some underlying bullishness and focus will be on 0.8844 resistance for today.

EU Juncker on US steel tariffs: It’s protectionism, pure and simple

In response to US steel and aluminum tariffs, European Commission President Jean-Claude Juncker immediately condemned that as “protectionism, pure and simple”. The US actions are “unjustified” and “at odds with WTO rules”. He also pledged to ” defend the Union’s interests, in full compliance with international trade law.”

Trade Commissioner Cecilia Malmstrom also criticized that using “threat of trade restrictions” to obtain concessions is not the way between “longstanding partners, friends and allies.” And, she added “now we have clarity, the EU’s response will be proportionate and in accordance with WTO rules.” EU will trigger a dispute settlement at the WTO and impose rebalance measures. Full statement of the EU here. Also, the EU has already published the list of US products for re-balancing back on May 18.

Canada planned retaliatory tariffs on CAD 16.6b in US imports

Canadian Prime Minister Justin Trudeau criticized Trump’s steel and aluminum tariffs as “totally unacceptable” and announced retaliatory tariffs on CAD 16.6b in US imports. A 15-day consultation period immediately began the tariffs will come into effect on July 1. There are two list of goods, one list that will be subject to a 25% tariff; a second list that will be subject to a 10% tariff. The details of the goods can be found here.

Trudeau emphasized that “Americans remain our partners, our allies and our friends” and “the American people are not the target” of the retaliation measures. He pledged to continue to make arguments based on logic and common sense” and hoped that “eventually they will prevail against an administration that doesn’t always align itself around those principles.”

Foreign Minister Chrystia Freeland, also said that the unilateral trade restrictions by the US are “in violation of NAFTA and WTO trade rules”. And Canada will launch dispute settlement proceedings under NAFTA Chapter 20 and WTO Dispute Settlement. Freeland also pledged to “closely collaborate with like-minded WTO members, including the European Union” to challenge the “illegal and counterproductive US measures at the two. Statement can be found here.

Mexico to hit back US on agricultural and steel products

Mexican Economy Ministry said there are wide-range “equivalent” measures to counter the US steel tariffs. It’s reported that Mexico will target agricultural products that could hit Trump’s base states. And the measures will be in place until the US stops its tariffs.

It said in a statement that “Mexico profoundly regrets and condemns the decision by the United States to impose these tariffs on imports of steel and aluminum from Mexico.” And, “Mexico reiterates its openness to constructive dialogue with the United States, its support for the international commerce system and its rejection of unilateral protectionist measures.”

The Ministry also said Mexico buys more steel and aluminum from the US than it sells. And it’s the top buying of US aluminum and second buyer of US steel.

Italy populist government formed, Conte as PM, Tria as economy minister, Savona as EU affairs minister

The political turmoil in Italy is now solved, at least in the near term, after a week of roller coaster ride. The anti-establishment 5-Star Movement and eurosceptic League agreed to form a political government again, averting a re-election. Law professor Giuseppe Conte remains the choice as prime minister and will sworn in on Friday. 5-Star and League leaders Luigi Di Maio and Matteo Salvini will be vice premiers.

Eurosceptic economist, 81-year-old Paolo Savona, who’s rejected by President Sergio Mattarella as economy minister, will take the post of EU affairs minister. On the other hand, economics professor Giovanni Tria get the job of economy minister.

Conte said that “we will work hard to reach the objectives included in the government contract and to improve the quality of life of all Italians.” He referred to “Contratto Per Il Governo Del Cambiamento” or “Contract for the Government of Change”.

The new Cabinet will face a confidence vote in both houses were the coalition have a thin majority. But the far-right Brothers of Italy, a League ally, said it would help by abstaining in that vote.

China Caixin manufacturing PMI unchanged at 51.1, export situation still disappointing

China Caixin manufacturing PMI was unchanged at 51.1 in May, slight below expectation of 51.2, indicating modest expansion. Dr. Zhengsheng Zhong, Director of Macroeconomic Analysis at CEBM Group noted that “the index for new export orders picked up in May, but remained in contraction territory, reflecting that the export situation was still grim.” And, “overall, operating conditions across the manufacturing sector remained stable. The growth in the price of industrial products has gained momentum, however, the export situation was still disappointing.”

Also release in Asian session, Japan PMI manufacturing was finalized at 52.8, revised up from 52.5. Japan capital spending rose 3.4% in Q1. New Zealand terms of trade dropped -1.90% qoq in Q1. Australia PMI manufacturing dropped to 57.4 in May, down from 58.3.

Looking ahead – UK PMI manufacturing and US non-farm payroll to watch

UK PMI manufacturing is a major focus in European session, and should indicate the strength of rebound in Q2 in UK economy. Eurozone will release PMI manufacturing revision. Swiss will also release PMI manufacturing.

Non-farm payroll report from US is the major focus later in the day. NFP is expected to show 190k growth in May. Unemployment rate is expected to be unchanged at 3.9%. The key still lies on wage growth as average hourly earnings is expected to rise 0.2% mom. US will also release ISM manufacturing and construction spending. Canada will releaser PMI manufacturing.

EUR/GBP Daily Outlook

Daily Pivots: (S1) 0.8769; (P) 0.8785; (R1) 0.8813; More…

EUR/GBP’s strong rebound and break of near term falling channel revives the bullish case. Intraday bias is back on the upside for 0.8844 resistance first. Break will resume whole rebound from 0.8620 and target 0.8967 cluster resistance (50% retracement of 0.9305 to 0.8620 at 0.8963). Decisive break there will confirm medium term reversal. However, below 0.8755 minor support will turn bias neutral and mix up the near term outlook again.

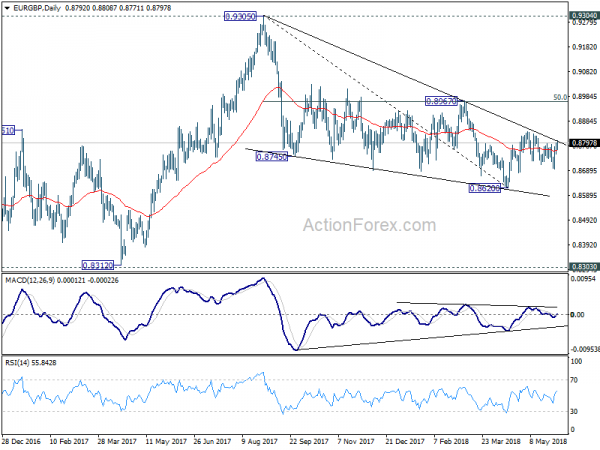

In the bigger picture, for now, the decline from 0.9305 is seen as a leg inside the long term consolidation pattern from 0.9304 (2016 high). Such consolidation pattern could extend further. Hence, in case of strong rally, we’d be cautious on strong resistance by 0.9304/5 to limit upside. Meanwhile, in another decline attempt, we’d expect strong support from 0.8116 cluster support (50% retracement of 0.6935 to 0.9304 at 0.8120) to contain downside.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 22:30 | AUD | AiG Performance of Manufacturing Index May | 57.5 | 58.3 | ||

| 22:45 | NZD | Terms of Trade Index Q/Q Q1 | -1.90% | -2.00% | 0.80% | 1.50% |

| 23:50 | JPY | Capital Spending Q1 | 3.40% | 3.20% | 4.30% | |

| 0:30 | JPY | PMI Manufacturing May F | 52.8 | 52.5 | 52.5 | |

| 1:45 | CNY | Caixin PMI Manufacturing May | 51.1 | 51.2 | 51.1 | |

| 7:30 | CHF | PMI Manufacturing May | 62.5 | 63.6 | ||

| 7:45 | EUR | Italy Manufacturing PMI May | 53 | 53.5 | ||

| 7:50 | EUR | France Manufacturing PMI May F | 55.1 | 55.1 | ||

| 7:55 | EUR | Germany Manufacturing PMI May F | 56.8 | 56.8 | ||

| 8:00 | EUR | Eurozone Manufacturing PMI May F | 55.5 | 55.5 | ||

| 8:30 | GBP | PMI Manufacturing May | 53.5 | 53.9 | ||

| 12:30 | USD | Change in Non-farm Payrolls May | 190K | 164K | ||

| 12:30 | USD | Unemployment Rate May | 3.90% | 3.90% | ||

| 12:30 | USD | Average Hourly Earnings M/M May | 0.20% | 0.10% | ||

| 13:30 | CAD | Manufacturing PMI May | 55.5 | |||

| 13:45 | USD | Manufacturing PMI May F | 56.7 | 56.6 | ||

| 14:00 | USD | Construction Spending M/M Apr | 0.80% | -1.70% | ||

| 14:00 | USD | ISM Manufacturing May | 58.1 | 57.3 | ||

| 14:00 | USD | ISM Prices Paid May | 77.9 | 79.3 |