Euro has been strong most of the day as Italian political risk temporarily receded. Stronger than expected Eurozone CPI reading also provided some support to the common currency. But it’s Yen that’s taking the spotlight again in early US session on risk aversion. DOW opened losing triple digits and stays in red after US announced the decision on steel and aluminium tariffs on Canada, Mexico and the EU. The temporary exemption will expire at midnight. 25% tariffs on steel and 10% on aluminum will then be imposed. For now, Canadian Dollar is having the biggest reaction to the decision with USD/CAD trading back above 1.2950. The pair could have its sight back on 1.3 handle.

US Commerce Secretary Wilbur Ross said earlier that “if there is an escalation it will be because the EU would have decided to retaliate.” No matter whether Ross believes in what he said or not, the tension has already escalated. And now it’s time for the EU, Canada and Mexico to announce their retaliation in response to escalation of trade tension by the US.

Released from US, personal income rose 0.3% in April, matched expectation. Personal spending rose 0.6%, above expectation of 0.4%. Headline PCE deflator rose 0.2% mom, 2.0% yoy, in line with consensus. Core PCE rose 0.2% mom, 1.8% yoy in April, versus expectation of 0.1% mom, 1.8% yoy.

Initial jobless claims dropped -13k to 221k in the week ended May 26 versus expectation of 230k. Four week moving average rose 2.5k to 222.25k. Continuing claims dropped -16k to 1.726m in the week ended May 19. Four week moving average of continuing claims dropped -8.5k to 1.7435m, lowest level since December 1973

From Canada, GDP grew 0.3% mom in March, in line with expectation.

German Merkel: We’ll have smart, determined and jointly agreed response to US steel tariffs

German Chancellor said today in Lisbon that European Union will give a “smart, determined and jointly agreed” response to the US is Trump decides to impose steel and aluminum tariffs on them.

She noted “we don’t know the decision yet but if tariffs were to be imposed, then we have a clear stance within the European Union.” And she added “we are convinced that these tariffs are not in line with WTO rules.”

The temporary exemption of US steel and aluminum tariffs will expire tomorrow. It’s widely reported that US will decide to start imposing tariffs on Mexico, Canada and the EU. And the decision would be announced today.

Euro maintains gain as CPI rose to 1.9%, beat expectation

Flash Eurozone CPI accelerated to 1.9% yoy in May, up from 1.2% yoy and came in well above expectation of 1.6%. Core CPI rose to 1.1% yoy, up fro 0.7% yoy and beat expectation of 1.0% yoy. Unemployment was unchanged at 8.5% in April, above expectation of 8.4%.

Reactions in the Euro is relatively muted as the higher than expected inflation was actually expected after upside surprise in both German and French CPI reading. Nonetheless, the solid rebound in inflation in Q2 should have eased much of ECB policy makers’ worries. The data add to the case for completing the asset purchase program this year. The question is whether it would end after September. President Mario Draghi could give some hints at the June 14 press conference.

Also released in European session, Swiss GDP rose more than expected by 0.6% qoq in Q1. Swiss retail sales dropped -2.2% yoy in April, below expectation of -1.4% yoy. UK mortgage approvals dropped to 62k in April. UK M4 money supply rose 0.2% mom in April.

China official PMI manufacturing rose to 51.9 as part of short-term fluctuation

The China official PMI manufacturing rose to 51.9 in May, up from 51.4, and beat expectation of 51.4. PMI non-manufacturing rose to 54.9, up from 54.8 and beat expectation of 54.8. In the release, contributing analyst Zhang Liqun noted that the slight increase in PMI was just “short-term fluctuation” and carries “no trend significance”. The rise in export orders showed there is no chance in the growing trend. Rise in purchase prices and ex-factory prices suggested that the decline in PPI could be coming to an end. In short, the data suggested that the economy continued to grow steadily in May.

Released from Japan, industrial production rose less than expected by 0.3% mom in April. Housing starts rose 0.3% yoy.

ANZ business confidence: Fairly uninspiring reading

New Zealand ANZ business confidence dropped to -27.2 in May, down from -23.4. That is, a net 27% of businesses are pessimistic about the year ahead. Views on their “own activity” also dipped from 18 to 14. ANZ noted in the release that “the survey made for fairly uninspiring reading this month, with all aggregate activity indicators flat to falling. The economy still has good tailwinds in the form of fiscal stimulus and the record-high terms of trade, but may be tiring nonetheless.” Meanwhile, ANZ’s composite growth indicator, a combination of business and consumer confidence, is consistent with around 2% y/y growth.

Released from Australia, private sector credit rose 0.4% mom in April as expected.

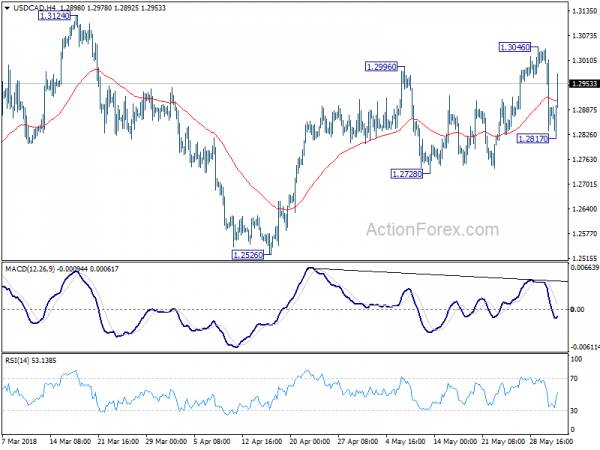

USD/CAD Mid-Day Outlook

Daily Pivots: (S1) 1.2977; (P) 1.3013; (R1) 1.3056; More…..

USD/CAD rebounds strongly after hitting 1.2817, as supported by 55 day EMA, and intraday bias is turned neutral again. With 1.2728 support intact, our bullish view is kept alive and focus is back on 1.3045. Break will resume the rise from 1.2526 and target 1.3124 key resistance. Decisive break there will confirm medium term reversal. Nonetheless, break of 1.2728 will indicate completion of the rebound from 1.2526 at 1.3046. And in that case, deeper fall would be seen back to 1.2526 and below.

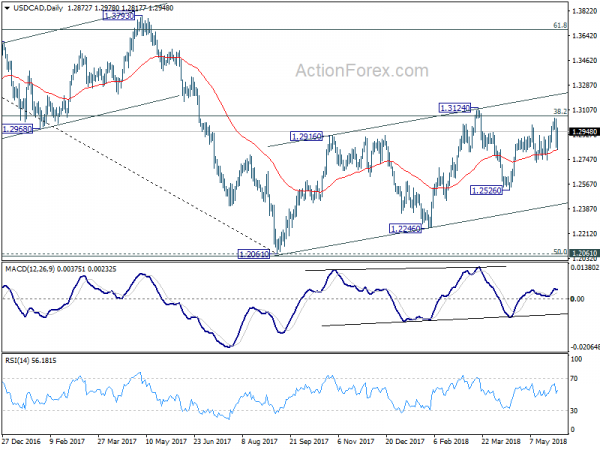

In the bigger picture, we’re favoring the case that that rebound from 1.2061 has not completed yet. But there is no follow through upside momentum so far. Focus remains on 38.2% retracement of 1.4689 to 1.2061 at 1.3065. Sustained trading above there will confirm medium term bullish reversal. That is, down trend from 1.4689 has completed at 1.2061 already. In that case, next target will be 61.8% retracement at 1.3685. However, break of 1.2526 support will dampen this bullish view again. And, focus will be back on 1.2061 key support level, which is close to 50% retracement of 0.9406 (2011 low) to 1.4689 (2015 high) at 1.2048.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:01 | GBP | GfK Consumer Confidence May | -7 | -8 | -9 | |

| 23:50 | JPY | Industrial Production M/M Apr P | 0.30% | 1.40% | 1.40% | |

| 01:00 | NZD | ANZ Business Confidence May | -27.2 | -23.4 | ||

| 01:00 | CNY | Manufacturing PMI May | 51.9 | 51.4 | 51.4 | |

| 01:00 | CNY | Non-manufacturing PMI May | 54.9 | 54.8 | 54.8 | |

| 01:30 | AUD | Private Sector Credit M/M Apr | 0.40% | 0.40% | 0.50% | |

| 05:00 | JPY | Housing Starts Y/Y Apr | 0.30% | -8.90% | -8.30% | |

| 05:45 | CHF | GDP Q/Q Q1 | 0.60% | 0.50% | 0.60% | |

| 07:15 | CHF | Retail Sales Real Y/Y Apr | -2.20% | -1.40% | -1.80% | -1.10% |

| 08:30 | GBP | Mortgage Approvals Apr | 62K | 63K | 63K | |

| 08:30 | GBP | Money Supply M4 M/M Apr | 0.20% | -1.10% | -1.40% | |

| 09:00 | EUR | Eurozone Unemployment Rate Apr | 8.50% | 8.40% | 8.50% | 8.60% |

| 09:00 | EUR | Eurozone CPI Estimate Y/Y May | 1.90% | 1.60% | 1.20% | |

| 09:00 | EUR | Eurozone CPI Core Y/Y May A | 1.10% | 1.00% | 0.70% | |

| 12:30 | CAD | GDP M/M Mar | 0.30% | 0.30% | 0.40% | |

| 12:30 | USD | Personal Income Apr | 0.30% | 0.30% | 0.30% | 0.20% |

| 12:30 | USD | Personal Spending Apr | 0.60% | 0.40% | 0.40% | 0.50% |

| 12:30 | USD | PCE Deflator M/M Apr | 0.20% | 0.20% | 0.00% | |

| 12:30 | USD | PCE Deflator Y/Y Apr | 2.00% | 2.00% | 2.00% | |

| 12:30 | USD | PCE Core M/M Apr | 0.20% | 0.10% | 0.20% | |

| 12:30 | USD | PCE Core Y/Y Apr | 1.80% | 1.80% | 1.90% | 1.80% |

| 12:30 | USD | Initial Jobless Claims (26 MAY) | 221K | 230K | 234K | |

| 13:45 | USD | Chicago PMI May | 62.7 | 58 | 57.6 | |

| 14:00 | USD | Pending Home Sales M/M Apr | -1.30% | 0.50% | 0.40% | |

| 14:30 | USD | Natural Gas Storage | 100B | 91B | ||

| 15:00 | USD | Crude Oil Inventories | -0.4M | 5.8M |