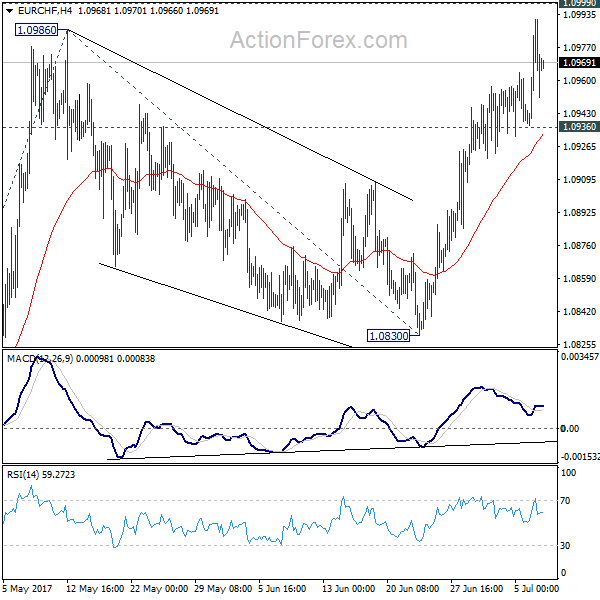

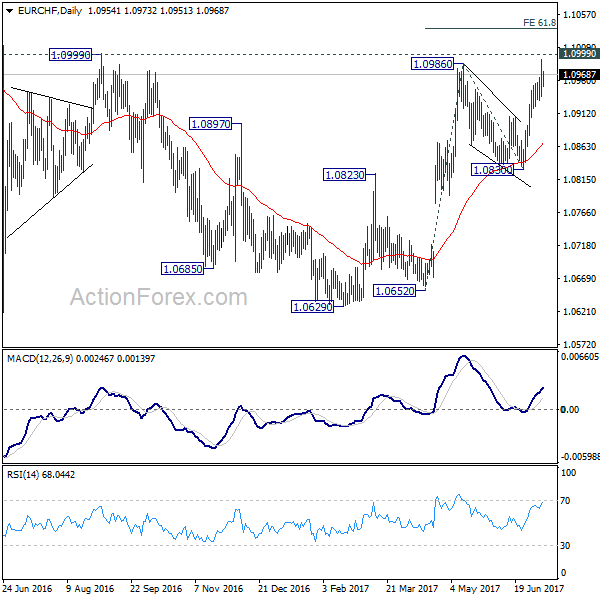

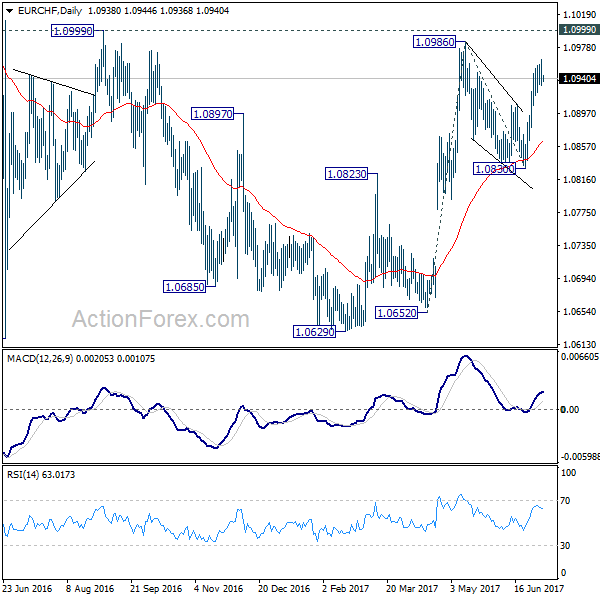

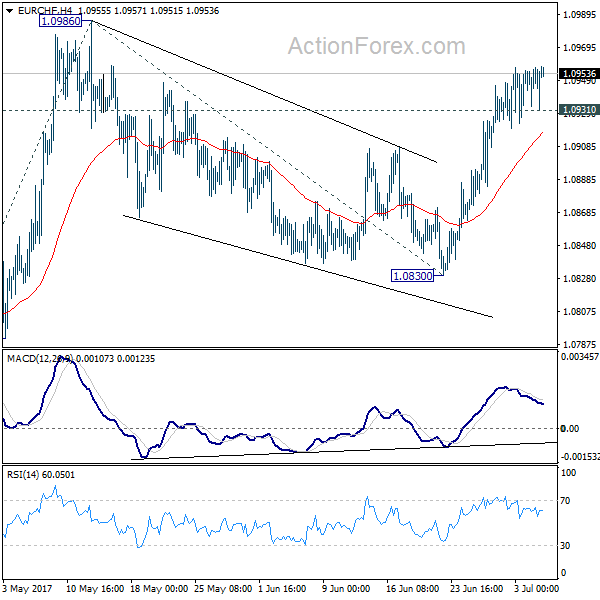

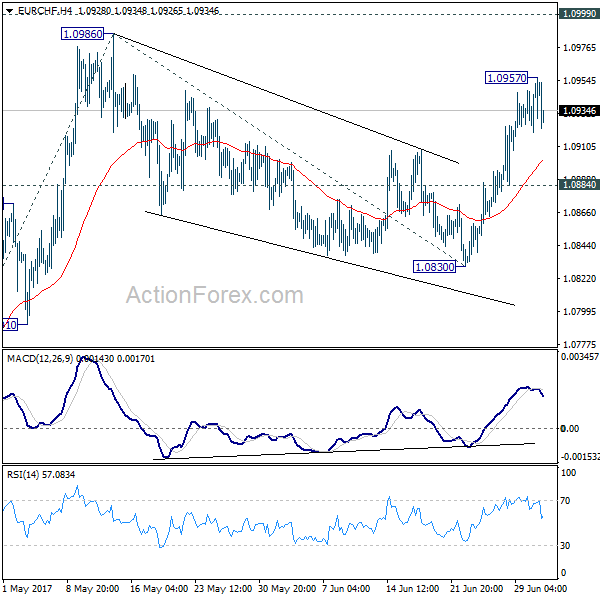

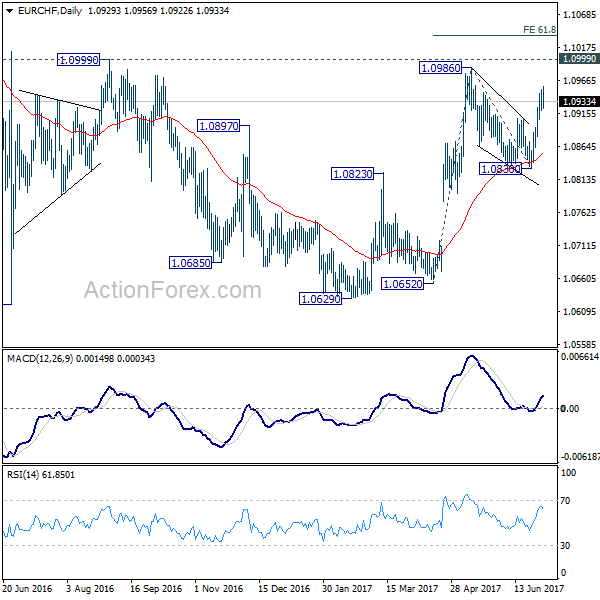

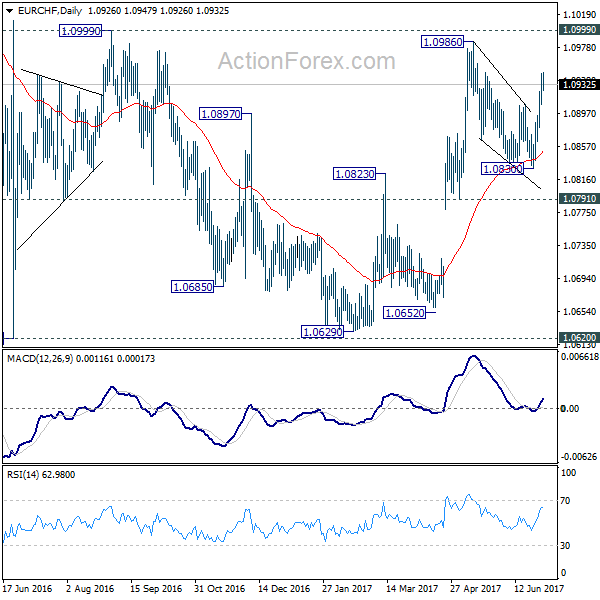

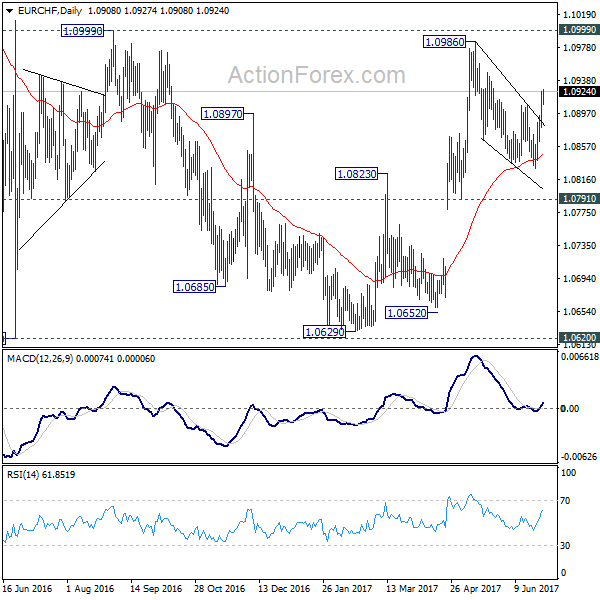

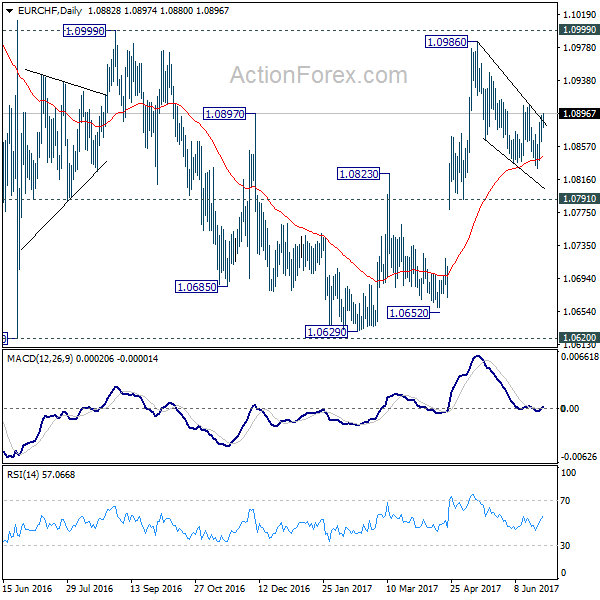

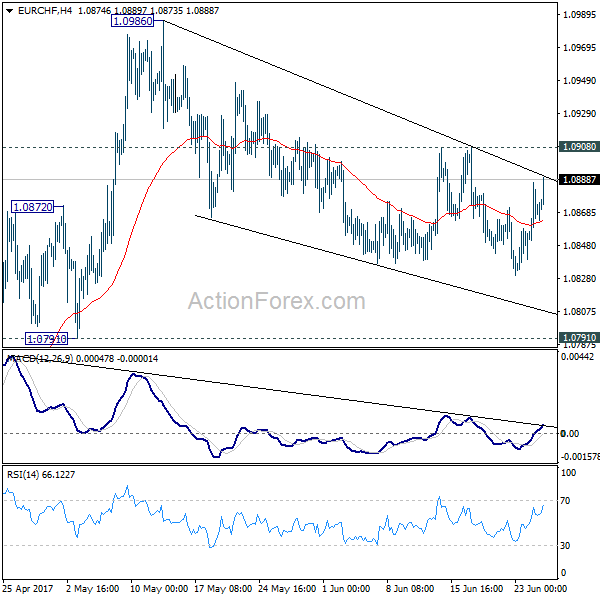

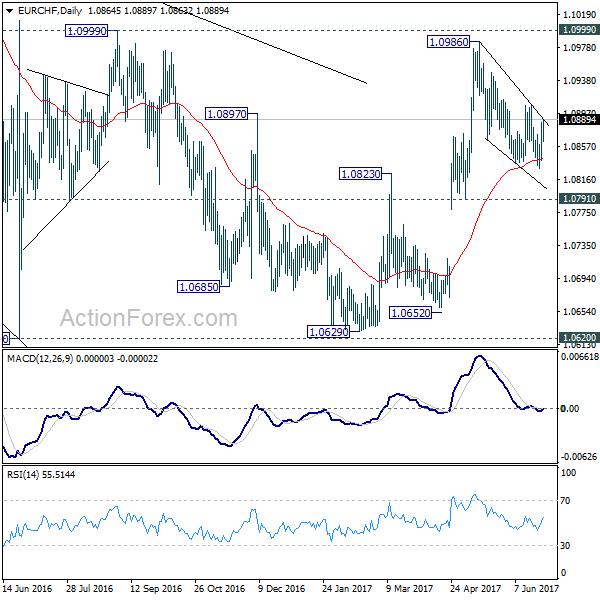

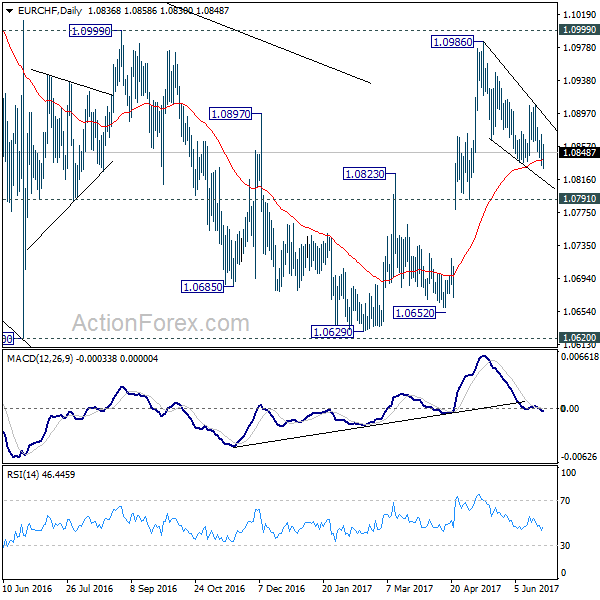

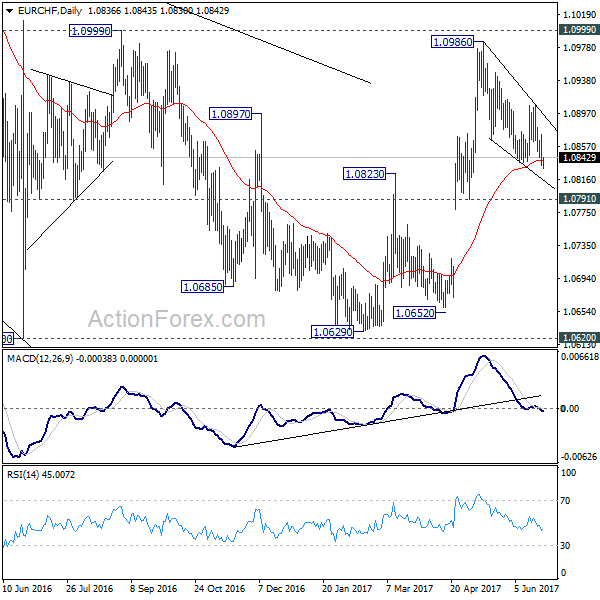

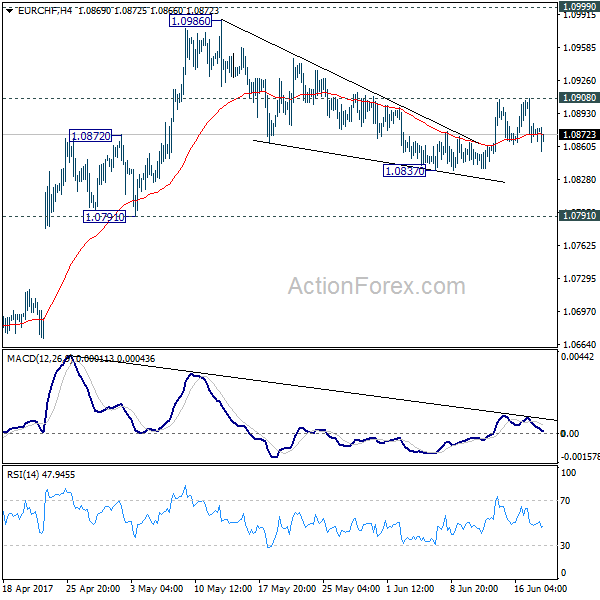

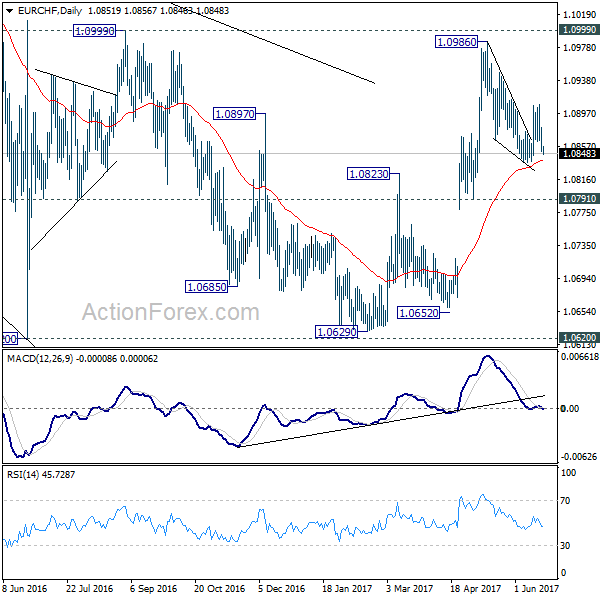

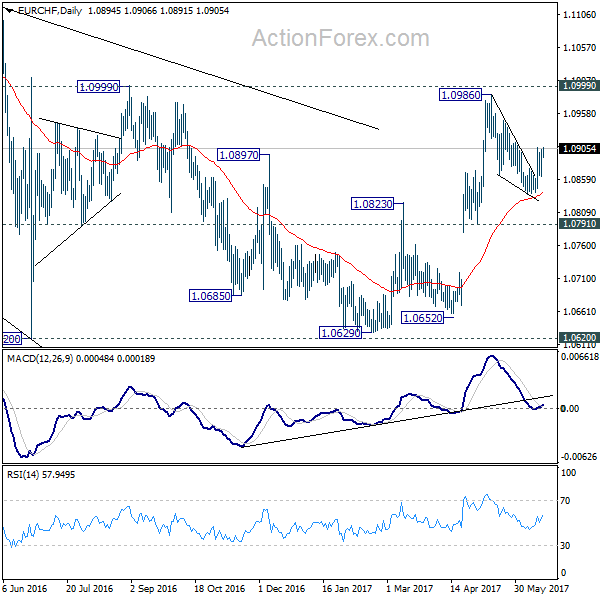

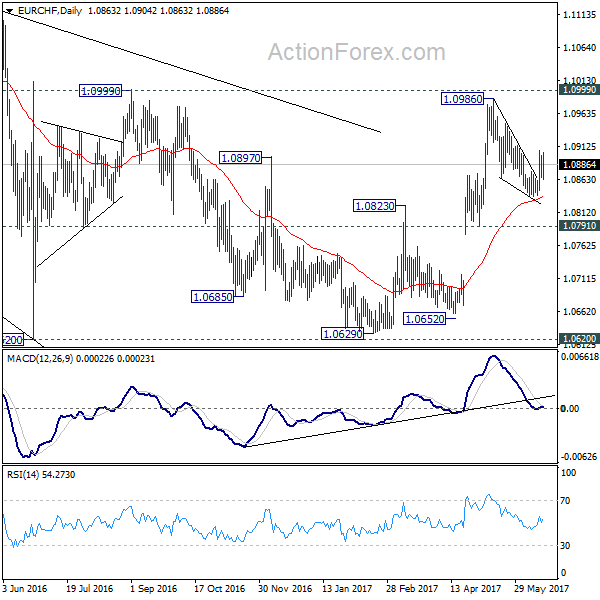

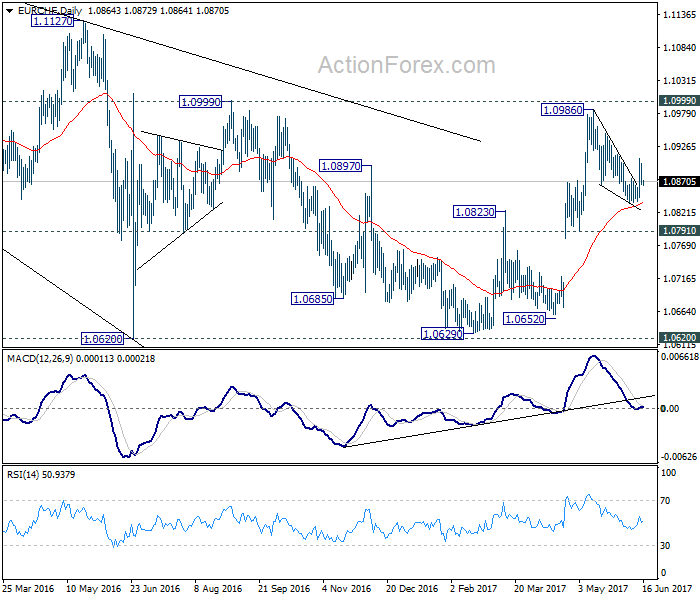

EUR/CHF’s rally extended last week and reached as high as 1.0999, touching 1.0999 medium term resistance. Initial bias stays on the upside this week. Current rally would target 61.8% projection of 1.0652 to 1.0986 from 1.0830 at 1.1036 next. On the downside, break of 1.0936 support is needed to indicate short term topping. Otherwise, outlook will remain bullish in case of retreat.

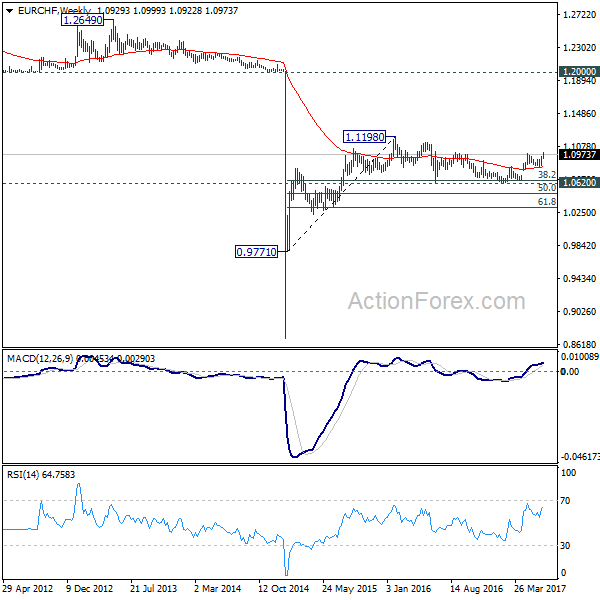

In the bigger picture, the price actions from 1.1198 are seen as a corrective move. Such correction could have completed after defending 38.2% retracement of 0.9771 to 1.1198 at 1.0653. Decisive break of 1.0999 resistance will target a test on 1.1198 high. For now, this will be the preferred case as long as 1.0830 support holds.