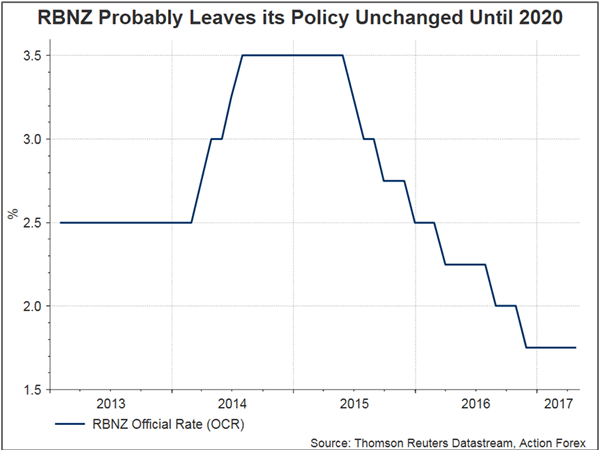

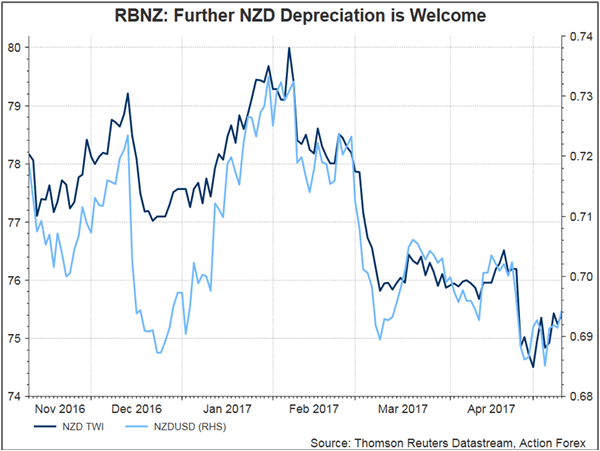

RBNZ left the OCR unchanged at 1.75% in May. Policymakers shrugged off the recent NZD depreciation and the rise in inflation, indicating that the monetary policy would likely stay unchanged for the rest of the year and probably until 2020 before tightening. The market was disappointed by the lack of hawkish comments and the unchanged forward guidance. Down -1.85, NZDUSD slumped to an 11-month low of 0.6816 after the announcement.

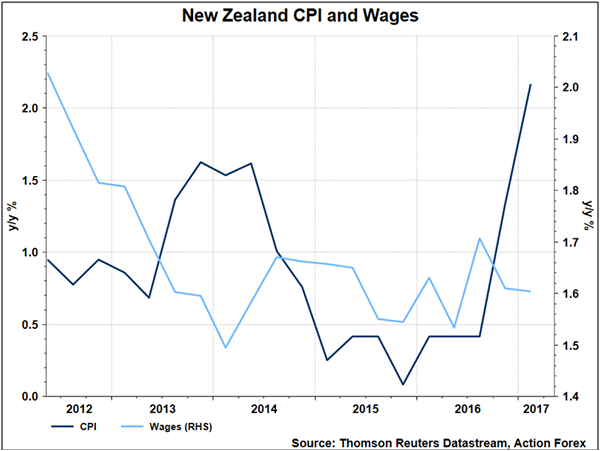

As noted in the statement, RBNZ acknowledged that global economic growth has ‘increased and become more broad-based over recent months’. Yet, it remained cautious over the ‘surplus capacity’ and ‘extensive political uncertainty’. Meanwhile, the central bank reminded the ‘weaker than expected’ domestic growth in 2H16. RBNZ also acknowledged the increase in New Zealand’s headline inflation in the March quarter, attributing the improvement to ‘higher tradables inflation, particularly petrol and food prices’. However, they judged that the effects are ‘temporary’ and ‘may lead to some variability in headline inflation over the year ahead’. It added that ‘non-tradables and wage inflation remain moderate but are expected to increase gradually. Overall, policymakers believed that headline inflation would reach the midpoint of the target band over the medium term. They maintained the longer-term inflation expectations at around +2%.

Policymakers were also aware of the depreciation in New Zealand dollar, attributing that -5% decline in the trade-weighted exchange rate since February to ‘reduced interest rate differentials’ and a response to the global developments. They added that further weakness in the currency would ‘help to rebalance the growth outlook towards the tradables sector’. On the housing market, Governor Graeme Wheeler noted at the press conference that ‘the slowing in house price inflation partly reflects loan-to-value ratio restrictions and tighter lending conditions’. He expected the moderation to continue, despite that ‘risk of resurgence given the continuing imbalance between supply and demand’.

While the market had anticipated tighter policy guidance as a result of rising inflation and NZD weakness, the RBNZ noted that ‘developments since the February Monetary Policy Statement on balance are considered to be neutral for the stance of monetary policy’. The RBNZ has kept its expected OCR track unchanged from the one in February, with the forecast at 1.8% through to September 2019, before rising to 2.0% in March 2020, where it now remains through June 2020.