The RBNZ is almost certain to raise the OCR by +25 bps to 0.5% next week. The Funding-For-Lending program (FLP) will stay unchanged at NZ$28B. This should not be affected by the slowdown in economic activities in the third quarter. While cautioning about the uncertainty of the pandemic and economic damage brought about by the lockdown, policymakers should still see a rate hike the option of “least regret”. The upside surprise in 2Q21 GDP growth, continued inflation strength and the resilient job market are supportive of the move. Forward guidance of the future rate hike path would be closely watched.

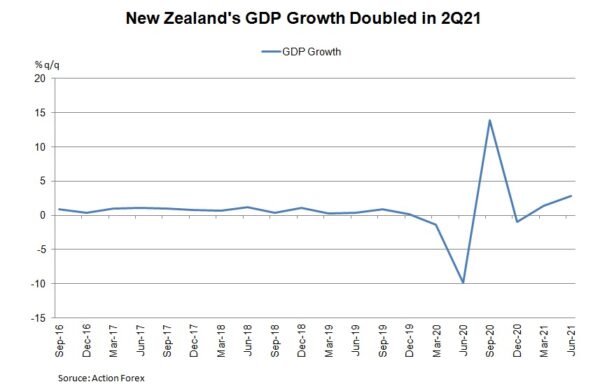

Economic data released since the August meeting has been strong, reinforcing the rhetoric of rate hike. GDP growth accelerated to +2.8% q/q in 2Q21, doubling the prior quarter’s +1.4% and consensus of +1.1%. From year ago, the economy expanded +17.4%, compared with +2.9% in the first quarter. Besides base effect, the strength was attributed to stimulus-induced consumption and business investment.

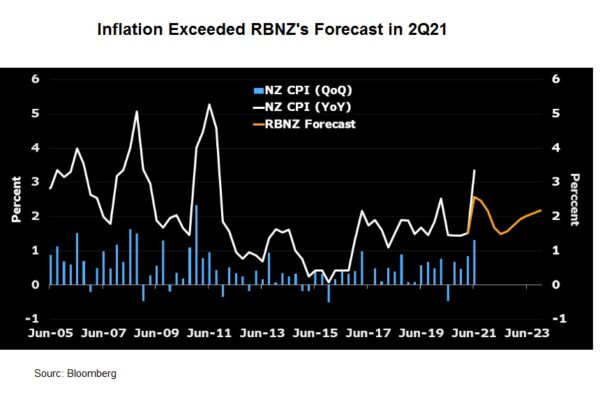

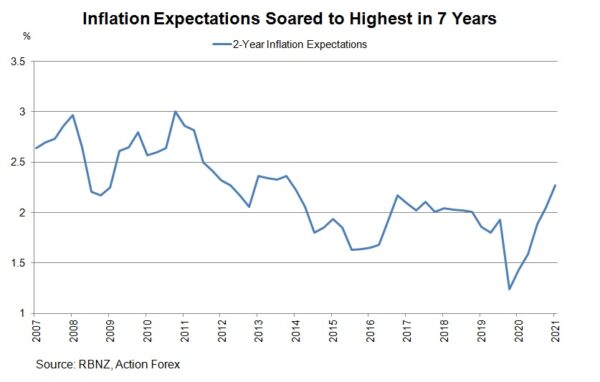

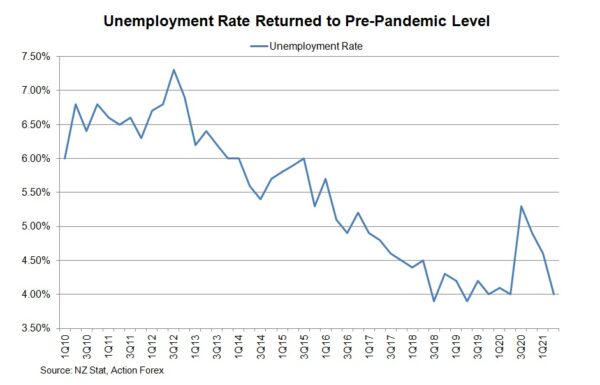

Global inflation has spiked. The same is true for New Zealand. Recalled that headline CPI more than doubled to +3.3% y/y in 2Q21, compared with consensus of +2.7%. The RBNZ survey of inflation expectations 2 years ahead soared +2.27% as of September. This marks the highest reading since June 2014. Meanwhile, the unemployment rate returned to pre-pandemic level of 4% in the June quarter.

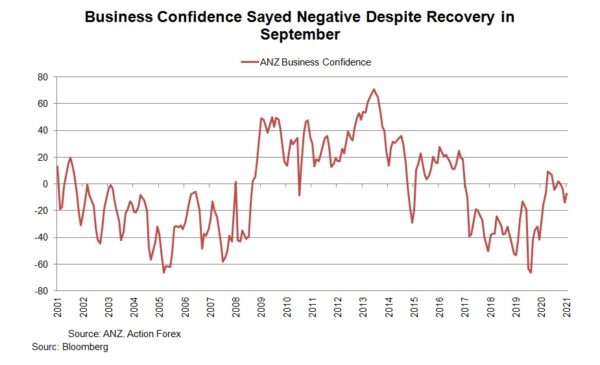

The recovery momentum is prone to slow in the third quarter, especially due to Auckland’s lockdown. Sentiment data have already suggested so. ANZ’s business confidence index was revised lower to -7.2 in September, from an initial reading of -6.8. The activity outlook index steadied at 18.2. Westpac’s consumer confidence slipped -4.4 points to 102.7 in 3Q21. Manufacturing activities have moderated rather sharply with the manufacturing PMI slumped to 40.1 in August, from the downwardly revised 62.2 in July.

The hiccups in the third quarter should be viewed as temporary as would not affect the monetary policy stance. In August, the central bank affirmed that the “clear direction is to reduce policy stimulus”, and “significant changes in demand” are needed to “change course” of this plan.

The market has almost fully priced in a +25 bps OCR increase next week. Speculations of a +50 bps hike are rising. Yet, we expect the former is more likely to occur as policymakers normalize its policy gradually. The focus of the meeting is the guidance of further tightening. We expect to see more rate hikes in subsequent meetings.