The focus of this week’s BOE is whether the result of the policy review would be revealed. In particular, whether there will be guideline on BOE’s exit sequence of QE and record low policy rate. Meanwhile, economic projections in reflection of the economic developments since the June would also be closely watched.

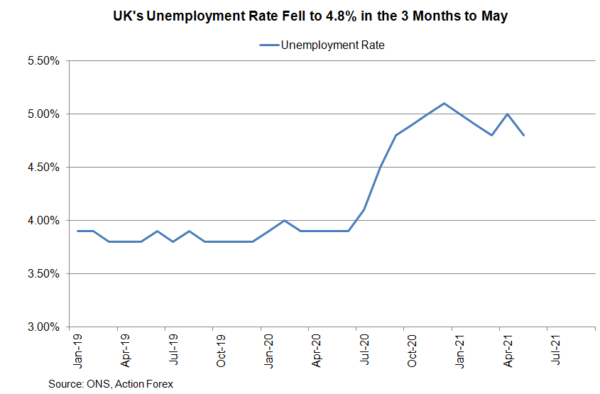

Economic data released since the last meeting have been mixed. Yet, they should not derail BOE’s upbeat outlook. The unemployment rate steadied at 4.8% in the three months through to May. ONS’ data also suggests that the number of payrolls increased +356K in June to 28.9M. That said, the figure remains -206K below pre-pandemic levels. The ONS also added that some regions, for the first time since the beginning of the pandemic, are now above pre-pandemic (February 2020) levels. Inflation accelerated with the headline CPI rising to +2.5% y/y in June, beating consensus of +2.2% and May’s +2.1%. Core CPI also rose to +2.3% from +2% in May. Headline CPI has exceeded BOE’s June projection of +1.7%.

On the flip side, PMI indices revealed a slowdown in economic activities. The manufacturing PMI dropped -3.5 points to 60.4 in July. Output and new order growth moderated to lowest in 4 month. As suggested in the accompanying report, the slowdown was driven by supply chain delays (including resources and labors). The services PMI also fell to a 4-month low of 59.6 in July, from 62.4 a month ago. Again, the biggest drag was labor shortage. The reports show that the slowdown was mainly driven by the supply side while demand remained resilient.

Against this backdrop, we expect policymakers to remain upbeat about the economic outlook. Upgrades in the near-term GDP growth and inflation forecasts are likely. Although policymakers are likely to maintain the view that the current strong inflation is transitory, an upward revision to the inflation forecasts is inevitable. Recall that in the June minutes, the members noted that inflation would likely “exceed 3% for a temporary period”. Some officials since the June meeting have signaled that the central bank’s expectations for peak inflation could be “well over 3%” to as high as 4%. We expect, following the June CPI data, the BOE would forecast that peak inflation could reach around 3.5% y/y.

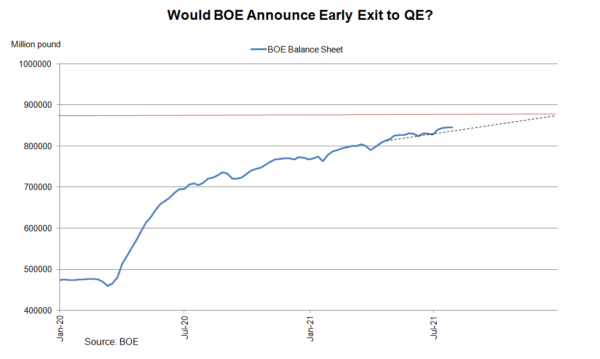

On the monetary policy, the market anticipates that the central bank could announce at this week’s meeting the result of the strategic policy review. The focus is the tightening sequence on balance sheet reduction and rate hike. Concerning the policy decision for the August meeting, we expect a unanimous vote to keep the Bank Rate unchanged at 0.1%. The decision to maintain QE purchases at 895B pound would be more divided. We expect Michael Saunders and Dave Ramsden to vote for an early end to the program. At the May and June meetings, the now-departed Chief Economist, Andy Haldane, was the only member dissenting to leave the size of QE purchases unchanged.