In his last meeting as the president, Mario Draghi is not expected to announce any new measures. Rather, he would be defending the needs of the stimulus package announced in September and urging for a bigger role in fiscal policy. Economic data released since the last meeting have surprised to the downside. Yet, it takes some time to gauge the effectiveness of the stimulus measures. The minutes for the September meeting revealed that the members were divided over QE resumption. This not only would be the focus in the Q&A session, but also a legacy left to the incoming president, Christina Lagarde.

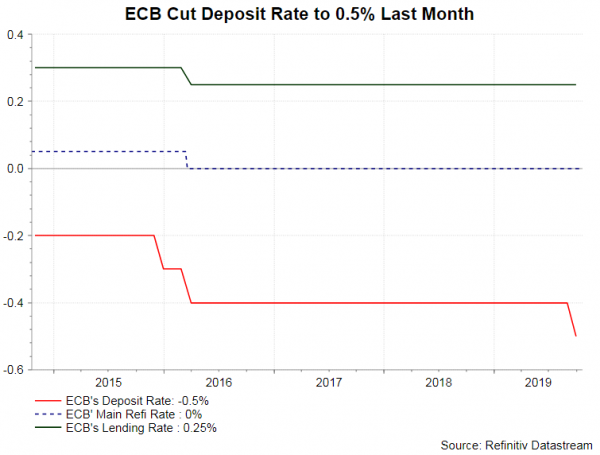

Recall that the central bank announced a stimulus package last month, in response to subdued inflation and global economic slowdown. Deposit rate was reduced by -10 bps to -0.5%. The rate cut came with a two-tier system, under which part of banks’ excess reserve holdings will be exempt from being charged at deposit rate. Meanwhile, ECB will resume the asset purchase program on November 1 at the pace of 20B euro/month. ECB also relaxed the borrowing conditions for TLTRO, removing the 10-bps spread with the average main refi rate.

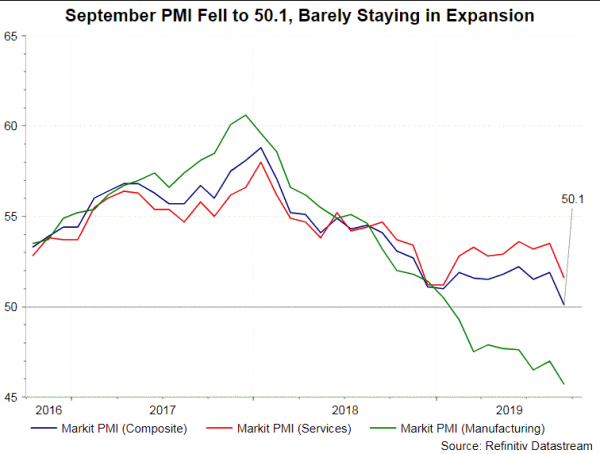

While it takes some time to gauge the effectiveness of the above measures on boosting growth and inflation, disappointing economic data released during the intermeeting period suggest that a dovish tone is still warranted. Headline CPI moderated for a third consecutive month to +0.83% y/y in September. Although core CPI climbed higher, it has been hovering about +1%. Both gauges have stayed far below ECB’s target of “close to, but below,+2%”. ECB’s GDP growth forecast of +1.1% this year might prove too optimistic. The economy expanded about +0.6% in the first quarter. However, PMI data show that the composite index averaged at 51.2 in the three months through to September. This is compared to the average of 51.7 in the first half of the year. This signals that third quarter growth would be weaker than the first two quarters of the year. Meanwhile, the trend suggests that the fourth quarter growth could be even worse.

The economic backdrop indicates that Draghi’s farewell message would remain dovish, paving the way for further easing in coming months. We expect the forward guidance would reiterate the stance that the policy rates will stay “at their present or lower levels” until “it has seen the inflation outlook robustly converge to a level sufficiently close to, but below, 2% within its projection horizon, and such convergence has been consistently reflected in underlying inflation dynamics”. Moreover, it would affirm that the asset purchase program will continue “as long as necessary”. It will “end shortly before it starts raising the key ECB interest rates”.

The minutes for the September meeting revealed that the members were divided over whether QE should be resumed. As noted in the minutes, “all members agreed that a further easing of the monetary policy stance was warranted to support the return to sustained convergence to the Governing Council’s inflation aim”. However, “a number of reservations were expressed about individual elements of the proposed policy package…Although the rational for a comprehensive package was widely shared, members assessed the case for specific elements differently…”. Meanwhile, the tiering system and even changes to the forward guidance were also rigorously debated. We expect Draghi will receive questions about the divided committee in the Q&A session. Meanwhile, this would be a difficult situation for the incoming president Lagarde.

The minutes for the September meeting revealed that the members were divided over whether QE should be resumed. As noted in the minutes, “all members agreed that a further easing of the monetary policy stance was warranted to support the return to sustained convergence to the Governing Council’s inflation aim”. However, “a number of reservations were expressed about individual elements of the proposed policy package…Although the rational for a comprehensive package was widely shared, members assessed the case for specific elements differently…”. Meanwhile, the tiering system and even changes to the forward guidance were also rigorously debated. We expect Draghi will receive questions about the divided committee in the Q&A session. Meanwhile, this would be a difficult situation for the incoming president Lagarde.