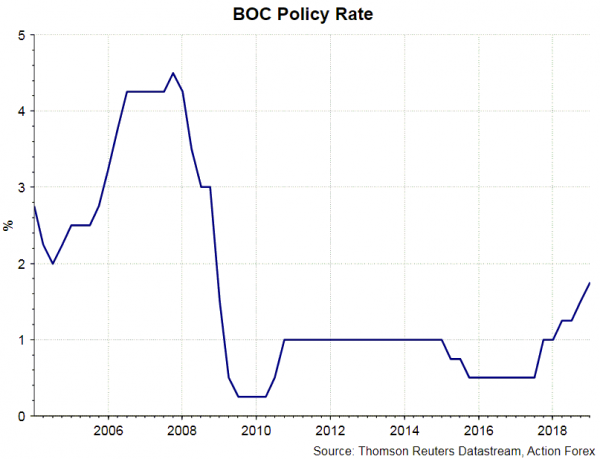

We expect BOC to leave the policy rate unchanged at 1.75% at the upcoming meeting this week. Besides releasing the statement and Monetary Policy Report, the central bank would also update the economic forecasts and host a press conference. The focus of the meeting would be possible downward revisions on the growth outlook and forward guidance on the policy stance. We expect the central bank to maintain the dovish tone lain down in the December meeting.

Latest Economic Developments

Canada’s job market remained resilient. The number of payrolls gained +9.3K in December, not retreating after the exceptionally strong month of November and beating consensus of +5K. The unemployment rate steadied at 5.6%. The downside in the report is that all of the increase in job positions was driven by part-time jobs (+28K) while full- time jobs actually contracted -19K last month. Meanwhile, both public and private sectors showed decline in positions while the number of self-employed soared +46K. The structure of the job market (increase in part-time and self-employed jobs) probably explains the sluggish wage growth, which is in fact a key reason for benign inflation. Headline CPI plunged to +1.7%, lowest since October 2017, amidst energy price slump. Core CPI was at +1.5% in November, a benign level that does not call for a rate hike. The momentum for future price increase is not strong, at all.

Markit’s manufacturing PMI dropped -1.3 points to 53.6 in December, the lowest since January 2017. Both “output” and “new orders” sub-indices were disappointing. As the agency suggested in the statement, “December data signaled a loss of momentum for manufacturers at the end of the year” as “stagnating export sales and softer energy sector demand” are the key reasons for the slowdown. It added that “global trade tensions have led to greater risk aversion”, resulting in diminished expectations for output growth in 2019.

BOC to Trim Forecasts

We expect BOC to trim its inflation forecast due to lower energy prices. Last week’s rebound in oil price was mainly driven by the Saudi-led production cut and US-China trade talk. We believe the boosts to oil prices are short-lived. Global economic slowdown this year is prone to limit demand for oil, limiting the rally in oil prices. BOC should also downgrade its GDP growth estimate modestly. In the near- term growth would be dampened by Alberta’s compulsory reduction in oil output, effective in the New Year. In the longer-term, the country’s economic growth would be affected by the overall slowdown in the global economy.

Forward Guidance

BOC would likely maintain the forward guidance indicated in December, noting that the policy rate would “need to rise into a neutral range to achieve the inflation target”. The central bank would also retain the stance that “the persistence of the oil price shock, the evolution of business investment, and the Bank’s assessment of the economy’s capacity will also factor importantly into our decisions about the future stance of monetary policy”.