AUD/USD – 0.7588

Recent wave: Wave 5 ended at 1.1081 and major correction has commenced for fall to 0.7000 and then towards 0.6500-10

Trend: Near term down

Original strategy :

Bought at 0.7525, Target: 0.7680, Stop: 0.7465

Position: – Long at 0.7525

Target: – 0.7680

Stop: – 0.7465

New strategy :

Hold long entered at 0.7525, Target: 0.7680, Stop: 0.7505

Position: – Long at 0.7525

Target: – 0.7680

Stop:- 0.7505

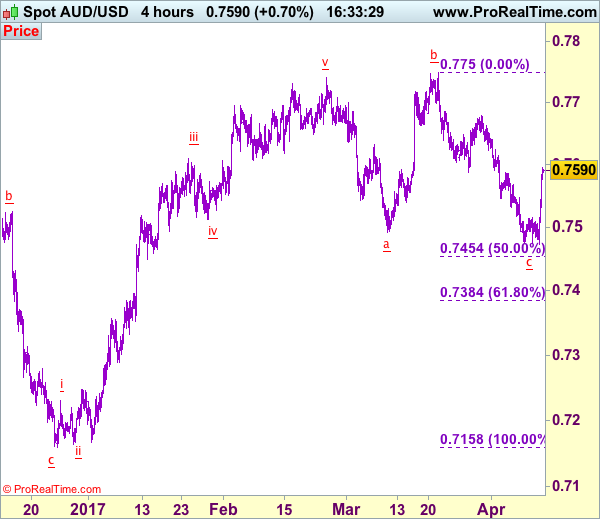

Although aussie fell marginally to 0.7473, as decent demand emerged there and has staged a strong rebound, retaining our bullishness and suggesting low is possibly formed there, hence consolidation with mild upside bias remains for further gain to 0.7625-30, however, break of resistance at 0.7680 is needed to add credence to this view and signal the fall from 0.7750 has ended, bring further gain to 0.7700-10 first but said resistance at 0.7750 should remain intact.

In view of this, we are holding on to our long position entered at 0.7525. Below 0.7500-05 would risk another test of said support at 0.7473 but break there is needed to signal the fall from 0.7750 top is still in progress for weakness to 0.7450-55 (50% Fibonacci retracement of 0.7158-0.7750), however, oversold condition should limit downside to 0.7380-85 (61.8% Fibonacci retracement), risk from there is seen for a rebound later.

On the 4-hour chart, the move from 0.8066 is the wave 5 with i: 0.8860, ii: 0.8315, wave iii is an extended move ended at 1.0183, iv: 0.9706 and wave v has ended at 1.1081 (also the top of entire wave 5). The subsequent selloff is the major correction which is unfolding as ABC-X-ABC and 2nd A leg has ended at 0.8848, followed by a-b-c wave B which ended at 0.9758, hence, 2nd C wave is now in progress and indicated downside target at 0.7000 and 0.6950 had been met, so further fall to 0.6710-20 cannot be ruled out.