US Dollar tumbled broadly and is now trading as the weakest major currency after US President Donald Trump talked down the exchange rate. The Dollar index reaches as low as 100.01 so far. It’s still holding on to 100 handle mainly thanks to the relative weakness of Euro, who’s trading as the second weakest one. But this 100 psychological level looks vulnerable. Commodity currencies are broadly higher. Canadian Dollar maintains post BoC gains. Aussie is lifted by strong employment data. Yen pares back some gains but remains the strongest one for the weak on falling treasury yields. US 10 year yield closed at 2.296 and is now close to last week’s low at 2.271. In other markets, Gold is staying firm at 1287 at the time of writing. But it’s starting to feel a bit heavy ahead of 1300 handle, as risk aversion eases. WTI crude oil also retreats mildly and is back at around 53.

Trump complained Dollar Strength. China not currency manipulator

In an interview with the Wall Street Journal, US President Donald Trump complained that US dollar "is getting too strong, and partially that’s my fault because people have confidence in me. But that’s hurting – that will hurt ultimately". He added that "it’s very, very hard to compete when you have a strong dollar and other countries are devaluing their currency". Meanwhile, Trump also reversed his position and said that China is "not currency manipulators". And he hailed that Chinese President Xi Jinping "wants to help us with North Korea."

Trump undecided on Fed chair Yellen’s second term

On interest rates, Trump affirmed his preference over a low-interest rate policy, noting that "as soon as [rates] go up, your stock market is going to go way down, most likely". During his election campaign, Trump had not reserved his criticism over Fed Chair Janet Yellen and indicated that he would replace her if he’s got elected. However, he showed in the interview his "respect" for Yellen and suggested that he has not decided whether he would reappoint her for the second term.

Separately, Dallas Fed President Robert Kaplan said that the plan to shrink Fed’s balance sheet won’t prompt adjustment in the rate path. He echoed other Fed speakers and said that Fed will start balance sheet normalization "as soon as later this year". Meanwhile, three rate hikes in total in 2017 remains his "baseline" case. He also noted that "we are not at full employment but we are getting there". And Fed can "afford to be gradual and patient" on rate hikes.

Canadian Dollar boosted by upbeat BoC

BoC appeared more confident over the economic growth outlook, although it maintained the policy rate unchanged at 0.50% yesterday. The central bank upgraded the GDP growth forecast for this year amidst strong housing market activities in the first quarter, but revised lower the figure for 2018. The country’s economy is expected to expand 2.6% this year, up from 2.1% in January’s projection, before decelerating to 1.9% in 2018 (January: 2.1%) and 1.8% in 2019. BoC now expects the output gap to close in 1Q18. Meanwhile, BoC has revised down the "projection of potential growth, reflecting persistently weak investment".

BoC remained cautious, suggesting that "it is too early to conclude that the economy is on a sustainable growth path". The central bank revised the inflation forecast a tick higher to 1.9% and 2% in 2017 and 2018, respectively. Inflation would then further improve to 2.1% in 2019. On the monetary policy, Governor Stephen Poloz described the stance as "decidedly neutral" as the members weighed the improved economic developments against the uncertain trade policy. BoC’s policy rate is expected to stay unchanged at 0.5% for the rest of the year.

More on BoC:

- BOC Upgraded Growth Outlook, Remains Cautious Over Trade Relations With US

- Bank of Canada Assumes a "Decidedly Neutral" Policy Stance

- Bank of Canada Interest Rate Announcement: Still Waiting for Sunny Stephen

Aussie boosted by strong job data

Australia Dollar is boosted by strong employment data today. Employment grew 60.9k in March, triple of expectation of 20.0k. Prior month’s figure was revised up from -6.4k to 2.8k. Full time jobs rose by 74.5k, highest jump in nearly 30 years since December 1987. Part-time jobs dropped -13.6k. Participation rate also rose from 64.6% to 64.8%. Unemployment rate was unchanged at 5.9% as more people are back in the market. Also from Australia, consumer inflation expectation rose 4.1% in April.

Adding to the support to Aussie, RBA said in its semiannual Financial Stability Review that " vulnerabilities related to household debt and the housing market more generally have increased." And, "some riskier types of borrowing, such as interest-only lending, remain prevalent." RBA also expressed the concern that "investors are likely to contribute to the amplification of the cycles in borrowing and housing prices, generating additional risks to the future health of the economy." Today’s job number certainly removed much burden on RBA for lowering interest rate again, with the background of worries on housing market bubble. Q1 CPI and GDP will be the next key pieces of data to watch.

Elsewhere…

Japan M2 rose 4.3% yoy in March. China trade surplus came in larger than expected at USD 23.9b, CNY 164b in March. German CPI final, Swiss PPI will be released in European session. Canada new housing price index, manufacturing shipments will be released in US session. US PPI, jobless claims and U of Michigan sentiment will also be featured.

AUD/USD Daily Outlook

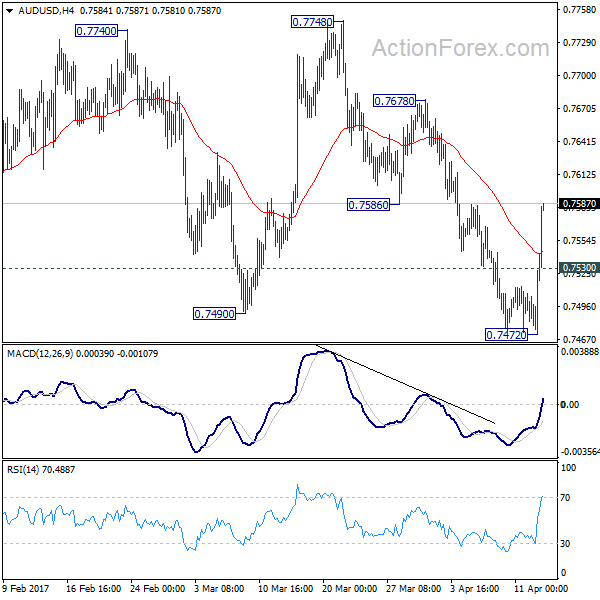

Daily Pivots: (S1) 0.7487; (P) 0.7507; (R1) 0.7542; More…

AUD/USD rebounded strongly with firm break of 0.7531 minor resistance. That indicates fall from 0.7748 is completed at 0.7472, after failing to sustain below 0.7490 key support. Intraday bias is turned back to the upside for 0.7678 resistance. More importantly, the development argues that rise from 0.7158 may be resuming. Break of 0.7678 could now pave the way through 0.7748 and put key fibonacci level at 0.7849 in focus. On the downside, below 0.7530 minor support will turn bias neutral again.

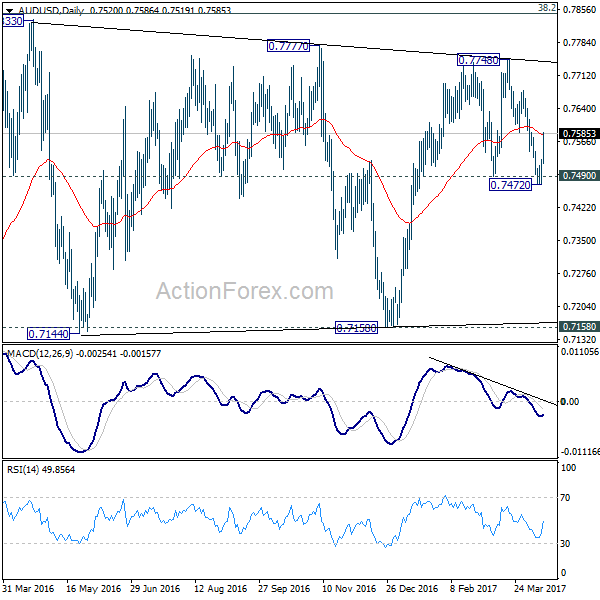

In the bigger picture, we’re still treating price actions from 0.6826 low as a correction. And, as long as 38.2% retracement of 0.9504 to 0.6826 at 0.7849 holds, long term down trend from 1.1079 is expected to resume sooner or later. Break of 0.6826 low will target 0.6008 key support level. However, firm break of 0.7849 will indicate that rise from 0.6826 is developing into a medium term rebound, rather than a sideway pattern. In such case, stronger rise should be seen to 55 month EMA (now at 0.8142) and above.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:50 | JPY | Japan Money Stock M2+CD Y/Y Mar | 4.30% | 4.20% | 4.20% | |

| 1:00 | AUD | Consumer Inflation Expectation Apr | 4.10% | 4.00% | ||

| 1:30 | AUD | RBA Financial Stability Review | ||||

| 1:30 | AUD | Employment Change Mar | 60.9k | 20.0k | -6.4k | 2.8k |

| 1:30 | AUD | Unemployment Rate Mar | 5.90% | 5.90% | 5.90% | |

| 3:15 | CNY | Trade Balance (USD) Mar | 23.9B | 12.5B | -9.1B | |

| 3:15 | CNY | Trade Balance (CNY) Mar | 164B | 76B | -60B | |

| 6:00 | EUR | German CPI M/M Mar F | 0.20% | 0.20% | ||

| 6:00 | EUR | German CPI Y/Y Mar F | 1.60% | 1.60% | ||

| 7:15 | CHF | Producer & Import Prices M/M Mar | 0.10% | -0.20% | ||

| 7:15 | CHF | Producer & Import Prices Y/Y Mar | 0.90% | 1.30% | ||

| 12:30 | CAD | New Housing Price Index M/M Feb | 0.20% | 0.10% | ||

| 12:30 | CAD | Manufacturing Shipments M/M Feb | -0.70% | 0.60% | ||

| 12:30 | USD | PPI M/M Mar | 0.00% | 0.30% | ||

| 12:30 | USD | PPI Y/Y Mar | 2.40% | 2.20% | ||

| 12:30 | USD | PPI Core M/M Mar | 0.20% | 0.30% | ||

| 12:30 | USD | PPI Core Y/Y Mar | 1.80% | 1.50% | ||

| 12:30 | USD | Initial Jobless Claims (APR 08) | 245k | 234k | ||

| 14:00 | USD | U. of Michigan Confidence Apr P | 96.6 | 96.9 | ||

| 14:30 | USD | Natural Gas Storage | 2B |