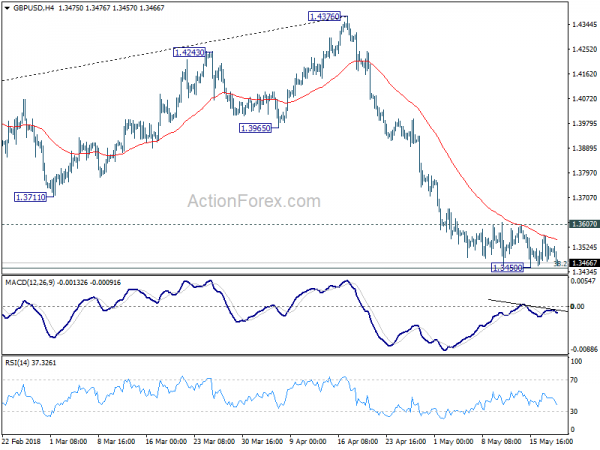

Daily Pivots: (S1) 1.3470; (P) 1.3519; (R1) 1.3565; More…

GBP/USD weakens again in early US session but it’s staying in range above 1.3450. Intraday bias remains neutral at this point. On the upside, above 1.3607 will indicate short term bottoming and bring strong rebound for 55 day EMA (now at 1.3815). On the downside, firm break of 1.3448 will pave the way to next fibonacci level at 1.2874.

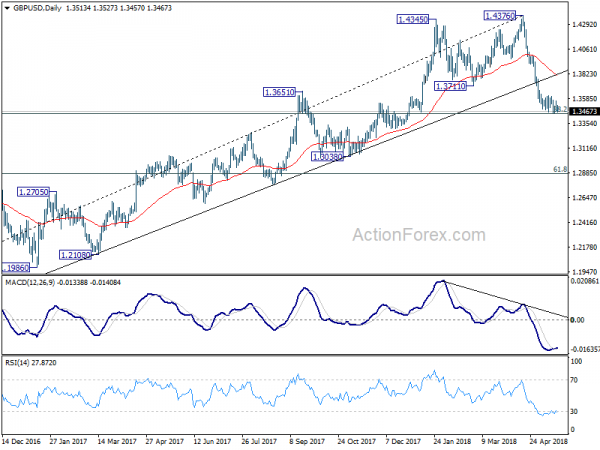

In the bigger picture, current development suggests that whole medium term rebound from 1.1936 (2016 low) has completed at 1.4376 already, with trend line broken, on bearish divergence condition in daily MACD, after rejection from 55 month EMA (now at 1.4223). 38.2% retracement of 1.1936 (2016 low) to 1.4376 at 1.3448 was almost met. Break there will target 61.8% retracement at 1.2874 and below. Outlook will stay bearish as long as 55 day EMA (now at 1.3815) holds, even in case of strong rebound.