We’d soon enter into US session. JPY continues to trade with one of the weakest, along with NZD.

A quick glance at JPY Action Bias table, we can that EURJPY and GBPJPY are the stronger ones intraday. But both D Action Bias are neutral. CADJPY may lack momentum in H Action Bias, but 6H and D Action Bias argue it’s in a trend. That prompts us to have a deeper look.

EURJPY D action bias chart clearly shows that it’s rebounding after a prior decline halts ahead of near term support around 129 level. Current rebound, while strong, is not in clearly a trend yet. It could be part of a range consolidation pattern.

On the other hand, CADJPY D action bias chart showed it’s in a solid up move from around 80 level. The moved turned into consolidation after failing 86. The rally could indeed be resuming with last week’s breakout. So, while EURJPY is stronger today, CADJPY is a better candidate for trend trading.

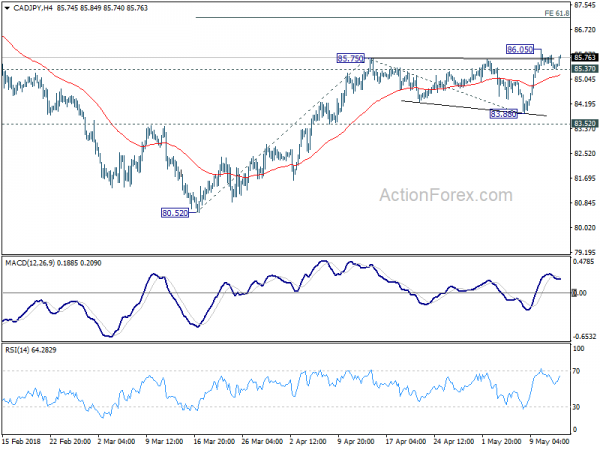

Back at the regular bar chart, for now, intraday bias in CADJPY stays neutral. But break of 86.05 will confirm rise resumption. CADJPY should target 61.8% projection of 80.52 to 85.75 from 83.88 at 87.11. Though, break of 85.13 will delay the bullish case and bring more consolidation first.