For the 24 hours to 23:00 GMT, the GBP declined 0.22% against the USD and closed at 1.3518, after the Bank of England (BoE) lowered Britain’s growth and inflation forecast at its May monetary policy meeting.

The BoE’s Monetary Policy Committee voted 7-2 to keep the benchmark interest rate on hold at 0.50%, amid a slump in the first-quarter economic growth. According to minutes of the meeting, officials believed that the recent slowdown in economic activity will prove temporary but cautioned that Britain’s economy is still clouded by Brexit uncertainties. Further, the central bank trimmed its 2018 growth forecast from a moderate 1.8% to a modest 1.4%, entirely due to weak first-quarter growth and added that inflation will slow faster than previously estimated.

In economic news, Britain industrial production grew 0.1% on a monthly basis in March, compared to a similar rise in the prior month, while investors had anticipated for an advance of 0.2%. On the other hand, the nation’s manufacturing production fell 0.1% on a monthly basis in March, compared to market consensus for a drop of 0.2%. In the prior month, manufacturing production had eased 0.2%. Furthermore, the nation’s construction output plunged 2.3% MoM in March, meeting market expectations and posting its biggest decline since August 2012. In the prior month, construction output had registered a revised drop of 1.0%.

In other economic news, total trade deficit in the UK widened to £3.09 billion in March, from a revised deficit of £1.18 billion in the prior month. Market participants had expected the nation to record a deficit of £2.00 billion. Additionally, leading think tank, NIESR estimated that UK’s gross domestic product (GDP) rose 0.1% in the three months to April 2018, following a growth of 0.2% in the January-March 2018 period.

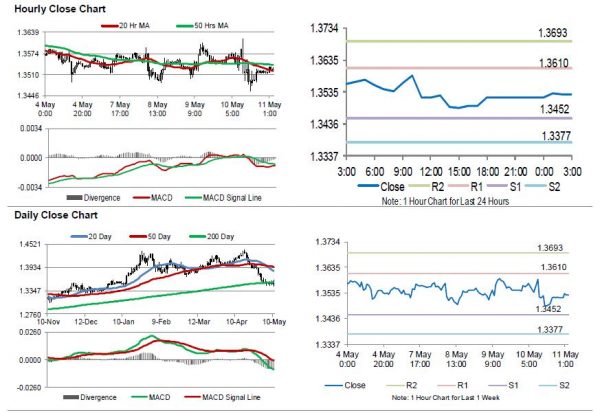

In the Asian session, at GMT0300, the pair is trading at 1.3527, with the GBP trading 0.07% higher against the USD from yesterday’s close.

The pair is expected to find support at 1.3452, and a fall through could take it to the next support level of 1.3377. The pair is expected to find its first resistance at 1.3610, and a rise through could take it to the next resistance level of 1.3693.

The currency pair is showing convergence with its 20 Hr moving average and trading below its 50 Hr moving average.