Dollar’s rebound gathers some momentum today as dollar index regained 100 handle and hit as high as 100.72 so far. Hawkish comments from Philadelphia Fed president Patrick Harker is seen as a factor supporting the greenback. Meanwhile, weakness in European majors is providing further lift. Technically, GBP/USD leads the way with break of 1.2411 minor support, which is seen as sign of near term reversal. USD/CAD also took out 1.3168 minor resistance which indicates near term bottoming. The near term focus will now turn to 1.0619 in EUR/USD, 1.0043 in USD/CHF and 113.44 in USD/JPY. In other markets, gold retreats mildly after hitting 1237.5 and is back at around 1230 at the time of writing. But there is no clear sign of topping yet and that mildly dampens the case for reversal in Dollar. WTI crude oil is staying in recent range between 50/55.

Philly Fed Harker Open to March Hike

Yesterday, Philadelphia Fed president Patrick Harker said that he’s open to a March hike. Harker noted that he’s "supportive of three rate hikes" this year depending on how the economy and policies evolve. And, more importantly, "March should be considered as a potential for another 25 basis point increase". While he said the Fed is not behind the curve now, he wants to "make sure we don’t get behind the curve". Nonetheless, it should be noted that fed fund futures are pricing in less than 10% chance of a March hike, much lower than nearly 30% last month. More evidence is needed to support the case for a March hike.

European Majors Soft on Draghi and France

European majors are weighed down by dovish comments from ECB president Mario Draghi and political developments. French conservative presidential candidate Francois Fillon was called to quit the run after the scandal of employing his wife and children as parliamentary aides. Meanwhile, Another Canadian National Front threatened to exit Eurozone. The news reminded traders of the political uncertainties in Eurozone this year. That includes elections in the Netherlands and Germany. And even there could be another election in Italy too.

It’s reported that IMF are getting concerned with Greece’s bailout program, as shown in the annual review of Greek economy published today. The positive side of the report is that most IMF executives agreed that Greece is on track for hitting fiscal surplus of 1.5% of GDP. And, no more further fiscal consolidation is needed at this time. However, "some Directors had different views on the fiscal path and debt sustainability."

ECB president Mario Draghi faced the European Parliament’s committee on economic affairs late yesterday. He noted that the central bank would not react to temporary spike in inflation. He emphasized that "our monetary policy strategy prescribes that we should not react to individual data points and short-lived increases in inflation". And, underlying inflation pressures "remain very subdued" reflecting "largely weak domestic cost pressures. There were speculations that ECB could start tapering as headline inflation, recorded at 1.8% in January, would exceed 2% target soon. And Draghi’s comments tamed such speculations.

Aussie Higher as RBA Maintained Neutral Stance

Aussie is generally firmer today after RBA stands pat and maintained a neutral stance. As widely anticipated, RBA left its cash rate unchanged at 1.50% at its first meeting in 2017. Policymakers acknowledged improvement in the global economic outlook. They also retained the view that the domestic economy would growth above-trend. The overall monetary stance is neutral, signaling the central bank is in no hurry to adjust the policy. The market is closely awaiting Governor Philip Lowe’s speech on Thursday and RBA’s Statement on Monetary Policy (SoMP) on Friday. The SoMP would reveal policymakers’ updated economic forecasts. We expect downgrades of both growth and inflation outlooks. More in RBA Sees Contraction In 3Q16 As Temporary, Maintains Neutral Stance

GBP/USD Mid-Day Outlook

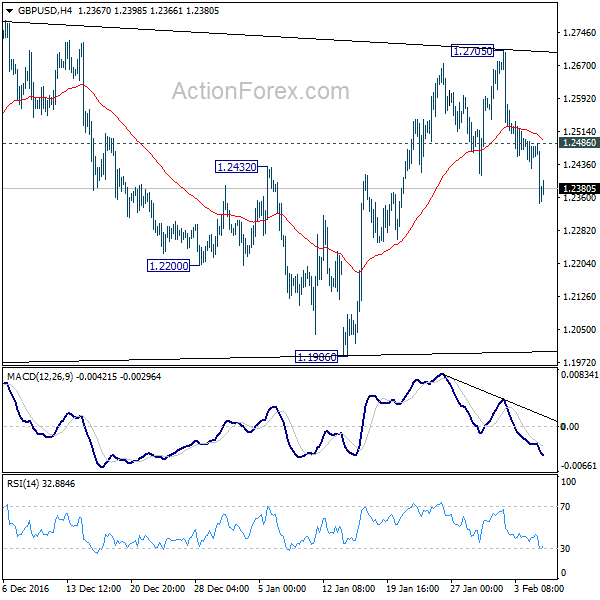

Daily Pivots: (S1) 1.2430; (P) 1.2464; (R1) 1.2501; More…

The break of 1.2411 minor support suggests that rebound from 1.1986 has completed at 1.2705 already. And, the whole consolidation pattern from 1.1946 low is possibly finished too. Intraday bias is turned back to the downside for retesting 1.1946 low. On the upside, above 1.2486 minor resistance will turn bias back to the upside. In case rebound from 1.1986 extends, we’d still expect strong resistance from 1.2774 resistance to limit upside.

In the bigger picture, fall from 1.7190 is seen as part of the down trend from 2.1161. There is no sign of medium term bottoming yet. Sustained trading below 61.8% projection of 2.1161 to 1.3503 from 1.7190 at 1.2457 will target 100% projection at 0.9532. Overall, break of 1.3444 resistance is needed to confirm medium term bottoming. Otherwise, outlook will remain bearish.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Consensus | Previous | Revised |

|---|---|---|---|---|---|---|

| 00:01 | GBP | BRC Retail Sales Monitor Y/Y Jan | -0.60% | 0.90% | 1.00% | |

| 02:00 | NZD | RBNZ 2-Year Inflation Expectation Q1 | 1.90% | 1.70% | ||

| 03:30 | AUD | RBA Rate Decision | 1.50% | 1.50% | 1.50% | |

| 05:00 | JPY | Leading Index Dec P | 105.2 | 105.5 | 102.8 | |

| 06:45 | CHF | SECO Consumer Confidence Jan | -3 | -11 | -13 | |

| 07:00 | EUR | German Industrial Production M/M Dec | -3.00% | 0.30% | 0.40% | 0.50% |

| 08:00 | CHF | Foreign Currency Reserves Jan | 644B | 646B | 645B | |

| 13:30 | USD | Trade Balance Dec | -44.3B | -45.0B | -45.2B | |

| 13:30 | CAD | International Merchandise Trade (CAD) Dec | 0.9B | 0.3B | 0.5B | |

| 13:30 | CAD | Building Permits M/M Dec | -6.60% | -2.50% | -0.10% | |

| 15:00 | CAD | Ivey PMI Jan | 58.3 | 60.8 |

Subscribe to our daily and mid-day newsletter to get this report delivered to your mail box