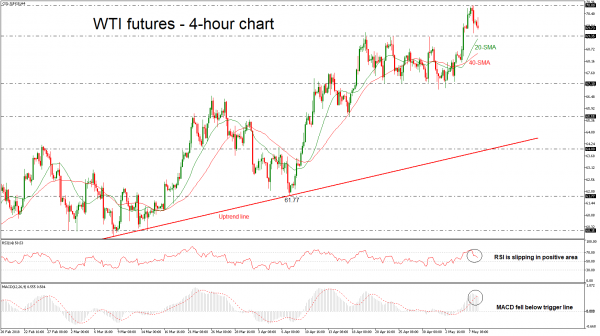

West Texas Intermediate (WTI) crude has advanced considerably and recorded a fresh three-and-a-half-year high of 70.80. The price retreated after the bounce off the mentioned level and the short-term technical indicators are endorsing the scenario for a potential bearish retracement.

Looking at momentum indicators, in the 4-hour chart, the RSI has plunged below the overbought levels and is pointing south, approaching the 50-neutral level. Also, the MACD is heading lower and posted a bearish cross with its trigger line in the positive territory, supporting the negative view.

In the wake of negative pressures, the market could meet immediate support at the 69.35 barrier, which is standing around the 20-simple moving average (SMA). A successful close below this level could see a re-test of the previous lows of 67.10, while in case of steeper declines the oil could breach this trough, diving to the 65.55 region.

On the flip side, a move to the upside again could touch the aforementioned three-and-a-half-year high but should the market increase positive momentum above this area, the 73.30 could be the next major focus, taken from the low on November 2014. A strong barrier, though, could be found at the 75.00 handle, identified from the September 2011 low. As a side note, the psychological levels of 71.00, 72.00, 73.00, 74.00 could act as significant obstacles for the bulls as well.