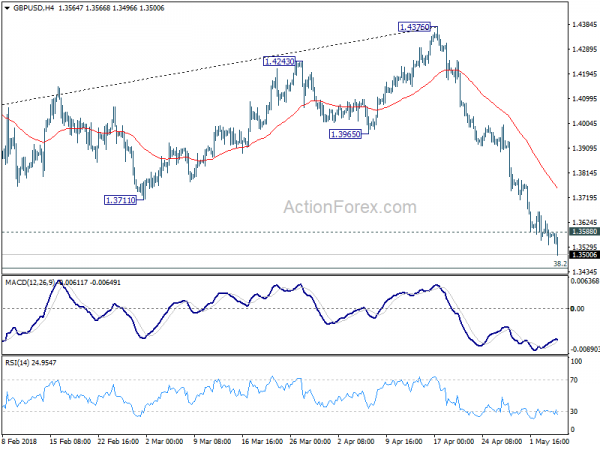

Daily Pivots: (S1) 1.3532; (P) 1.3580; (R1) 1.3624; More…

GBP/USD’s decline extends in US session and reaches as low as 1.3519 so far. While downside momentum is unconvincing as seen in 4 hour MACD, intraday bias is staying on the downside for 1.3448 fibonacci level next. On the upside, above 1.3588 minor resistance will argue that a short term bottom is formed. In that case, stronger recovery could be seen back to 4 hour 55 EMA (now at 1.3753) and above before staging another fall.

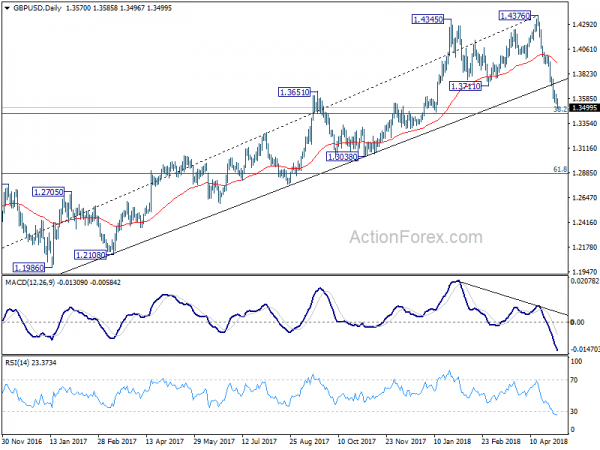

In the bigger picture, current development suggests that whole medium term rebound from 1.1936 (2016 low) has completed at 1.4376 already, with trend line broken, on bearish divergence condition in daily MACD, after rejection from 55 month EMA (now at 1.4248). Deeper decline should be seen to 38.2% retracement of 1.1936 (2016 low) to 1.4376 at 1.3448 first. Break will target 61.8% retracement at 1.2874 and below. Outlook will stay bearish as long as 55 day EMA (now at 1.3955) holds, even in case of strong rebound.