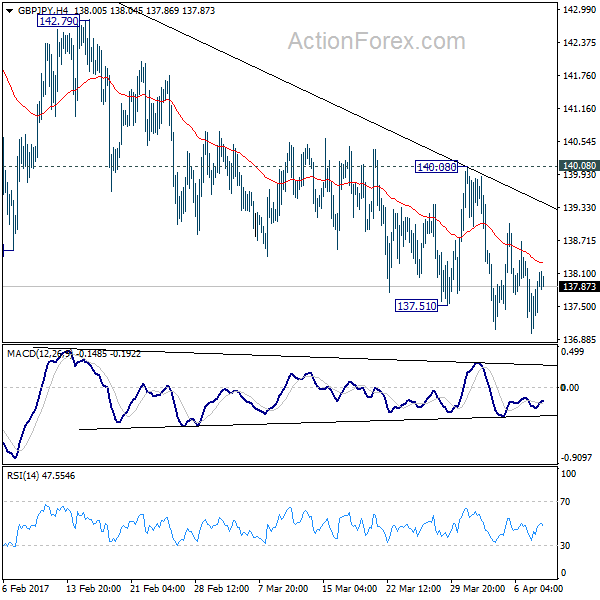

Daily Pivots: (S1) 136.73; (P) 137.54; (R1) 138.18; More…

Further fall is expected in GBP/JPY with 140.08 resistance intact. But still, choppy price actions from 148.42 are viewed as a corrective pattern. Hence, we’d anticipate strong support from medium term fibonacci level at 135.39 to bring rebound. On the upside, firm break of 140.08 resistance will now indicate near term reversal and turn bias back to the upside for 142.79 resistance first.

In the bigger picture, price actions from 122.36 medium term bottom are still seen as a corrective pattern. Main focus is on 38.2% retracement of 195.86 to 122.36 at 150.42. Rejection from there will turn the cross into medium term sideway pattern. Or, sustained break of 50% retracement of 122.36 to 148.42 at 135.39 will turn outlook bearish for a test on 122.36 low. Though, sustained break of 150.42 will extend the rebound towards 61.8% retracement of 195.86 to 122.36 at 167.78.