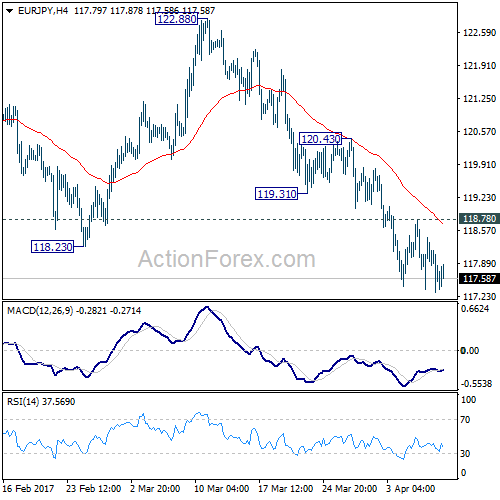

EUR/JPY’s sharp decline and break of 118.23 resistance confirmed resumption of whole fall from 124.08. More importantly, the development argues that whole medium term rebound from 109.20 is completed at 124.08 already. Deep fall is now expected ahead.

Further fall is expected this week as long as 118.78 minor resistance holds. EUR/JPY should now target 61.8% retracement of 109.20 to 124.08 at 114.88 next. On the upside, above 118.78 will indicate short term bottoming and bring rebound back to 119.31/120.43 resistance zone. That also coincides with 55 day EMA (now at 120.19). In that case, we’re look at the reactions in this resistance zone to assess the outlook again.

In the bigger picture, the firm break of 38.2% retracement of 109.20 to 124.08 at 118.39 indicates that medium term rise from 109.20 is completed at 124.08. That’s well below 126.09 key support turned resistance. Also, EUR/JPY failed to sustain above 55 week EMA. Deeper decline would now be seen back to 109.20 low. Overall, the down trend from 149.76 (2014 high) is not completed yet. Break of 109.20 will resume such down trend towards 94.11 low. In any case, break of 126.09 is needed needed to confirm medium term reversal.

In the long term picture, medium term decline from 149.76 is seen as part of a long term sideway pattern from 88.96. Decisive break of 126.09 will indicate that such decline is completed and EUR/JPY has started another medium term rally already. Before that, deeper fall is mildly in favor towards 94.11 low. Overall, long term range trading will continue.