Dollar recovers mildly today but stays in red across the board for the week so far. The dollar index hit as low as 99.89 and is trying to defend 100 handle for the moment. Treasury yields tumbled sharply overnight with 10 year yield closing at 2.403, down -0.064. But stocks were just a touch lower with DJIA lost -0.14% to close at 19799.85, staying in familiar range. Markets continue to reaction to US president Donald Trump’s initial actions. It’s reported that Trump promised business leaders to reduce tax with business regulations cut by 75%, or more. Regarding corporate tax, Trump noted that his administration is going to be "cutting taxes massively for both the middle class and for companies, and get it down to We’re trying to get it 15 to 20%, from 35%.

Meanwhile, he also signed an executive order yesterday to remove US from the Trans-Pacific Partnership. He is also expected to renegotiate" the North American Free Trade Agreement (NAFTA) with Canada and Mexico. It was reported that the Canadian government "will consider bilateral trade measures during renegotiation of the NAFTA a sign it could potentially move ahead at least in part without Mexico". Trump will also be meeting UK’s Prime Minister Theresa May on Friday. Trade policy is expected to be a major discussion topic as May indicated her plan of a hard Brexit last week.

Japan Prime minister Shinzo Abe said today that he would continue to advocate free trade even without TPP. Government spokesman Koichi Hagiuda said that "without the U.S., it would lose the fundamental balance of benefits." Trade minister Hiroshige Seko said that Japan will "continue to explain to the U.S. about the strategic and economic merits of the TPP."

Released from Japan, PMI manufacturing rose to 52.8 in January, above expectation of 52.3. That’s the highest reading in nearly three years since March 2014. IHS Markit economist noted that "manufacturing conditions improved at the strongest rate in nearly three years, helped by solid expansions in both output and new orders." And, "the rise in total incoming new orders was driven in part by a sharp increase in international demand, as new export orders rose at the quickest rate in over a year."

Looking ahead, Eurozone PMIs will be the main focus in European session. UK will release public sector net borrowing. US will release existing home sales.

AUD/USD Daily Outlook

Daily Pivots: (S1) 0.7517; (P) 0.7552; (R1) 0.7588; More…

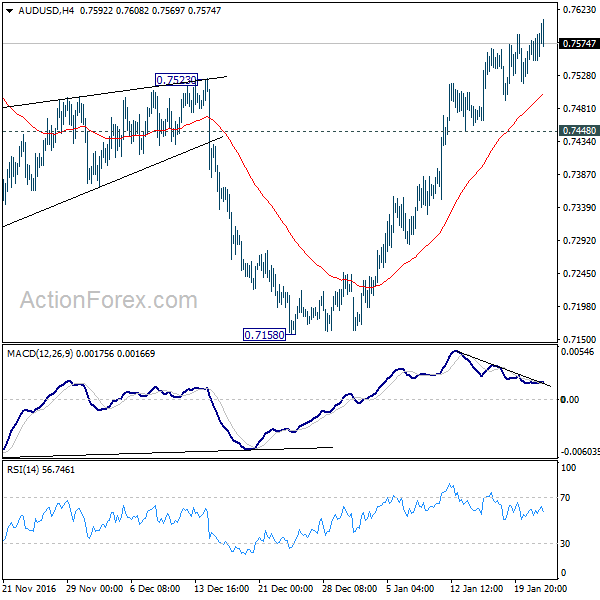

AUD/USD’s rebound from 0.7158 extends to as high as 0.7608 so far but continues to lose upside momentum. With 0.7448 minor support intact, further rise could still be seen. But upside should be limited by 0.7777/7833 resistance zone to bring near term reversal. On the downside, below 0.7448 minor support will turn bias back to the downside for 0.7144 key support level.

In the bigger picture, AUD/USD is staying inside long term falling channel and it’s likely that the down trend from 1.1079 is still in progress. Break of 0.6826 low will confirm this bearish case. We’ll be looking for bottoming sign again as it approaches 0.6008 key support level. Meanwhile, sustained break of 0.7833 resistance will be a strong sign of medium term reversal.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Consensus | Previous | Revised |

|---|---|---|---|---|---|---|

| 0:30 | JPY | PMI Manufacturing Jan P | 52.8 | 52.3 | 52.4 | |

| 8:00 | EUR | France Manufacturing PMI Jan P | 53.4 | 53.5 | ||

| 8:00 | EUR | France Services PMI Jan P | 53.1 | 52.9 | ||

| 8:30 | EUR | Germany Manufacturing PMI Jan P | 55.4 | 55.6 | ||

| 8:30 | EUR | Germany Services PMI Jan P | 54.5 | 54.3 | ||

| 9:00 | EUR | Eurozone Manufacturing PMI Jan P | 54.8 | 54.9 | ||

| 9:00 | EUR | Eurozone Services PMI Jan P | 53.9 | 53.7 | ||

| 9:30 | GBP | Public Sector Net Borrowing (GBP) Dec | 6.7B | 12.2B | ||

| 15:00 | USD | Existing Home Sales Dec | 5.54M | 5.61M |

Subscribe to our daily and mid-day newsletter to get this report delivered to your mail box