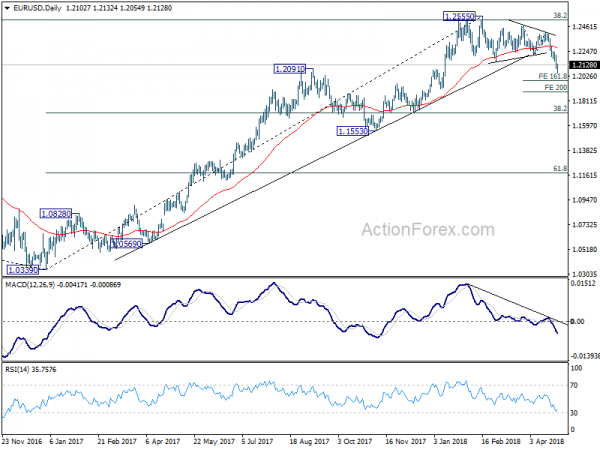

EUR/USD’s dropped sharply to 1.2054 last week. The strong break of 1.2154 key support confirmed medium term topping at 1.2555. But as a temporary low as formed at 1.2054, initial bias is neutral this week for some consolidations first. Upside of recovery should be limited by 1.2214 support turned resistance to bring another decline. Below 1.2054 will target 161.8% projection of 1.2475 to 1.2214 from 1.2413 at 1.1991 first. Break will target 200% projection at 1.1891.

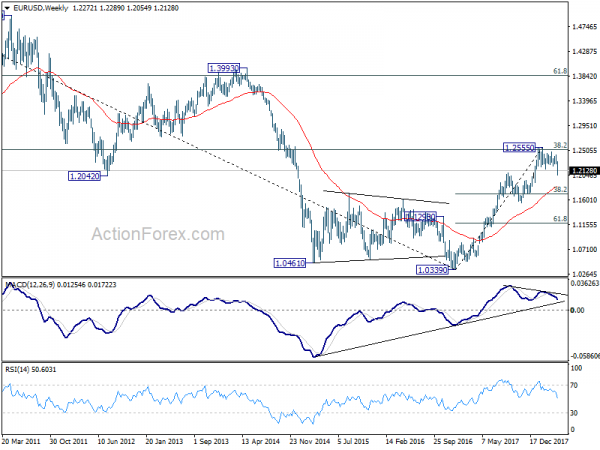

In the bigger picture, current decline and firm break of 1.2154 support confirms rejection by 38.2% retracement of 1.6039 (2008 high) to 1.0339 (2017 low) at 1.2516. A medium term top should be in place at 1.2555 and deeper decline would be seen back to 38.2% retracement of 1.0339 to 1.2555 at 1.1708 first. We’ll look at the structure and momentum of such decline before decision if it’s an impulsive or corrective move.

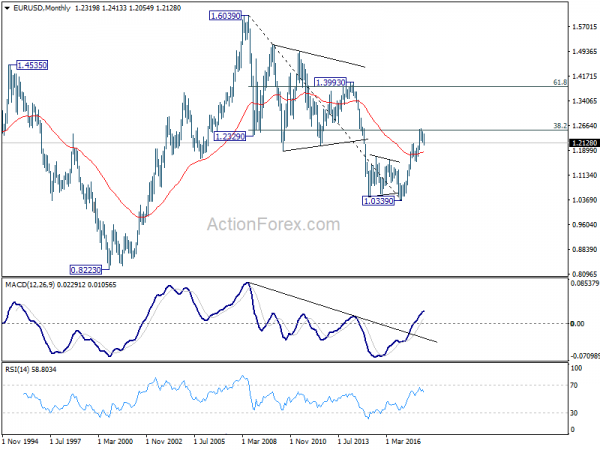

In the long term picture, 1.0339 is seen as an important bottom as the down trend from 1.6039 (2008 high) could have completed. It’s still early to decide whether price action from 1.0339 is developing into a corrective or impulsive pattern. Reaction to 38.2% retracement of 1.6039 to 1.0339 at 1.2516 will give important clue to the underlying momentum.