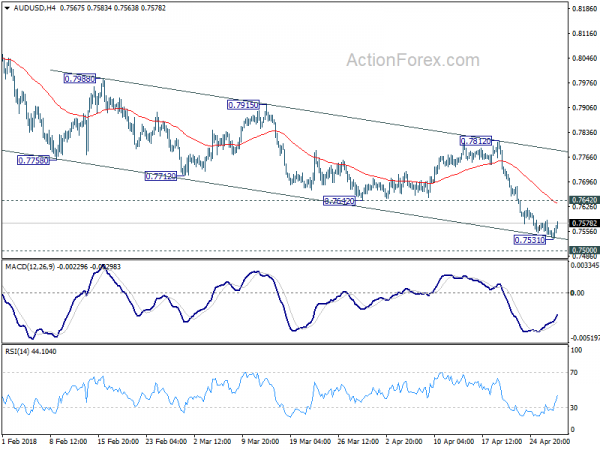

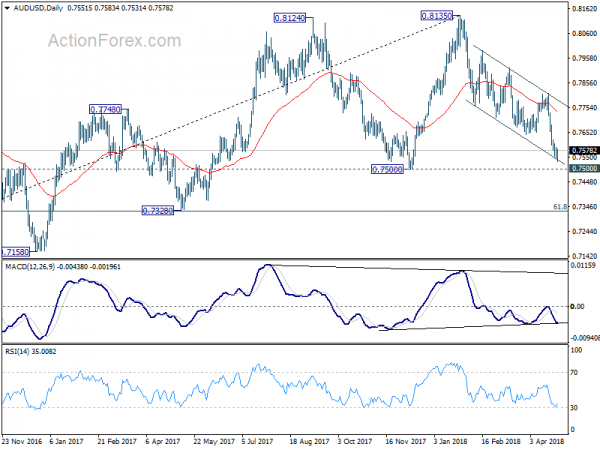

AUD/USD’s decline from 0.8135 resumed last week and dropped to as low as 0.7531. As a temporary low was formed after hitting near term channel support, initial bias is neutral this week first. Some consolidations would be seen but upside should be limited by 0.7642 support turned resistance. Below 0.7531 will target 0.7500 key support level. However, firm break of 0.7642 will be an early sign of near term reversal and turn focus back to 0.7812 resistance.

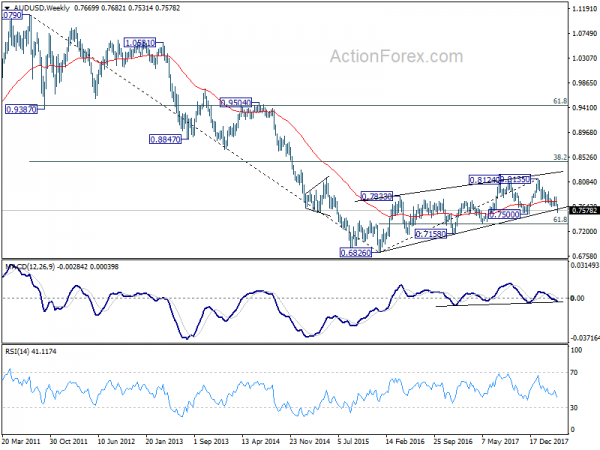

In the bigger picture, medium term rebound from 0.6826 is seen as a corrective move. Decisive break of 0.7500 key support will suggest that such correction is completed. In that case, deeper decline would be seen back to retest 0.6826 low. In case of another rise, we’d expect strong resistance from 38.2% retracement of 1.1079 to 0.6826 at 0.8451 to limit upside to bring long term down trend resumption eventually.

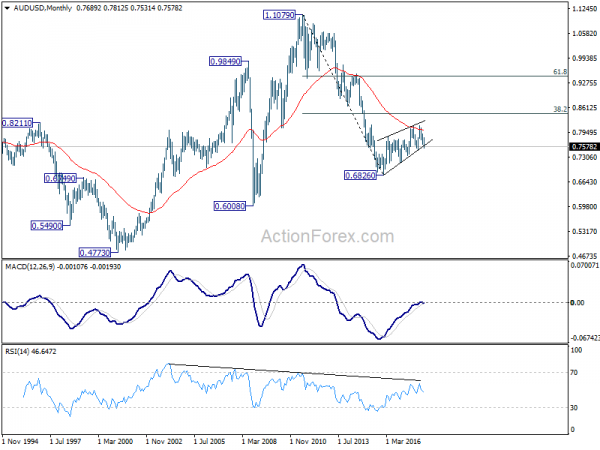

In the longer term picture, 0.6826 is seen as a long term bottom. Rise from there could either reverse the down trend from 1.1079, or just develop into a corrective pattern. At this point, we’re favoring the latter. And, as long as 38.2% retracement of 1.1079 to 0.6826 at 0.8451 holds, we’d anticipate another decline through 0.6826 at a later stage. But strong support should be seen between 0.4773 (2001 low) and 0.6008 (2008 low).