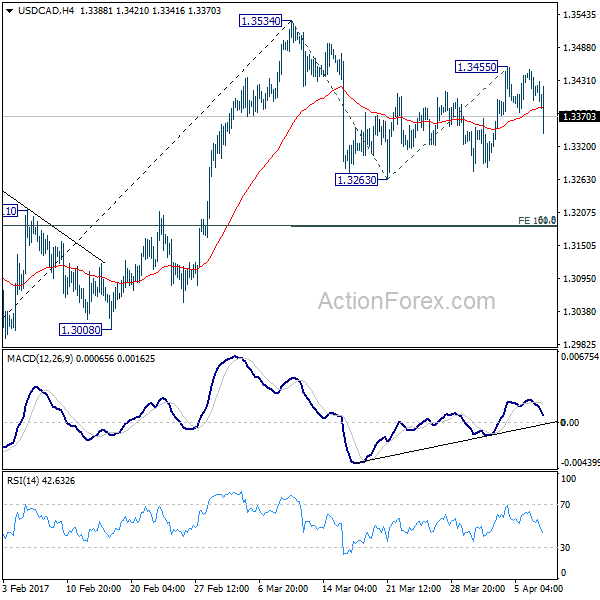

Daily Pivots: (S1) 1.3390; (P) 1.3420; (R1) 1.3442; More….

USD/CAD’s sharp fall and break of 1.3373 minor support suggests that recovery from 1.3263 has completed with three waves up to 1.3455. The corrective structure in turns indicates that decline from 1.3534 is resuming. Intraday bias is turned back to the downside for 1.3263 support and below. Fall from 1.3534 is still viewed as a correction for the moment. Hence, we’d expect strong support from 1.3184 cluster level (61.8% retracement of 1.2968 to 1.3534 at 1.3184, 100% projection of 1.3534 to 1.3263 from 1.3455 at 1.3814 too) to contain downside and bring rebound. On the upside, break of 1.3455 will turn bias back to the upside for 1.3534 resistance.

In the bigger picture, price actions from 1.4689 medium term top are seen as a correction pattern. The first leg has completed at 1.2460. The second leg from 1.2460 is likely still in progress and could target 61.8% retracement of 1.4689 to 1.2460 at 1.3838. We’d look for reversal signal there to start the third leg. Break of 1.2968 will argue that the third leg has already started and should at least bring at retest of 1.2460 low. However, sustained trading above 1.3838 would pave the way to retest 1.4689 high.