The US dollar is higher against major pairs except the JPY who is trading higher awaiting the Bank of Japan (BOJ) monetary policy statement and press conference. The European Central Bank (ECB) was less than forthcoming about its plans earlier today and in his press conference President Mario Draghi made some comments that cancelled each other out by highlighting growth moderation, but mentioning underlying strength in the EU economy. The US dollar continues to advance awaiting the release of the GDP data for the first quarter of 2018.

- US GDP forecasted at 2.0 percent in Q1

- UK GDP forecasted at 0.3 percent in Q1

- US dollar trading at 3.5 month high

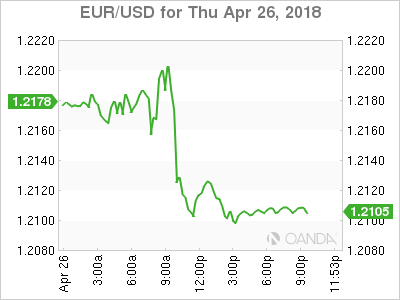

Euro Falls After ECB Cautious Words

The EUR/USD lost 0.46 percent on Thursday. The single currency is trading at 1.2104 after the European Central Bank (ECB) opted to leave its benchmark rate intact and made no announcements regarding the end of the quantitative easing program. ECB President Mario Draghi was neither hawkish nor dovish, which resulted in little support for the euro. The eyes of the market will now be fixed in the June and July meetings for some insights into the plans of the central bank. The euro is now at a monthly low versus the US dollar with the uncoming first estimate of the US gross domestic product (GDP) expected at 2.0 percent. The Bureau of Economic Analysis will release the advance US GDP at 8:30 am EDT.

Consumer spending in the US is thought to have slowed down which explains the lower forecast for the first quarter when the US economy grew by 2.9 percent in the last quarter of 2017. The first quarter has historically been a difficult one for US growth the 2.0 percent target would be a first at that level since 2015. This is only the first of three estimates, but given that it sets the expectations for the other two it is the one that has the most impact. A stronger than forecasted figure could boost the USD higher as the EUR is lacking traction after a non-eventful ECB statement. A weaker than anticipated GDP data point in the US could see the greenback giving some of the gains of this week ahead of next week’s May Federal Open Market Committee (FOMC) meeting.

US companies reported earnings this week with the good results driving stock prices higher in particular the tech sector. US yields continue to flirt with the 3.0 percent line, but this time it is under as the 10 year note fell to 2.990 percent. US unemployment claims fell to 209,000 fell to its lowest level in 48 years with next week’s U.S. non farm payrolls (NFP) to show if there is any impact of strong US employment on wage growth.

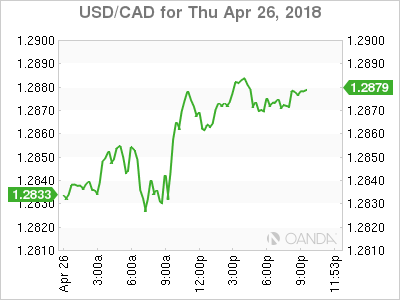

Loonie Caught Between Big Dollar and NAFTA Hopes

The USD/CAD gained 0.34 percent. The currency pair is trading at 1.2881 ahead of the release of US GDP growth for the first quarter. The loonie has traded in a range for the past two days as the positive price of oil pressures and NAFTA optimism have been neutralized by a strong dollar. The Bank of Canada (BoC) kept rates unchanged on April 18, but yesterday BoC governor Stephen Poloz was optimistic when addressing Parliament’s upper house. Poloz expects a rebound as the economy if finally positive, but he also warned about possible headwinds picking up.

Oil prices have helped the Canadian currency as WTI remains above $68 but is no match for the boost that US dollar is getting from upgraded growth expectations that have the U.S. Federal Reserve looking to add another rate hike to the three they had already forecasted for this year. The interest differential between the Canadian benchmark at 1.25 percent and the US Fed funds rate at 1.5–1.75 will only grow as the Bank of Canada (BoC) cannot match the Fed for fear of the impact higher rates could have on record borrowing levels of Canadian households.

Next week will have few opportunities for the CAD from economic releases with the market mostly focused on US employment and the FOMC statement. A NAFTA announcement in the near future could take the loonie from current ranges, but although some progress has been made there is nothing concrete for the market to use when valuing the currency.

Market events to watch this week:

Thursday, April 26

10:00pm JPY BOJ Policy Rate

10:00pm Monetary Policy Statement

Midnight JPY BOJ Outlook Report

Friday, April 27

Tentative JPY BOJ Press Conference

4:30am GBP Prelim GDP q/q

8:30am USD Advance GDP q/q