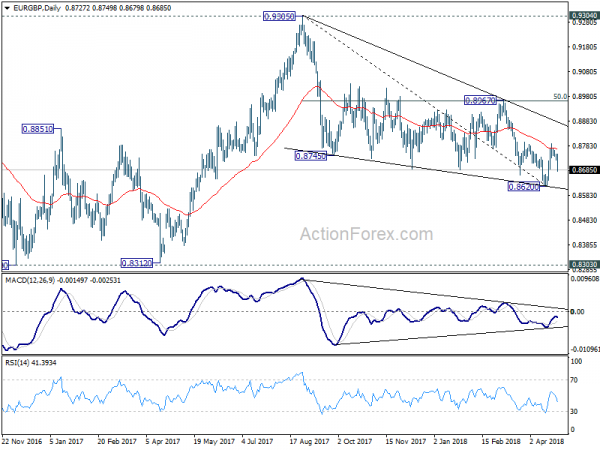

Daily Pivots: (S1) 0.8722; (P) 0.8736; (R1) 0.8744; More…

EUR/GBP’s sharp decline and break of 0.8688 minor support suggests that rebound from 0.8620 has completed at 0.8790 already, ahead of 0.8796 resistance, limited by 55 day EMA. The development also dampens the bullish case of near term reversal. Intraday bias is turned back to the downside for 0.8620 low first. Break there will resumed the whole decline from 0.9305. On the upside, though, above 0.8796 will resume the rebound from 0.8620 instead.

In the bigger picture, for now, the decline from 0.9305 is seen as a leg inside the long term consolidation pattern from 0.9304 (2016 high). Such consolidation pattern could extend further. Hence, in case of strong rally, we’d be cautious on strong resistance by 0.9304/5 to limit upside. Meanwhile, in another decline attempt, we’d expect strong support from 0.8116 cluster support (50% retracement of 0.6935 to 0.9304 at 0.8120) to contain downside.