Dollar retreats mildly in Asian session today but remains the strongest one for the week. US 10 year yield finally took out 3% level overnight with some conviction. TNX hit as high as 3.035 before closing at 3.024, up 0.041. The development helped lifted Dollar Index above key near term resistance at 91.01 to close at 91.17. The stage is set for Dollar to reverse its medium term down trend. Though, the greenback still have one more hurdle to overcome. That is, 1.2154 support in EUR/USD. That would very much depends on today’s ECB rate decision and press conference, as well as US Q1 GDP data tomorrow.

Markets seek ECB Draghi’s view on Q1 slowdown

There is little chance of any change in monetary policy nor language in today’s ECB rate decision and press conference. President Mario Draghi will most likely continue to sound cautious and noncommittal. Expectations are indeed on the June meeting where ECB will release new economic projections, and will likely signal what it’s going to do after asset purchase program expires in September.

Nonetheless, today’s meet may not be a non-event. Since the March meeting, Eurozone’s economic data have surprised to the downside. It would be of great interest to see the policymakers’ interpretation of the situation. All in all, we expect the members to view the first quarter slowdown as driven by temporary factors, e. g.: weather, which do not affect the monetary stance. More in ECB Preview: Caution over Recent Slowdown Won’t Affect QE Schedule

And some suggested readings on ECB:

- No Change to ECB Guidance Yet

- ECB Preview – Not On Draghi’s Watch

- ECB Meeting: Staying “Cautious” for Now?

Moody’s affirms US Aaa rating, stable outlook.

Moody’s Investor Service affirmed US Aaa rating. Outlook was also maintained as stable. Moody’s noted that “exceptional economic strength” of the US, very high strength of its institution, very low exposure to credit related-shocks. And that “counter balance” the lower fiscal strength.

The rating agency also noted that “diversity, dynamism, and competitiveness” of the US economy, Dollar’s status as the “pre-eminent international reserve currency” and the “very large size and depth” of the treasury market. These advantages will “offset rising fiscal pressures” from “ageing-related entitlement spending, higher debt service payments”, and recent policy actions that will likely lower revenues and increase expenditures.

For now, Moody’s expected US and China to reach a trade deal eventually. However, Moody’s Senior Credit Officer William Foster said that “if things ultimately progress in a way that is outside of the base case, that would be negative for both countries and for the global market place, but our expectation is this will be negotiated back from the headlines you’re reading.”

Canada Freeland: “Good” and “constructive” progress made in NAFTA talks

Canadian Foreign Minister Chrystia Freeland, Mexican Economy Minister Ildefonso Guajardo and US Trade Representative Robert Lighthizer are still carrying on with NAFTA renegotiation in Washington.

Freeland hailed yesterday that “there is a very strong, very committed, good-faith effort for all three parties to work 24/7 on this and to try and reach an agreement.” And, some “good” and “constructive” progress was made. They are working on “a set of “proposals based on the creative ideas the U.S. came up with in March”.

But there are still some major differences. For example, Canada is firm on it’s stance that object the including of a “sunset clause” what would allow one of the three members to quit after five years. Freeland said that the withdrawal mechanism is “absolutely unnecessary”.

Also Freeland reiterated Canada’s opposition to US steel and aluminum tariffs, which is currently exempted until May 1. She said “Canada’s position has been clear from the outset and that is that Canada expects to have a full and permanent exemption from any quotas or tariffs.”

Fitch affirms Japan’s ‘A’ IDR rating with stable outlook. Trade protectionism poses a downside risk

Fitch Ratings affirmed Japan’s Long-Term Foreign-Currency Issuer Default Rating (IDR) at ‘A’ with a Stable Outlook. Fitch noted Japan’s “balance the strengths of an advanced and wealthy economy, with high governance standards and strong public institutions, against weak medium-term growth prospects and high public debt.” And, “strong external finances marked by a persistent current account surplus and large net external credit and international investment positions relative to peers.”

Fitch expected Japan GDP growth to slow to 1.3% in 2018 and 0.7% in 2019. However, “trade protectionism poses a downside risk to the outlook, exemplified by the imposition of a 25% tariff on US imports of steel and aluminium, including from Japan.” Also, “spillovers from trade tensions between the US and China are also a risk, as are tensions on the Korean peninsula.” Regarding inflation, Fitch projected headline inflation to reach only 1.2% at the end of 2018, and rise temporarily to 2.8% at the end of 2019 due to sales tax hike.

The monetary settings under BoJ’s yield curve control framework will “remain broadly unchanged for the foreseeable future”. Fitch noted recent slowdown in asset purchase has been sufficient to sustain the share of outstanding JGBs held by the central bank at around 40%-45%. And, “this level of BoJ ownership is within levels that would prevent the emergence of problems for JGB market liquidity, which the BoJ continues to monitor closely.”

South Korean Moon and North Korean Kim to plant the tree of “peace and prosperity” on Friday

South Korean President Moon Jae-in will meet with North Korean leader Kim Jong-un in a historical encounter tomorrow on Friday. That’s the first highest level summit between the two countries for in more than a decade.

According South Korean chief of staff, the meeting will start at 10:30 a.m. (0130 GMT) at the Peace House in Panmunjom, a village just north of the de facto border between North and South Korea. Kim will then cross the border at 9:30 a.m. (0030 GMT). Moon and Kim will then have lunch separately before holding a tree-planting ceremony in the afternoon.

In the ceremony, a pine tree will be planted on the demarcation line, as a symbol of “peace and prosperity”. Soil from Mount Paektu in North Korea and Mount Halla in South Korea will be used. Also, the tree with be watered with water brought from the Taedong River in the North and the Han River in the South.

A second round of talk will then be held after a walk in Panmunjom. A pact will then be signed by Kim and Moon, with an announcement. And the encounter will conclude with dinner on the South’s side and watch a video clip themed ‘Spring of One’.

On the data front

Australia import price index rose 2.1% qoq in Q1, well above expectation of 1.2% qoq. German will release Gfk consumer confidence, UK will release BBA mortgage approvals and CBI reported sales. Later in the day, US will release jobless claims, trade balance, wholesale inventories and durable goods orders.

EUR/USD Daily Outlook

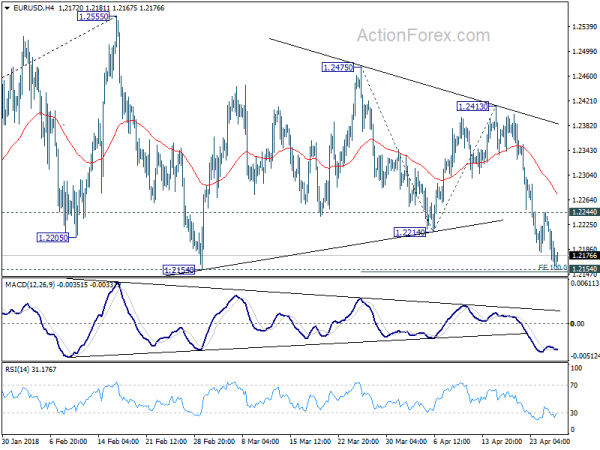

Daily Pivots: (S1) 1.2135; (P) 1.2186 (R1) 1.2213; More….

EUR/USD dropped to as low as 1.2159 so far and focus is now on 1.2154 key support. Decisive break there should confirm the bearish case of medium term reversal. In addition, the break of 100% projection of 1.2475 to 1.2214 from 1.2413 will indicate downside acceleration. In that case, EUR/USD should target 161.8% projection at 1.1991 next. In case of recovery, outlook will remain bearish as long as 1.2244 minor resistance holds. And further decline is still expected. However, break of 1.2244 will indicate strong support from 1.2154 and turn intraday bias back to the upside for 1.2413, to extend recent range trading.

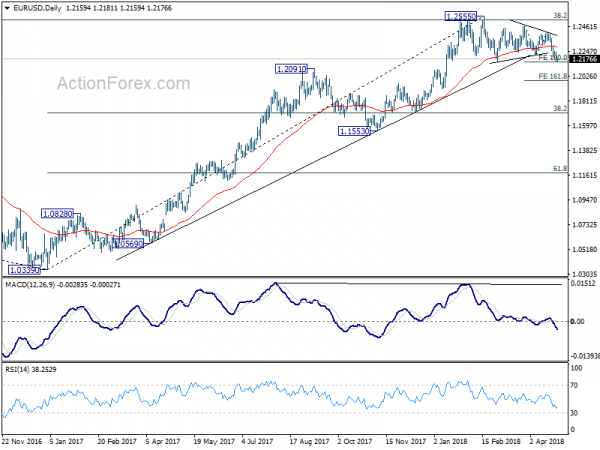

In the bigger picture, key fibonacci level at 38.2% retracement of 1.6039 (2008 high) to 1.0339 (2017 low) at 1.2516 remains intact despite attempts to break. Firm break of 1.2154 support will confirm rejection by this fibonacci level. And in that case, a medium term top is at least formed at 1.2555. EUR/USD should then head back to 38.2% retracement of 1.0339 to 1.2555 at 1.1708 first. We’ll look at the structure and momentum of such decline before decision if it’s an impulsive or corrective move.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 1:30 | AUD | Import price index Q/Q Q1 | 2.10% | 1.20% | 2.00% | |

| 6:00 | EUR | German GfK Consumer Confidence May | 10.8 | 10.9 | ||

| 8:30 | GBP | BBA Loans for House Purchase Mar | 37.1K | 38.1K | ||

| 10:00 | GBP | CBI Reported Sales Apr | -2 | -8 | ||

| 11:45 | EUR | ECB Rate Decision | 0.00% | 0.00% | ||

| 12:30 | USD | Initial Jobless Claims (APR 21) | 230K | 232K | ||

| 12:30 | USD | Advance Goods Trade Balance Mar | -74.8B | -75.9B | ||

| 12:30 | USD | Wholesale Inventories M/M Mar P | 0.60% | 1.00% | ||

| 12:30 | USD | Durable Goods Orders Mar P | 1.40% | 3.00% | ||

| 12:30 | USD | Durables Ex Transportation Mar P | 0.40% | 1.00% | ||

| 14:30 | USD | Natural Gas Storage | -36B |