Here are the latest developments in global markets:

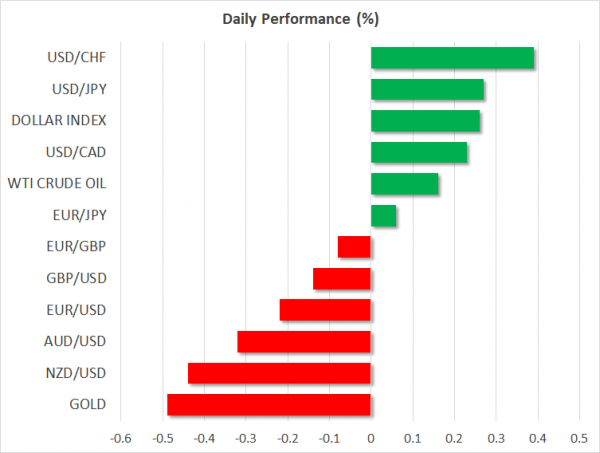

FOREX: The dollar continued to receive love from US Treasury yields, with the 10-year note spiking to a fresh 3-year high of 3.02% during the early European afternoon, underpinned by concerns of rising inflation and increasing debt supply. Easing trade tensions also lifted investors’ confidence in the currency after the US President admitted on Tuesday that China and the US “have got a very good chance at making a deal”. In the aftermath, the dollar index made a fresh 3 ½-month high at 91.11, while dollar/yen reached a new peak at 109.26, its highest since February 8. Meanwhile, euro/dollar remained under pressure, rising moderately from 1.2185 to 1.2221 (-0.16%), unable to gain much from hawkish comments delivered by ECB members, Yves Mersch and Vitas Vasiliauskas today as the spread between the US and German 10-year government bond yields turned the widest in 29 years. Note that ECB policymakers are meeting today to decide on monetary policy, with the announcement made tomorrow. Pound/dollar did not have a good day either so far, trading weak at 1.3962 (-0.09%). Political risks were weighing on the pair given the growing split in May’s inner cycle regarding the Brexit withdrawal bill which could interrupt progress in EU-UK negotiations. In antipodean currencies, aussie/dollar and kiwi dollar were the worst performers, changing hands lower at 0.7584 (-0.26%) and 0.7093 (-0.37%). Dollar/loonie was up at 1.2856 (+0.18%).

STOCKS: Stocks in Europe were all flashing red at 0800 GMT following their Asian and US counterparts as rising US Treasury yields continued to steal demand from equities. The pan-European STOXX 600 retreated further below its 10-week highs, losing 0.43%, on energy and basic materials. The blue-chip Euro STOXX 50 was also down by an equivalent percentage after peaking at an 8-week high yesterday. The German DAX 30 tumbled by 0.70%, Britain’s FTSE 100 fell by 0.32% and Spain’s IBEX 35 pulled back by 0.56%. Asian equities closed lower, while futures tracking US stock indices were hinting that losses may be in store for the US. In corporate news, Credit Swiss, Switzerland’s second biggest bank, and the luxury goods company Kering saw their shares surge after both companies posted an upbeat performance in the first quarter of 2018. However, the gains were not enough to offset losses in the European stock markets.

COMMODITIES: Oil prices gained some ground, recovering from the losses made after the API weekly oil report showed an unexpected increase in US crude inventories. OPEC-led supply cuts and rising speculation that the US will impose fresh sanctions on Iran were the main market drivers. Yesterday, Trump opposed the 2015 nuclear deal (signed by Iran, the United States, the United Kingdom, Russia, France, China, Germany and the European Union) despite the French President’s efforts to persuade him to maintain the agreement. WTI crude and Brent were trading at $67.74 (+0.10%) and $73.80 (-0.08%) per barrel. In precious metals, gold was hovering at $1,324 (-0.46%) per ounce, near three-week lows.

Day Ahead: Equities could dominate attention in absence of data

The calendar will be light of data for the remainder of the day, with investors turning their eyes on long-term US Treasury yields which managed to break above levels last seen back in 2014 over concerns on rising inflationary pressures and debt-issuance. It would be interesting to see whether US Treasury yields will maintain their positive momentum in the following days, affecting currency and equity markets as well.

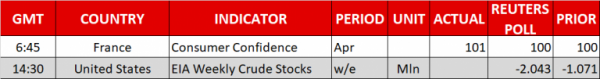

The only release today in focus will be the EIA weekly report on US oil inventories, which could add further volatility to oil prices. According to forecasts, crude inventories are expected to drop by 2.043 million barrels in the week ending April 20 compared to a fall of 1.071 million in the previously tracked week.

Corporate earnings remain on the forefront on Wednesday, with AT&T, eBay, Facebook and Ford reporting results after the closing bell on Wall Street.

Turning to today’s public appearances, at 2015 GMT Bank of Canada Governor Stephen Poloz and Senior Deputy Governor Carolyn Wilkins will be appearing before a Senate Standing Committee on Finance.