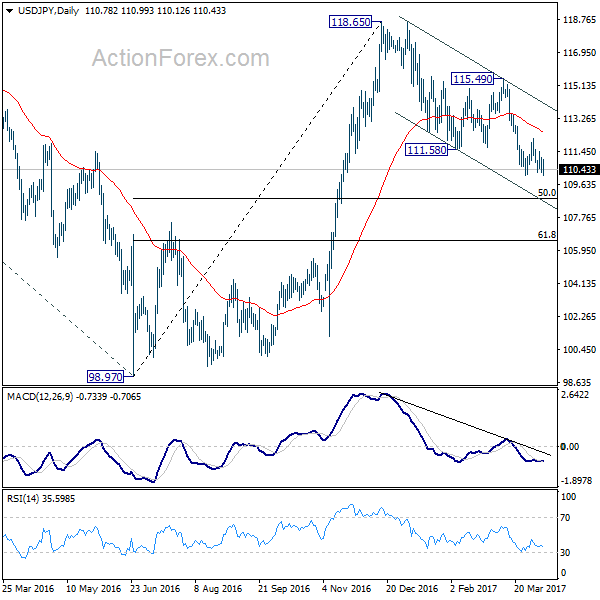

Daily Pivots: (S1) 110.34; (P) 110.74; (R1) 111.19; More….

USD/JPY dips notably in Asian session but stays above 110.10 support so far. Intraday bias remains neutral and more consolidations cannot be ruled out. But still, break of 112.19 resistance is needed to indicate short term reversal. Otherwise, outlook will stay bearish for another fall. Break of 110.10 will extend the whole decline from m 118.65 and target 50% retracement of 98.97 to 118.65 at 108.81. On the upside, however, break of 112.19 resistance will indicate short term reversal and turn bias back to the upside for 115.49 resistance.

In the bigger picture, price actions from 125.85 high are seen as a corrective pattern. The impulsive structure of the rise from 98.97 suggests that the correction is completed and larger up trend is resuming. Decisive break of 125.85 will confirm and target 61.8% projection of 75.56 to 125.85 from 98.97 at 130.04 and then 135.20 long term resistance. Nonetheless, sustained trading below 55 week EMA (now at 111.16) will extend the consolidation from 125.85 with another fall through 98.97 before completion.