Attention will shift to monetary policy next week as the European Central Bank and the Bank of Japan hold scheduled policy meetings. GDP will come into focus too, with preliminary readings for the first three months of 2018 expected out of the United Kingdom, the United States and France. Also important will be the flash April PMIs for the Eurozone, Japan and the US.

Australian inflation eyed after disappointing job figures

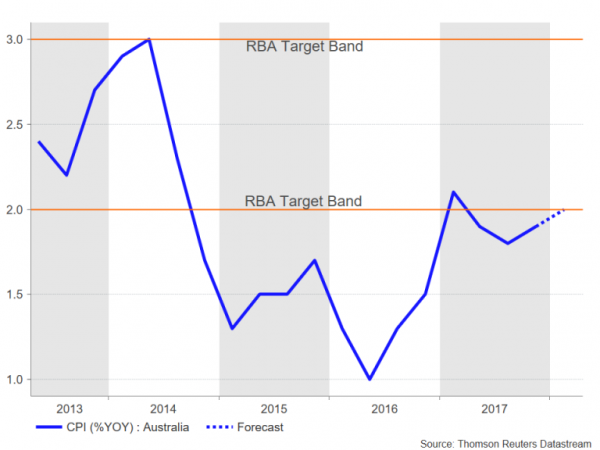

The Australian dollar mostly shrugged off disappointing employment numbers out of Australia this week but could come under pressure on Tuesday if the latest quarterly inflation data fails to meet expectations. The 12-month CPI rate had nudged up to 1.9% in the December quarter and is forecast to rise further to 2.0% in the first three months of 2018. If it fails to climb to within the Reserve Bank of Australia’s 2-3% target band, investors could further push back expectations of how soon the RBA will raise rates, driving the aussie lower.

No surprises expected from Bank of Japan

The Bank of Japan’s latest policy decision will be the highlight of the Japanese calendar on Friday, but before then, there will be a slew of data releases to watch. The Nikkei/Markit flash manufacturing PMI is due on Monday. On Thursday, data on the labour market, industrial output and retail sales should provide a glimpse as to how well the Japanese economy fared at the end of the first quarter.

The Bank of Japan meets on Thursday and Friday to set monetary policy. While no change in policy is anticipated by BoJ policymakers, the Bank will publish its latest quarterly outlook report, which will contain the latest forecasts on economic growth and inflation. Most likely, there will be little change to the outlook, with the Bank sticking to its previous forecast of meeting the 2% inflation goal during the fiscal year 2019. Reaction in forex markets is therefore likely to be limited, especially if Governor Haruhiko Kuroda once again talks down the possibility of an imminent change in policy in his press conference. If the meeting ends up being a non-event, the yen could be susceptible to downside pressure against the US dollar as traders in recent days started paying more attention to the widening yield differential of US treasuries with other government bonds.

ECB meets amid slowing growth concerns

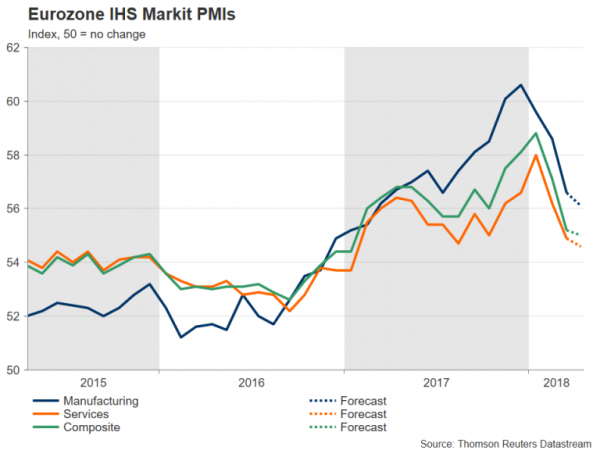

The ECB and Sweden’s Riksbank will be the other central banks meeting next week. There will also be plenty of data for traders to sift through. The flash April PMIs on Monday will be the biggest data to watch. Eurozone economic activity slowed notably during the first quarter according to the closely watched surveys by IHS Markit. Those hoping for an end to the slowdown look set to be disappointed as both the manufacturing and services PMIs are expected to deteriorate further in April, with the composite PMI forecast to decline to a 15-month low of 55.0. More business confidence gauges will follow with Germany’s Ifo business climate index on Tuesday and the Eurozone economic sentiment index on Friday, both for April. Also scheduled for release on Friday is the first estimate of first quarter GDP growth for France. The French economy is forecast to grow by 0.4% quarter-on-quarter in the March quarter.

Prior to that though, all eyes will be on the ECB on Thursday. The ECB is widely expected to keep monetary policy and its forward guidance unchanged in April as the Eurozone economy struggles to maintain its growth momentum. ECB President, Mario Draghi will probably use the recent weak data to make his case for the need for only gradual removal of monetary stimulus. The absence of fresh direction though from the ECB would keep the euro confined to its three-month old range of 1.2150-1.2550 against the dollar for longer.

Finally, the Riksbank will too be announcing its interest rate decision on Thursday. The Swedish central bank is expected to keep its repo rate at -0.5%. In February, the minutes of the bank’s last policy meeting had revealed that policymakers were cautious about beginning the rate hike cycle in the second half of 2018. Any pushing back of the timing of the first rate increase could trigger fresh losses for the Swedish krona, which is down against both the euro and the dollar in the year to date.

Sterling faces another big test with Q1 UK GDP

Disappointing inflation and retail sales numbers out of the UK this week, proved traders may have gotten carried away with May rate hike expectations. Bank of England Governor, Mark Carney, fuelled even more doubt about a move in May in remarks on Thursday, sending the British currency tumbling from a post-Brexit high of $1.4376 to two-week lows near the $1.40 level. The preliminary reading of first quarter GDP growth on Friday could be the nail in the coffin for a rate increase by the BoE next month. GDP growth is forecast to moderate to 0.3% q/q in the three months to March, from 0.4% in the prior quarter. An even weaker reading could drag cable below $1.40, but a surprise positive figure could invite the sterling bulls back into the market.

GDP data to headline US calendar

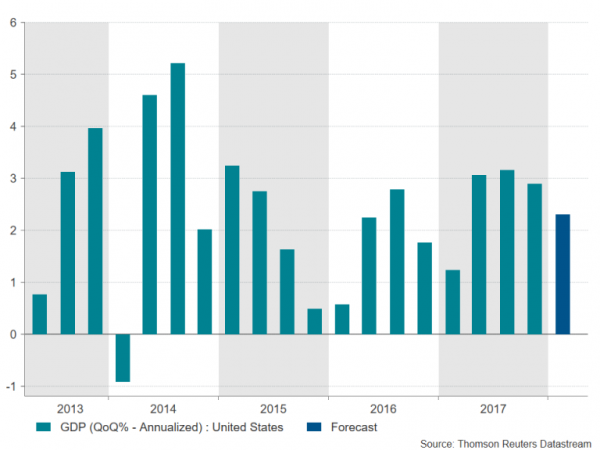

The US economic calendar will be a rather packed one, with the highlight coming at the end of the week from the advance estimate of GDP growth for the first quarter. Ahead of that, focus will fall on the Markit flash April PMIs and March existing homes sales on Monday. There will be more housing data on Tuesday, including new home sales, as well as the Conference Board consumer confidence index. The consumer confidence gauge is forecast to ease further in April, falling from 127.7 to 125.0. On Thursday, attention will turn to the latest durable goods orders, which are expected to increase by 1% month-on-month in March, following a 3.1% rise in the prior month.

On Friday, investors will be scrutinizing the first estimate of GDP growth for the January-March period. The US economy is forecast to have expanded by an annualized rate of 2.3% during the quarter, below the prior 2.9% rate. Softer consumer spending is thought to have weighed on growth during the first quarter and a slightly worse reading is unlikely to make much impact on Fed policymakers given the expected boost over the coming months from the tax cuts. However, a better figure could be just what the dollar needs to make a move for the 108-yen level as trade and geopolitical risks subside.