Here are the latest developments in global markets:

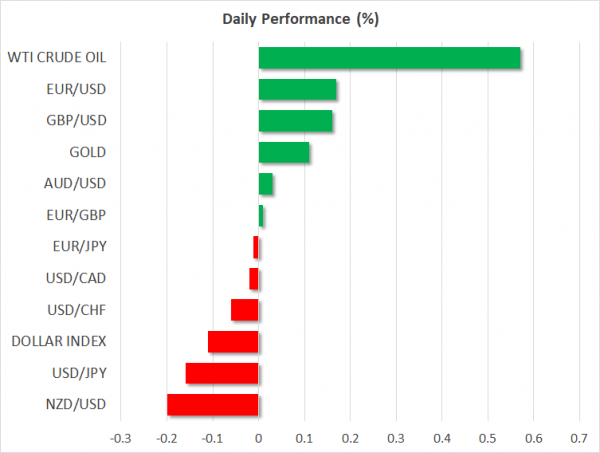

FOREX: The US dollar index was 0.1% lower on Tuesday, extending the losses it posted yesterday amid renewed speculation that the US administration is seeking a weaker currency. Sterling/dollar traded 0.15% higher today after surging yesterday as well, reaching a fresh high last seen in June 2016, amid speculation that upcoming UK economic data will “green light” a rate hike by the Bank of England in May.

STOCKS: US markets closed higher yesterday, buoyed by a decline in geopolitical risks, as the US-led strike in Syria was seen as being an isolated, contained incident that will not escalate any further. The Dow Jones led the pack, gaining nearly 0.9%, while the S&P 500 and the Nasdaq Composite rose by 0.8% and 0.7% respectively. The recovery looks set to continue today, as futures tracking the Dow, S&P and Nasdaq 100 are all pointing to a higher open. In Asia, most of the major benchmarks traded lower. In Japan, the Nikkei 225 closed practically flat, while the Topix fell by 0.36%. In Hong Kong, the Hang Seng slipped 0.37% as China’s GDP data for Q1 were a touch softer than expected. In Europe, futures tracking all the major indices were flashing green.

COMMODITIES: Oil prices rose on Tuesday, with WTI and Brent crude climbing by nearly 0.6% and 0.5% respectively. There was no clear fundamental trigger behind the recovery, with market chatter attributing it to lingering concerns over potential supply disruptions, most notably in Iran in case of new sanctions, and in Venezuela that has experienced a sharp drop in production. Today, oil traders will turn their sights to the private API crude inventory data, ahead of the official EIA figures tomorrow. In precious metals, gold was trading 0.1% higher today, last seen near the $1347/ounce mark. The dollar-denominated safe haven struggled to advance yesterday amid a risk-on environment, even despite a drop in the US dollar.

Major movers: Sterling comes back in fashion, dollar softens despite decent data

The British pound staged an impressive rally yesterday, that seems to be continuing today. Against the dollar, sterling reached fresh highs last seen in June 2016, without any clear fundamental catalyst behind the move. A reasonable explanation for the surge is investors adding to their long-GBP positions in anticipation of strong UK economic data this week. The nation will release its jobs figures today, followed by inflation numbers tomorrow and retail sales on Thursday. Markets currently see a 72% probability for the Bank of England (BoE) to hike rates in May and an overall strong set of data could seal the deal for such an action, at least from the market’s perspective, and thereby boost sterling. Conversely, a soft set of prints could generate doubts about a May hike, leading to profit-taking in the pound.

The dollar was trading on a soft note yesterday, unable to draw support from the slightly-stronger-than-expected US retail sales for March. The currency’s underperformance may be related to a tweet by US President Trump yesterday, in which he accused China and Russia of being currency manipulators, even though the US Treasury did not label them as such in its latest report. The tweet was seen as reinforcing earlier rhetoric from the White House favoring a weaker US dollar. In other news, President Trump nominated Richard Clarida for Fed Vice Chair, a former Vice Treasury Secretary and a managing director at investment firm PIMCO.

Elsewhere, the loonie is practically flat against the dollar today, after gaining ground yesterday amid the broader risk-on market sentiment. Some signs of progress in the NAFTA talks may have helped as well. Mexico’s Economy Minister noted on Monday that several chapters of a deal were now virtually settled, and that the three sides may meet again on Thursday as they push for a swift settlement.

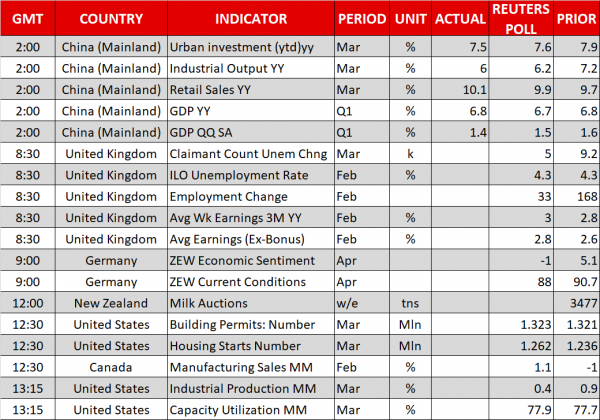

Day ahead: UK wage growth and employment figures, German ZEW and US housing data on the agenda

Important releases out of the UK might attract the lion’s share of attention during today’s trading, especially in light of sterling trading at elevated levels at the moment relative to other major currencies.

UK data on employment and wage growth will be made public at 0830 GMT. Average weekly earnings, both including and excluding bonuses, are anticipated to have accelerated in February, rising by 3.0% and 2.8% correspondingly on an annual basis. Should the figures materialize, in conjunction with inflation readings coming in as expected on Wednesday, this would push real income growth back into positive territory (i.e. wage growth would exceed price increases). Such an outcome is likely to more conclusively put on the table a May rate hike by the Bank of England and consequently provide an additional boost to the British currency. The odds of an interest rate increase currently stand at 72% according to UK overnight index swaps. Elsewhere, the unemployment rate is projected to remain at the multi-decade low of 4.3%.

Germany, the euro area’s largest economy, will see the release of the ZEW institute’s surveys on economic sentiment – a measure gauging the outlook – and current conditions at 0900 GMT. The two business confidence gauges declined in the two months that preceded, with the economic sentiment index falling to its lowest since September 2016 in March – rising trade risks were cited as reasons for the tumble. A further decline is projected for the two measures in April.

At 1230 GMT, the number of building permits and housing starts for the month of March will be made public out of the US, while Canadian manufacturing sales for February are scheduled for release as well. A few minutes later (at 1315 GMT), the US will be on the receiving end of industrial production figures for March. Manufacturing output, a subset of industrial production, will also be generating interest. Data on capacity utilization will be released at the same time.

Kiwi pairs could face volatility as the outcome of the bi-weekly milk auction is made public later today; dairy products are New Zealand’s largest goods export earner. The relevant print lacks a specific time of release, with most calendars having it slated for 1200 GMT.

Oil traders will be paying attention to API’s weekly report on crude stockpiles due at 2030 GMT.

Some of the big names releasing quarterly results on Tuesday are Goldman Sachs and Johnson & Johnson; both companies’ reports will be made public before the US market open.

Fed policymakers John Williams (voter), Randal Quarles (permanent-voter) and Patrick Harker (non-voter) will be making appearances today at 1315 GMT, 1400 GMT and 1500 GMT respectively. Also of interest in terms of policymakers’ appearances might be a news conference by German Finance Minister Olaf Scholz during which he could touch on the trade dispute between the US and the EU.

In politics, US President Donald Trump will be meeting Japanese Prime Minister Shinzo Abe on Tuesday; discussions are scheduled to continue tomorrow. Developments on the Korean peninsula and trade issues are likely to be discussed.

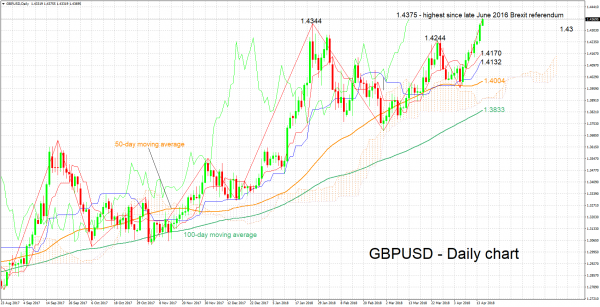

Technical Analysis: GBPUSD at highest since June 2016; possibly overbought

GBPUSD is rising for the fourth straight day, having reached 1.4375 earlier on Tuesday, its highest since the late June 2016 Brexit referendum; price action is currently close to this level. The Tenkan- and Kijun-sen lines are positively aligned in support of a bullish short-term picture, though the Chikou Span might be signaling an overbought market.

Stronger-than-expected UK data are anticipated to be met with gains in GBPUSD, with resistance potentially coming at the 1.44 and 1.45 round figures.

On the downside and in case of disappointing figures, support could be met around the 1.43 handle that may also hold psychological importance, and further below near the area of 1.4244, this being a peak from the recent past.