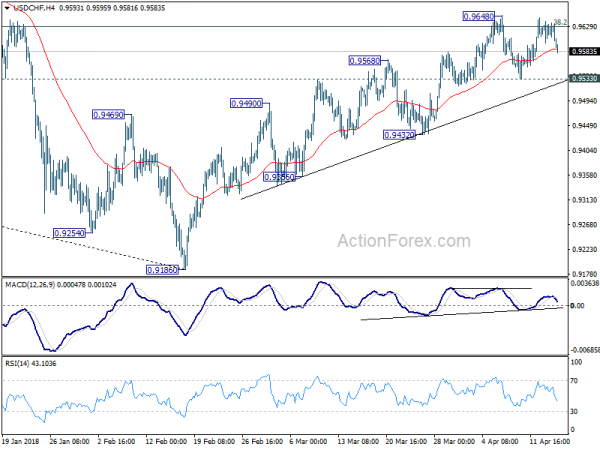

Daily Pivots: (S1) 0.9599; (P) 0.9618; (R1) 0.9638; More…

USD/CHF failed to take 0.9648 and weakens again today. But it’s staying in range of 0.9533/9648 and intraday bias remains neutral. On the downside, break of 0.9533 minor support should indicate rejection by 0.9626 key fibonacci resistance. Intraday bias would then be turned to the downside side for 0.9432 support. Further break there will turn near term outlook bearish for retesting 0.9186 low. On the upside, sustained trading above 0.9626 will be another evidence of larger reversal. In that case, further rally should be seen back to next fibonacci level at 0.9900.

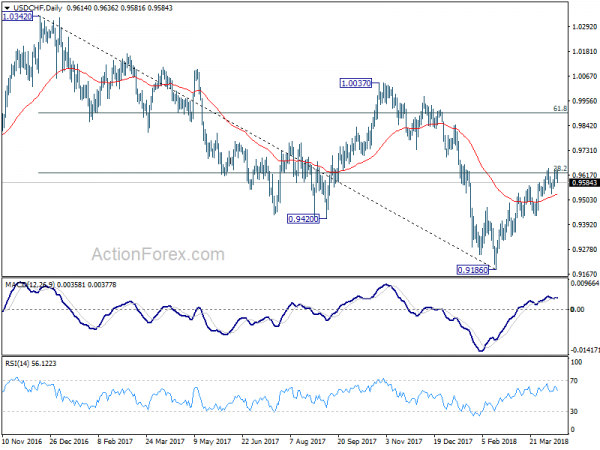

In the bigger picture, fall from 1.0342 is seen as a medium term down trend. Main focus is on 38.2% retracement of 1.0342 (2016 high) to 0.9186 (2018 low) at 0.9626. Sustained break there will add to the case of trend reversal and target 61.8% retracement at 0.9900 and above. However, rejection from 0.9626 will maintain medium term bearishness for another low below 0.9186.

In the bigger picture, fall from 1.0342 is seen as a medium term down trend. Main focus is on 38.2% retracement of 1.0342 (2016 high) to 0.9186 (2018 low) at 0.9626. Sustained break there will add to the case of trend reversal and target 61.8% retracement at 0.9900 and above. However, rejection from 0.9626 will maintain medium term bearishness for another low below 0.9186.