Here are the latest developments in global markets:

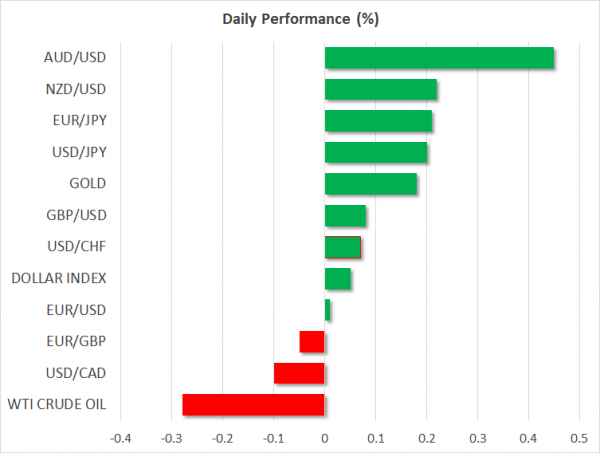

FOREX: The US dollar index traded higher on Friday, but by less than 0.1%, extending the gains it posted yesterday as geopolitical and trade risks moderated, and the yields on longer-term US Treasuries surged. The yen traded 0.2% lower against both the euro and the dollar, as the risk-on environment curtailed demand for the safe haven Japanese currency.

STOCKS: US markets closed higher, boosted by signals that the situation in Syria may not escalate after all, and hints from the US administration that it may finally join the Trans-Pacific Partnership (TPP) trade deal, which it previously rejected. The Dow Jones led the pack, gaining 1.2%, while the Nasdaq Composite and the S&P 500 climbed by 1.0% and 0.8% respectively. That said, futures tracking the Dow, S&P, and Nasdaq 100 are mixed, pointing to a slightly higher open for the Dow today, but a lower one for the S&P and Nasdaq 100. The risk-on sentiment was evident in Japan today, with the Nikkei 225 and the Topix rising by 0.55% and 0.6% correspondingly. In Hong Kong, the Hang Seng was practically unchanged. In Europe, futures tracking most of the major indices were flashing green.

COMMODITIES: Oil prices pulled back on Friday, with both WTI and Brent declining by nearly 0.3%. This modest correction is likely owed to the fact the US may not attack Syria in the end, following tweets from President Trump suggesting as much. That said, one has to note that this correction is extremely small compared to the spectacular surge in oil prices earlier in the week, after the US said it may strike Syria. This suggests either that there are still concerns the Syrian situation could impact oil production elsewhere in the Middle East, or that other factors were at play in pushing prices higher recently. In precious metals, gold is 0.2% higher today, recouping some of the significant losses it posted yesterday as geopolitical concerns eased.

Major movers: Risk appetite returns as geopolitical and trade risks moderate

Thursday was another rollercoaster ride in markets, with the general theme being an improvement in risk sentiment as anxieties around geopolitics and protectionism declined. The risk-on moves followed a tweet from the US President suggesting a military action in Syria may not be so imminent after all, aiding speculation that a US-Russia standoff may be averted. Safe havens such as the yen and gold started to crumble, while US stock futures surged, helping the major indices to open higher.

Later in the day, these moves were exacerbated by news the US may join the Trans-Pacific Partnership (TPP), a trade deal the US pulled out of after President Trump was elected, and that the President criticized extensively on the election trail. This signal, alongside comments from Trump that “now we’re really negotiating” with China, likely heightened speculation that a trade war may be never occur, and that all the recent rhetoric was simply posturing ahead of crucial talks.

In the big picture, US-China trade risks seem to be gradually easing, and while the US may still attack Syria, any strike appears increasingly more likely to be an isolated event as opposed to the beginning of a prolonged military operation. Judging by the latest market moves, investors seem to be siding with this view as well, and barring some unforeseen headline that alters this outlook, risk appetite could remain supported for a while. The key risk to this argument is a WSJ report that circulated overnight, suggesting the US plans to introduce new tariffs against China next week. While this was largely overlooked by markets, if true, it may trigger a further deterioration in sentiment before the situation improves.

Elsewhere, the euro underperformed yesterday, after the March ECB minutes were perceived as dovish. Policymakers discussed downside risks emanating from a potential escalation in trade conflicts, while also expressing concerns that a euro appreciation may weigh on inflation.

The commodity-linked currencies are all on the front foot today, with aussie/dollar gaining 0.4% and reaching a one-month high, while kiwi/dollar rose by 0.2%. The loonie was also marginally higher against the US dollar.

Day ahead: JOLTS job openings and University of Michigan survey due out of US

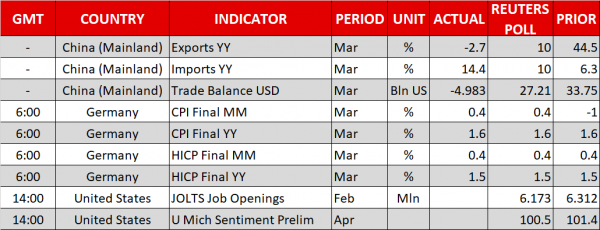

The calendar is mostly empty of important releases on Friday, barring a few readings out of the US that are expected to generate interest. In the absence of data, market participants may remain focused on developments on the geopolitical & trade fronts.

February’s JOLTS job openings report and the preliminary University of Michigan report on consumer sentiment for the month of April have the capacity to lead to positioning on the US currency. Both prints are scheduled for release at 1400 GMT. The University of Michigan consumer sentiment index is anticipated to ease a bit – though still remain at elevated levels – after rising to a more-than-a-decade high in March. Besides the headline figure, the surveys gauging the inflation outlook will also be of particular importance.

Of significance to oil traders will be the US Baker Hughes oil rig count due at 1700 GMT.

In equites, JPMorgan Chase, Citigroup and Wells Fargo are among companies releasing quarterly earnings results on Friday; all three are reporting before Wall Street’s opening bell. Beyond corporate releases, any updates on global trade issues or the conflict in Syria have the capacity to drive sentiment as well.

Regional Fed Presidents Eric Rosengren, James Bullard and Robert Kaplan will be making public appearances at 1130 GMT, 1300 GMT and 1700 GMT respectively. None of them holds voting rights within the FOMC in 2018. ECB President Mario Draghi will also be talking at 1100 GMT, though the topic of discussion renders any market-sensitive comments unlikely.

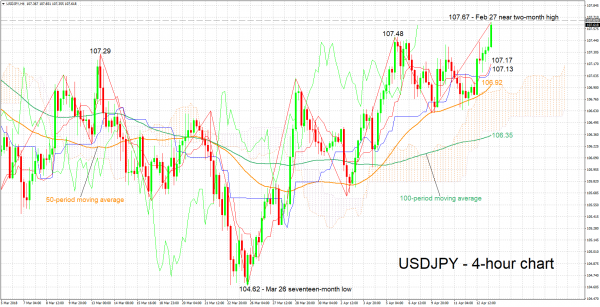

Technical Analysis: USDJPY rises to 1½-month high, short-term bullish

USDJPY has risen to touch a one-and-a-half-month high of 107.65 during Friday’s trading, while it is currently trading not far below that mark. The Tenkan- and Kijun-sen lines are positively aligned in support of a bullish picture for the pair in the short-term.

Upbeat US releases later in the day could provide an additional boost to USDJPY. Immediate resistance could be met around late February’s near two-month high of 107.67. An upside break would shift the attention to the 108 round figure as an additional barrier to the upside.

Weaker-than-anticipated releases might weaken the pair, with immediate support potentially coming around 107.48, a previous peak. Further declines would eye the area around the current level of the Tenkan-sen at 107.17, which also includes the Kijun-sen at 107.13 and a peak from the recent past at 107.29.

Rising geopolitical and/or trade uncertainty can also spur movements in the pair, particularly pushing it lower. The opposite holds true as well.