Here are the latest developments in global markets:

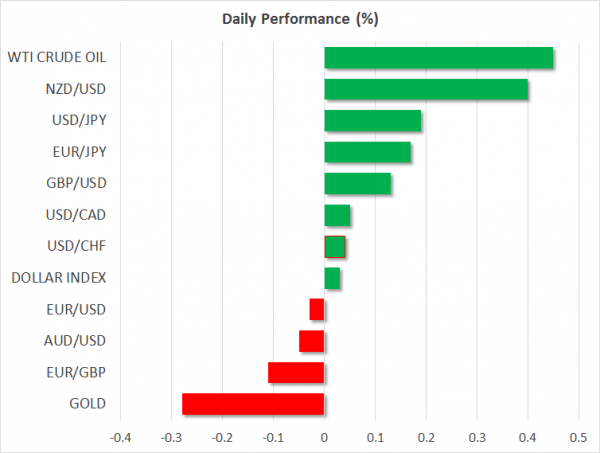

FOREX: The US dollar was attempting a rebound on Monday, climbing back above the 107 level against the Japanese yen after twice coming under pressure on Friday. A smaller-than-expected increase in March nonfarm payrolls out of the US followed heated exchanges between the US and China on trade, causing the dollar to undo its prior day’s gains when it rose to 5-week highs. However, comments by US President Donald Trump over the weekend helped ease some of the fears about the prospect of a Sino-US trade war, with the dollar index edging up slightly to 90.16 at the start of European trading today. The euro and the pound benefited from the dollar weakness to recover from last week’s multi-week lows. The single currency was last trading flat at $1.2277, but sterling extended Friday’s gains to reclaim the $1.41 level to a 1½-week high. The Australian and New Zealand dollar were also firmer, rising by 0.2% and 0.6% to $0.7690 and $0.7301 respectively. The Canadian dollar was slightly down versus its US counterpart but stuck close to Friday’s 5-week high of C$1.2729 per US dollar.

STOCKS: Asian stocks turned green on Monday and European bourses were also poised to open higher despite losses of more than 2% on Wall Street on Friday. Sentiment in equity markets tracked US stock futures higher, which were lifted by a slightly more conciliatory tone on trade with China by President Trump over the weekend. Hong Kong was the biggest gainer, with the Hang Seng index surging 1.5% as Chinese and other regional markets reopened after a long holiday weekend. Japan’s Nikkei 225 index was also positive, rising by 0.5%. In Europe, future for London’s FTSE, the German DAX and the French CAC were pointing to gains of around 0.5%.

COMMODITIES: Gold prices seemed unmoved by reports of an airstrike at a Syrian air base on Monday. Syria says the missile strikes were likely carried out by the US in response to a suspected chemical attack by Syrian forces on civilians on Saturday. But the Pentagon has denied any involvement. However, news that North Korea has reportedly told the United States that it is prepared to discuss denuclearization when leaders of the two nations meet next month offset the latest tensions in the Middle East. The precious metal was last trading marginally lower at $1331 an ounce. Oil prices shrugged off an increase in the US oil rig count last week to head higher on Monday. Both WTI and Brent crude were up 0.45% at $62.33 and $67.42 a barrel respectively.

Major movers: Dollar fights off selling pressure to hold near 107 yen

There was relative calm in forex markets on Monday as the week’s trading got underway. While a disappointing US jobs report and an escalation of trade tensions between the US and China put a dent in risk sentiment on Friday, the dollar sell-off was limited and traders were more focused on the first quarter earnings season, which has just begun and will fully kick off next week. The dollar found support at 106.76 yen on Friday and is currently hovering around the 107-yen level.

Also weighing on the greenback last week was a speech by Fed Chair Jerome Powell. In his first big speech on the economy since becoming chair, Powell stuck to familiar language. He reiterated that ‘further gradual increases’ in interest rates are needed while remaining cautious about wage inflation, saying ‘The absence of a sharper acceleration in wages suggests that the labor market is not excessively tight’.

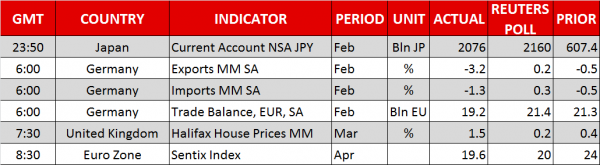

Earlier, economic data showed the US economy added just 103k jobs in March, versus forecasts of 193k, though there was a small upward revision to the prior month’s figure. There was relief however, that there were no surprises in wages, which grew by 2.7% year-on-year as expected.

Renewed dollar weakness on Friday helped other majors bounce back. The euro moved away from a 5-week low of $1.2212 but appears to have met resistance at $1.2290, with an unexpected drop in German exports in February not doing the single currency any favours on Monday. The pound recorded a stronger rebound, managing to rise back above $1.41 and the New Zealand dollar also recovered sharply to re-test the $0.73 level.

There was some boost to risk appetite following remarks by President Trump and his officials at the weekend where they sought to downplay talks of ‘trade war’ and were hopeful of a solution. President Trump tweeted ‘China will take down its trade barriers because it is the right thing to do. Taxes will become reciprocal and a deal will be made on intellectual property.’

However, the Trump administration may need some tough persuading to do as a spokesman for China’s Ministry of Commerce said late on Friday that ‘It’s impossible for both sides to engage in any negotiation’.

The US was having better luck in updating its trading relations with its neighbours though. Hopes are high that a deal on NAFTA can be reached with Canada and Mexico. The optimism drove the Canadian dollar to a 5-week high of C$1.2729 to the greenback on Friday but eased to C$1.2780 on reports that a preliminary deal is unlikely this month.

Day Ahead: ECB speeches eyed

With little in terms of data releases for the rest of the day apart from the Eurozone sentix index, focus will be on possible remarks by European Central Bank officials in planned speeches. ECB Vice President Vitor Constancio will present the Bank’s annual report at the European Parliament at 13:00 CET, while Governing Council member Peter Praet will participate in the European Finance Forum in Germany at 16:45 GMT.

With the euro losing steam since the end of March, investors will be watching for policymakers’ views on the Eurozone economy given recent indications of moderating growth at the start of 2018, and the implications of any slowdown on monetary policy. Hawkish comments could help the euro break above $1.23 but signs of concerns about growth could push the single currency below $1.22.

Trade relations between the US and China look set to remain at the forefront of traders’ attention this week with nerves high for another potential escalation in the trade dispute. Investors will be hoping that President Xi of China will use his address at the Boao Forum for Asia on Tuesday to ease tensions by announcing more access for US firms in China’s domestic market.

Should China go far enough in making concessions to the US, it could provide a major boost to risk assets and as well as the US dollar.