‘The markets are waiting for the conference between the most important leaders in the world.’ – Jiang Shu, Shandong Gold Group (based on Reuters)

Pair’s Outlook

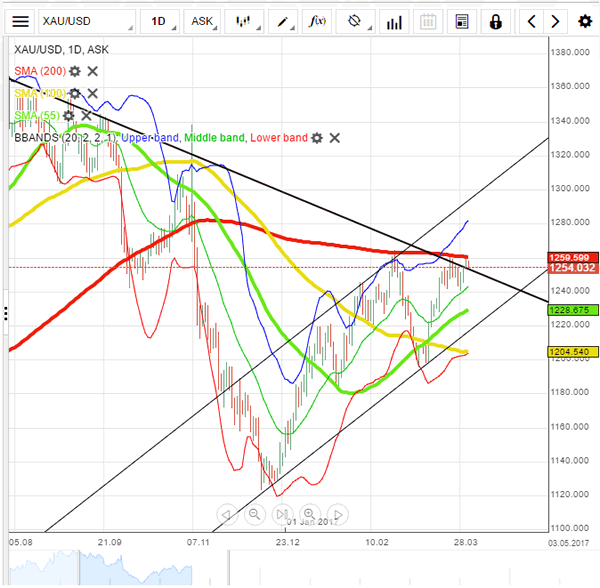

On Wednesday morning the yellow metal’s price remained almost unchanged at the 1,255 mark. However, various clues were indicating that the bullion’s price was about to decline down to the 1,250 mark, where a cluster of support was located at. The main reason for that hypothesis was the fact that the 200-day SMA was providing resistance at the 1,256.45 level, and gold clearly could not pass it. It is highly possible that the bullion’s price will decline down to the combined support of the weekly PP and the 50.00% Fibonacci retracement level, respectively, at 1,249.67 and 1,248.96 during the day’s trading session.

Traders’ Sentiment

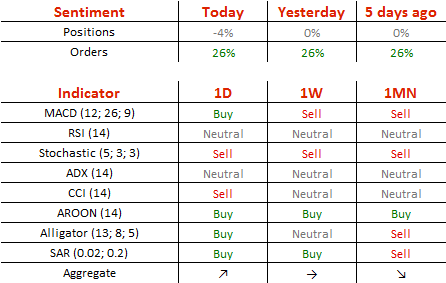

Traders have become slightly bearish on the metal, as 52% of open positions are short on Wednesday. Meanwhile, 63% of trader set up orders are to buy.