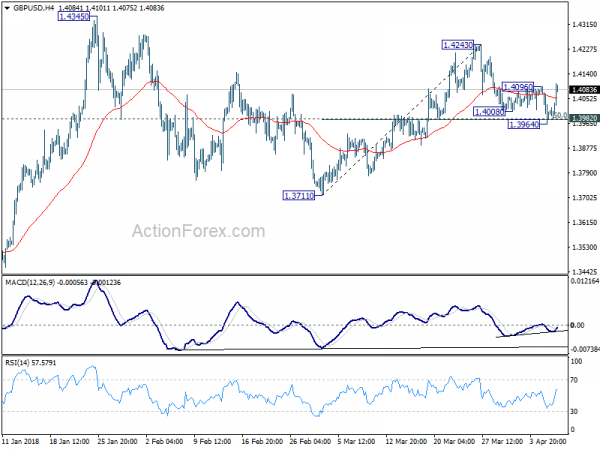

Despite dipping to 1.3964 initially last week, GBP/USD drew solid support from 1.3982 and rebounded. The break of 1.4096 minor resistance suggests that pull back from 1.4243 has completed already. Initial bias is turned back to the upside for 1.4243 first. Break will target a test on 1.4345 high next. On the downside, however, sustained break of 1.3964/82 will indicate completion of the rise from 1.3711. In that case, deeper decline should be seen back to retest 1.3711.

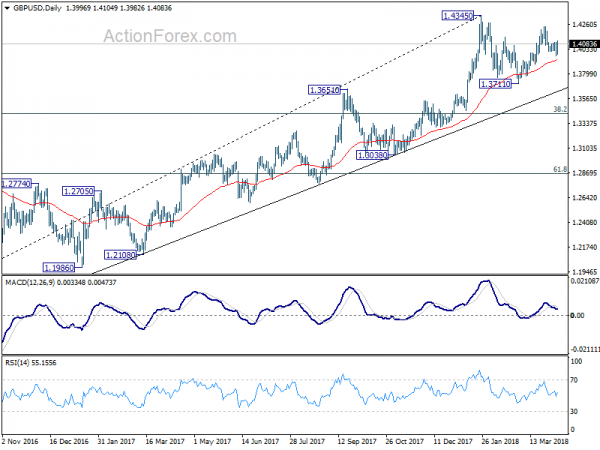

In the bigger picture, as long as 1.3651 resistance turned support holds, medium term outlook in GBP/USD will remain bullish. Rise from 1.1946 is at least correcting the long term down trend from 2007 high at 2.1161. Further rally would be seen back to 38.2% retracement of 2.1161 (2007 high) to 1.1946 (2016 low) at 1.5466. However, GBP/USD fails to sustain above 55 month EMA (now at 1.4267) so far. Break of 1.3651 will be the first sign of medium term reversal and turn focus to 1.3038 support for confirmation.

In the bigger picture, as long as 1.3651 resistance turned support holds, medium term outlook in GBP/USD will remain bullish. Rise from 1.1946 is at least correcting the long term down trend from 2007 high at 2.1161. Further rally would be seen back to 38.2% retracement of 2.1161 (2007 high) to 1.1946 (2016 low) at 1.5466. However, GBP/USD fails to sustain above 55 month EMA (now at 1.4267) so far. Break of 1.3651 will be the first sign of medium term reversal and turn focus to 1.3038 support for confirmation.

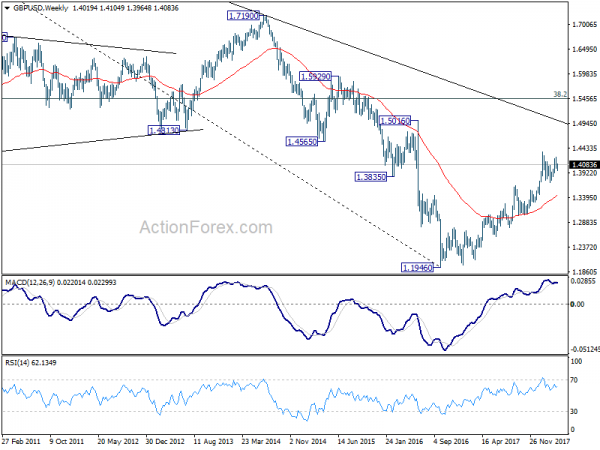

In the longer term picture, rise from 1.1946 should at least be correcting the whole long term down trend from 2.1161 and should target 38.2% retracement of 2.1161 (2007 high) to 1.1946 (2016 low) at 1.5466. It too early to tell if it’s developing into a long term up trend. We’ll monitor the upside momentum and reaction to 1.5466 to decide later.

In the longer term picture, rise from 1.1946 should at least be correcting the whole long term down trend from 2.1161 and should target 38.2% retracement of 2.1161 (2007 high) to 1.1946 (2016 low) at 1.5466. It too early to tell if it’s developing into a long term up trend. We’ll monitor the upside momentum and reaction to 1.5466 to decide later.