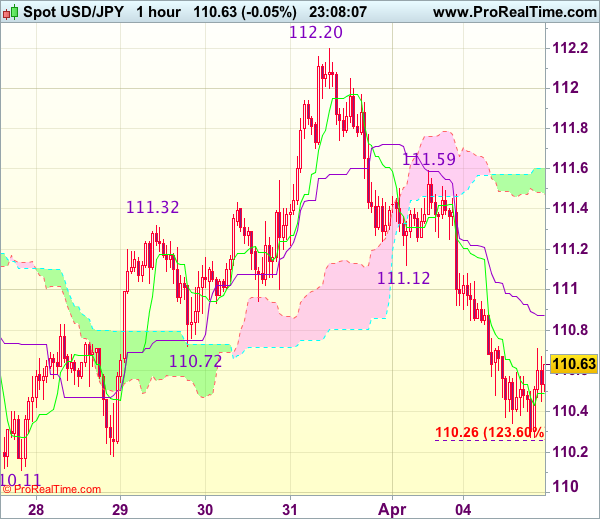

USD/JPY – 110.57

Most recent candlesticks pattern : N/A

Trend : Near term down

Tenkan-Sen level : 110.50

Kijun-Sen level : 110.87

Ichimoku cloud top : 111.60

Ichimoku cloud bottom : 111.47

Original strategy :

Sell at 110.95, Target: 109.95, Stop: 111.30

Position : –

Target : –

Stop : –

New strategy :

Sell at 110.95, Target: 109.95, Stop: 111.30

Position : –

Target : –

Stop : –

As the greenback has recovered after falling to 110.27, suggesting minor consolidation above this level would be seen and test of the Kijun-Sen (now at 110.87) cannot be ruled out, however, reckon upside would be limited and resistance at 111.12 should remain intact, bring another decline later to 110.26-27 (1.236 times projection of 112.20-111.12 measuring from 111.59 and said intra-day support), break there would extend the fall from 112.20 to last week’s low at 110.11. Looking ahead, break there is needed to retain downside bias and confirm medium term decline has resumed for further subsequent fall to 109.80-85 (1.618 times projection of 112.20-111.12 measuring from 111.59) which is likely to hold on first testing.

In view of this, would not chase this fall here and would be prudent to sell dollar on recovery as 110.90-95 should limit upside. Above previous support at 111.12 (now resistance) would defer but only break of resistance at 111.59 would abort and signal the fall from 112.20 has ended instead.