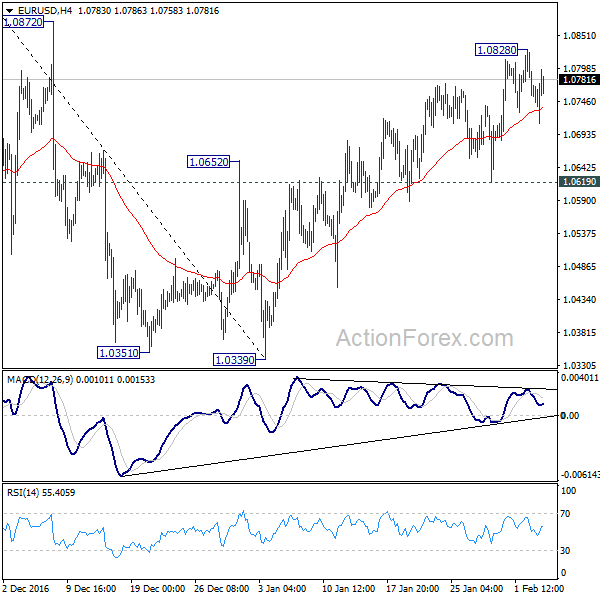

EUR/USD’s choppy rise from 1.0339 extended higher last week but lost momentum again after hitting 1.0828. Initial bias remains neutral this week first. We’d holding on to the view that rise from 1.0339 is a correction. Hence, in case of another rise, upside should be limited by 1.0872 resistance and bring fall resumption eventually. Break of 1.0619 will turn bias to the downside for retesting 1.0339 low.

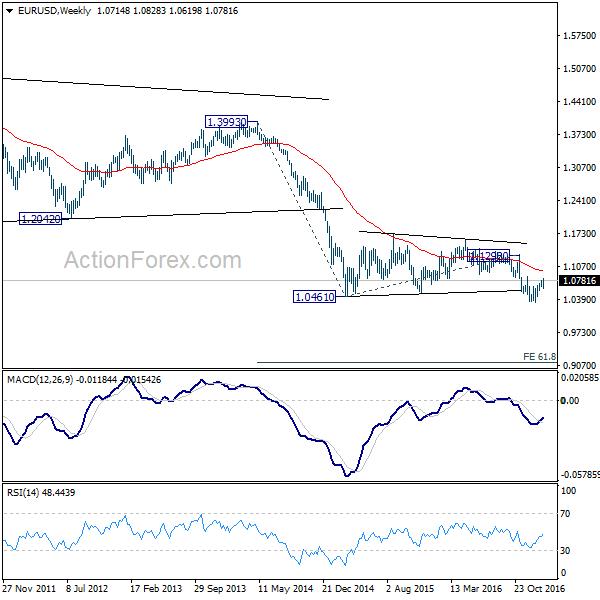

In the bigger picture, whole down trend from 1.6039 (2008 high) is in progress. Such down trend is expected to extend to 61.8% projection of 1.3993 to 1.0461 from 1.1298 at 0.9115. On the upside, break of 1.1298 resistance is needed to confirm medium term bottoming. Otherwise, outlook will stay bearish in case of rebound.

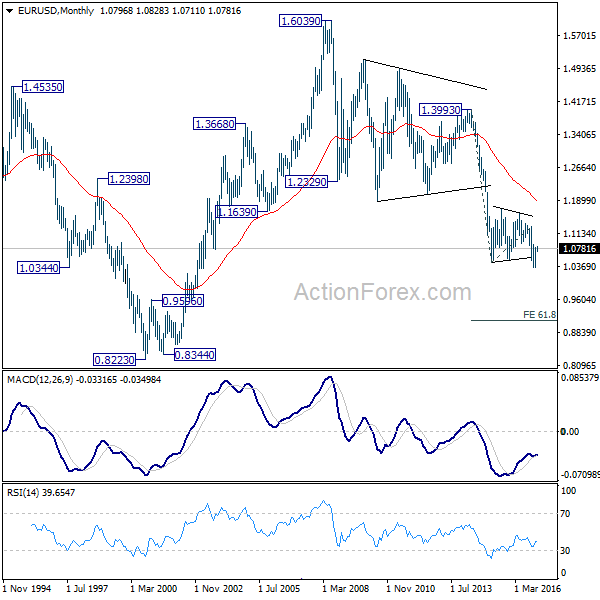

In the long term picture, the down trend from 1.6039 (2008 high) is still in progress and there is no clear sign of completion. We’d expect more downside towards 0.8223 (2000 low) as long as 1.1298 resistance holds.

Subscribe to our daily and mid-day newsletter to get this report delivered to your mail box