The US dollar gained against major pairs thanks to strong economic indicators and the end of month and quarter flows. The greenback had a positive week ahead of the easter holiday. The first week of April will kick off with a plethora of US economic data, the most important of all the U.S. non farm payrolls (NFP). Central banks will get back into action with the Reserve Bank of Australia (RBA), although no changes to monetary policy are expected in the next meeting.

- Reserve Bank of Australia (RBA) anticipated to keep rate unchanged

- US job reports to add jobs but focus is on wage growth

- European inflation to guide ECB on QE and rates

US 4Q GDP and Quarter End Flows Boost USD

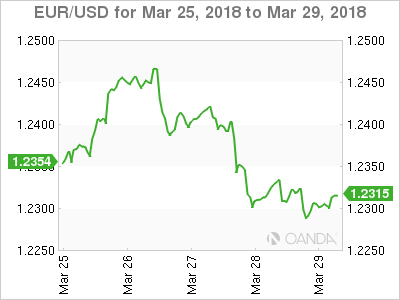

The EUR/USD lost 0.24 percent in the last five trading days. The single currency is trading at 1.2323 at the end of a short trading week due to the Easter holiday. The USD got a boost from better than expected GDP data on Wednesday. The final estimate came in at 2.9 percent for the fourth quarter of 2017 improving on the two previous releases. The greenback also got a boost from quarter end flows which increase the demand of the currency for portfolio rebalancing across asset classes.

The USD is still having a bad start to 2018. The EUR is up 2.69 percent versus the dollar year to date. Low inflation has been the fly in the euro’s ointment. Economic growth is stronger, but lack of inflationary pressures make talks of interest rate hikes by the European Central Bank (ECB) premature. The flash consumer price index (CPI) release on Wednesday, April 4 at 5:00 am EDT. The market expects a 1.4 percent gain in the CPI and 1.1 percent on the core CPI readings.

The USD is still having a bad start to 2018. The EUR is up 2.69 percent versus the dollar year to date. Low inflation has been the fly in the euro’s ointment. Economic growth is stronger, but lack of inflationary pressures make talks of interest rate hikes by the European Central Bank (ECB) premature. The flash consumer price index (CPI) release on Wednesday, April 4 at 5:00 am EDT. The market expects a 1.4 percent gain in the CPI and 1.1 percent on the core CPI readings.

US employment data will drop this week with the ADP private payrolls on Wednesday, April 3 at 8:15 am EDT forecasted at 206,000, and the biggest indicator in the market the U.S. non farm payrolls (NFP) to be published on Friday, April 6 at 8:30 am EDT. After the massive 300,000 jobs gain a lower gain of 190,000 is expected, but the eyes of the market will be focused on the average hourly earnings data point with an expected 0.3 percent gain.

Mexican Peso Soars as NAFTA and Politics Find Stability

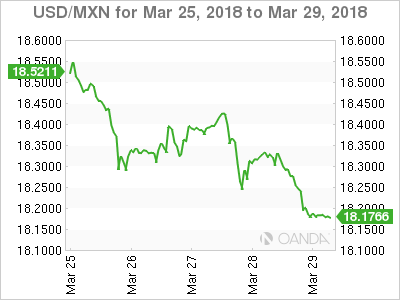

The Mexican peso has been one of the best performers against the USD in 2018. Dollar highs against the MXN in the last two quarters came about in December of 2017 when NAFTA anxiety was at its strongest. Inflexible US demands on auto and other big topics have prevented the NAFTA renegotiation from moving forward. Canada and Mexico did not buckle under pressure and given the deep relationships with US states, many of them under Republican governors, the market is not pricing in a sudden end of the trade agreement.

The USD/MXN is trading at 18.1766 on Friday. The currency pair started trading at 18.5211 and the USD has only depreciated as the week has gone by. The sudden urgency by the Trump administration to wrap up the renegotiation by May 1st is seen as a good sign as this time they seem to be willing to come to the table to sign an agreement. Originally the three nations wanted the talks to have wrapped up by the end of last year to avoid running close to political events. Mexican presidential elections in July, where the left is leading the polls, US midterms in the fall and provincial elections in Ontario and Quebec could end up eroding support for NAFTA.

The USD/MXN is trading at 18.1766 on Friday. The currency pair started trading at 18.5211 and the USD has only depreciated as the week has gone by. The sudden urgency by the Trump administration to wrap up the renegotiation by May 1st is seen as a good sign as this time they seem to be willing to come to the table to sign an agreement. Originally the three nations wanted the talks to have wrapped up by the end of last year to avoid running close to political events. Mexican presidential elections in July, where the left is leading the polls, US midterms in the fall and provincial elections in Ontario and Quebec could end up eroding support for NAFTA.

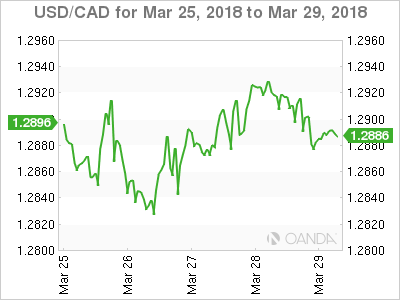

Loonie Looking Ahead to Trade and Employment Data

The USD/CAD was flat in the last five trading days. The currency pair is trading at 1.2889. The better than expected US Final GDP for the fourth quarter turned the tables in favour of the US dollar, alongside month end flows. The NAFTA optimism has done little to boost the loonie in comparison to the peso. The slowdown in the economy is a concern despite rising oil prices. The Bank of Canada (BoC) is expected to hike at least two times this year to keep up with the U.S. Federal Reserve, but it would be limited if the economy does not find traction.

Canadian jobs data will be released at the same time as the US NFP report on Friday, April 6 at 8:30 am EDT. The economy is forecasted to add another 20,000 jobs after last month’s 15,000 gain. Later at 10:00 am EDT the Ivey purchasing managers index (PMI) will be published. US jobs will take most of the spotlight, but given the perceived softness of the Canadian economy a strong employment indicator would be a positive for the loonie.

Canadian jobs data will be released at the same time as the US NFP report on Friday, April 6 at 8:30 am EDT. The economy is forecasted to add another 20,000 jobs after last month’s 15,000 gain. Later at 10:00 am EDT the Ivey purchasing managers index (PMI) will be published. US jobs will take most of the spotlight, but given the perceived softness of the Canadian economy a strong employment indicator would be a positive for the loonie.

Market events to watch this week:

Monday, April 2

- 10:00am USD ISM Manufacturing PMI

Tuesday, April 3

- 12:30am AUD Cash Rate

- 12:30am AUD RBA Rate Statement

- 4:30am GBP Manufacturing PMI

- 9:30pm AUD Retail Sales m/m

Wednesday, April 4

- 4:30am GBP Construction PMI

- 8:15am USD ADP Non-Farm Employment Change

- 10:00am USD ISM Non-Manufacturing PMI

- 10:30am USD Crude Oil Inventories

- 9:30pm AUD Trade Balance

Thursday, April 5

- 4:30am GBP Services PMI

- 8:30am CAD Trade Balance

Friday, April 6

- 8:30am CAD Employment Change

- 8:30am CAD Unemployment Rate

- 8:30am USD Average Hourly Earnings m/m

- 8:30am USD Non-Farm Employment Change

- 8:30am USD Unemployment Rate

*All times EST