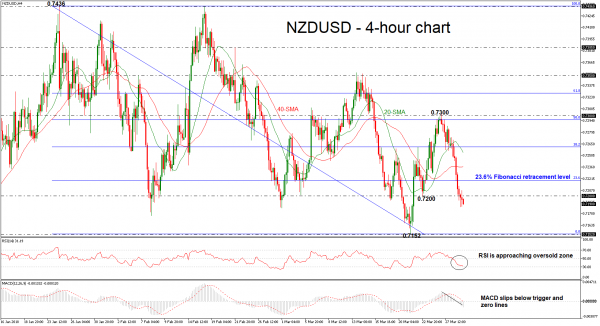

NZDUSD turned increasingly bearish after a bounce off the 0.7300 handle on Tuesday, breaking below the 0.7200 strong psychological level yesterday.

Today the pair continues to head lower, but the RSI in the 4-hour chart is not far away from oversold levels therefore upside movements cannot be excluded yet in the short-term. The MACD gives additional bearish signals, as the index is stretching downwards into negative territory.

If prices extend lower, the next support could come around the 2-month low of 0.7152. A break below this level could endorse the bearish bias and open the way towards the 0.7100 key-level.

However, if prices rebound, the focus could shift to the 23.6% Fibonacci retracement level of 0.7220 of the downleg from 0.7436 to 0.7152. Above this level, the next target could come in the region within the 20- and 40-period simple moving averages (SMAs), this is between 0.7237 – 0.7254.