US stocks tumbled sharply in the final hour of trading overnight, taking out key support levels in the wake of the start of US-China trade war. DOW closed sharply lower by -724.42 pts or -2.93% at 23957.89 overnight as fear of trade war intensified. S&P 500 was down -68.24 pts or -2.52% at 2643.69. NASDAQ also dropped -178.61pts or -2.43% to 7166.68. Selling continues in Asia with Nikkei trading down -4.4%, or near -950 pts at the time of writing. Hong Kong HSI is also losing -3% or over -900 pts.

In the currency markets, Dollar is under broad based selling pressure and is trading all in red against others for the day and the week. Yen rides of strong risk aversion and is trading as the strongest one since yesterday. In particular, USD/JPY’s firm break of 105.24 support now open up the case through 100 handle.

US-China trade war starts

Trump announced tariffs on USD 50-60b of annual imports from China. He noted that “this is the first of many”. The White House added that it was also seeking to impose new investment restrictions on Chinese companies. Initial reaction was muted as what was announced was a big difference to rumor of USD 50b in tariffs. Nonetheless, the selloff in stocks and rally in Yen picked up momentum in the last trading hour, as traders dumped their position ahead of China’s retaliation measures.

In Asian session, China’s Ministry of Commerce announced measures countering US tariffs. But it should be noted that these measures are in response to Trump’s steel and aluminum tariffs, not the USD 50b section 301 tariffs announced overnight. China also said it could take legal action regarding the steel tariffs under WTO rules. So far, it appears that China is trying to play by the book.

The MOFCOM proposed a list of 128 US imports with total value at over USD 3b in 2017. A 15% tariff will be imposed on the first group including wines, fresh fruit, dried fruit and nuts, steel pipes, modified ethanol, and ginseng. Then a 25% tariff could be imposed on the second group, including pork and recycled aluminium goods if both sides failed to reach a resolution through talks.

Trump exempted over 50% of steel imports from tariffs, but not Japan nor Taiwan

Separately, Trump also announced temporary suspension to the steel and aluminum tariffs, until May 1, 2018. The final result will depend on the discussions outcome. The countries that are temporarily exempted include Argentina, Australia, Brazil, Canada, Mexico, EU and South Korea.

According to Wood Mackenzie data, in 2017, the top 10 steel importer to US are Canada (16.7%), Brazil (13.2%), South Korea (9.7%), Mexico (9.4%), Russia (8.1%), Turkey (5.6%), Japan (4.9%), Germany (3.7%), Taiwan (3.2%), China (2.9%).

The total contribution of the exempted countries is 52.7%. Meanwhile, two notable absentees are Japan and Taiwan. Japanese’s request for exemption seemed to have fallen on deaf ears. Both Japan and Taiwan are seen by many as the closest allies of the US in the far east.

Japan CPI core hit 1% for the first time since 2014

Japan national CPI core accelerated to 1.0% yoy in February, up from 0.9% yoy and met expectation. That’s also the first time it hits 1% level since August 2014. The so called core-core CPI, CPI excluding fresh food and energy, rose to 0.5% yoy.

Newly appointed BoJ deputy governor Masazumi Wakatabe said in the parliament that the reading, especially the core-core CPI, showed that Japanese inflation expectation remain weak. He noted that “when compared to the United States or Europe, gains in Japan’s core-core CPI are insufficient.” He added that “what we can learn from this is that people still don’t believe inflation will reach 2 percent.” And, “inflation expectations are not anchored.”

And he pledged to “maintain the regime and stance we have in place for monetary policy to meet 2 percent inflation and to strengthen it if possible.”

BoE voted 7-2 to leave bank rate unchanged yesterday

While Sterling pared back much again after BoE rate decision yesterday, it’s still among the strongest ones for the week. BOE voted 7-2 to leave the Bank rate at 0.50%. For the two dissents, Ian McCafferty and Michael Saunders, who opted for a hike this month, they believed that “slack was largely used up and that pay growth was picking up, presenting upside risks to inflation in the medium term. A modest tightening of monetary policy at this meeting could mitigate the risks from a more sustained period of above-target inflation that might ultimately necessitate a more abrupt change in policy and hence a greater adjustment in growth and employment”. More in BOE Voted 7-2 to Leave Bank Rate Unchanged at 0.50%

Suggested reading on BoE: BoE Still on Track for a May Hike

Looking ahead

Canada CPI and retail sales will be the main focus today. Canadian Dollar has been strong this week on optimism over NAFTA renegotiation. But more is needed to solidify bullish momentum. US will also release durable goods orders and new home sales.

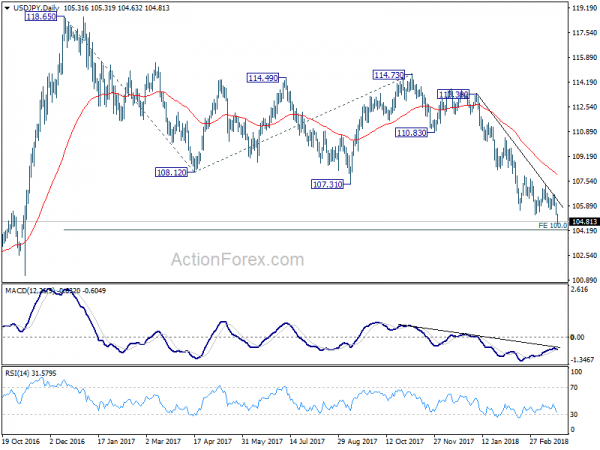

USD/JPY Daily Outlook

Daily Pivots: (S1) 104.99; (P) 105.53; (R1) 105.82; More…

USD/JPY dives to as low as 104.63 so far as decline accelerates. Firm break of 105.24 support confirms resumption of decline from 114.73. Such fall is part of the whole pattern from 118.65. Intraday bias now stays on the downside for 100% projection of 118.65 to 108.12 from 114.73 at 104.20 next. Sustained break there will pave the way to 98.97 (2016 low). On the upside, break of 106.63 resistance is needed to indicate short term bottoming. Otherwise, outlook will remain bearish in case of recovery.

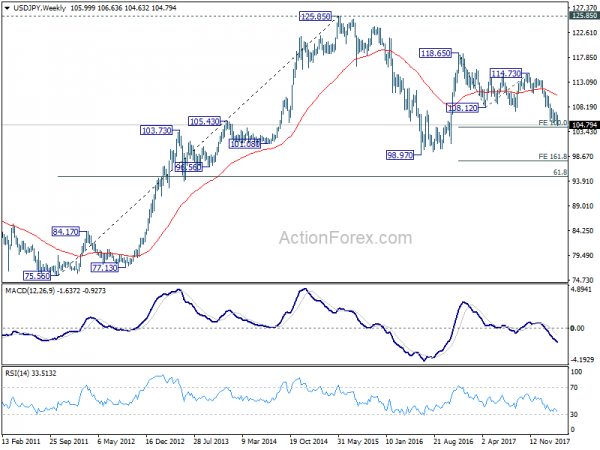

In the bigger picture, medium term down trend from 118.65 2016 high is still in progress and extending. Build up in downside momentum argues that it might be extending the whole corrective pattern from 125.85 (2015 high). 100% projection of 118.65 to 108.12 from 114.73 at 104.20 will be a key level to watch as firm break there could bring downside acceleration. And in that case, 98.97 key support level (2016 low) would at least be breached. This bearish case will now be favored as long as 108.12 support turned resistance holds.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:30 | JPY | National CPI Core Y/Y Feb | 1.00% | 1.00% | 0.90% | |

| 12:00 | GBP | BoE Quarterly Bulletin | ||||

| 12:30 | CAD | CPI M/M Feb | 0.50% | 0.70% | ||

| 12:30 | CAD | CPI Y/Y Feb | 2.00% | 1.70% | ||

| 12:30 | CAD | CPI Core Common Y/Y Feb | 1.90% | 1.80% | ||

| 12:30 | CAD | CPI Core – Median Y/Y Feb | 1.90% | |||

| 12:30 | CAD | CPI Core – Trim Y/Y Feb | 1.80% | |||

| 12:30 | CAD | Retail Sales M/M Jan | 1.20% | -0.80% | ||

| 12:30 | CAD | Retail Sales Ex Auto M/M Jan | 0.90% | -1.80% | ||

| 12:30 | USD | Durable Goods Orders Feb P | 1.70% | -3.60% | ||

| 12:30 | USD | Durables Ex Transportation Feb P | 0.50% | -0.30% | ||

| 14:00 | USD | New Home Sales Feb | 621K | 593K |