Bets for a Bank of England rate hike in May received a major boost this week after the United Kingdom and the European Union reached a deal on a 21-month transition period that would come into effect when Britain officially leaves the bloc at the end of March 2019. The positive development is likely to sway BoE policymakers in favour of signalling a rate increase in May when they convene on Wednesday and Thursday for a two-day monetary policy meeting. No change in interest rates or to the quantitative easing program is expected on Thursday.

The Bank struck a hawkish tone at the February policy meeting with Governor Mark Carney saying that rates would need to be raised “somewhat earlier and to a somewhat greater extent than we had thought in November”. There was more hawkish rhetoric at the inflation hearing before Parliament’s Treasury Select Committee on February 21. The normally dovish Andy Haldane, the Bank’s chief economist, warned that the balance of risks to the path of interest rates needed to return inflation to target is to the upside.

A transition deal is an important component in the Bank’s decision making as it would maintain the status quo for British firms to remain in the single market until at least the end of 2020, helping businesses plan forward. But with that uncertainty now seemingly lifted, the focus has shifted solely on economic indicators.

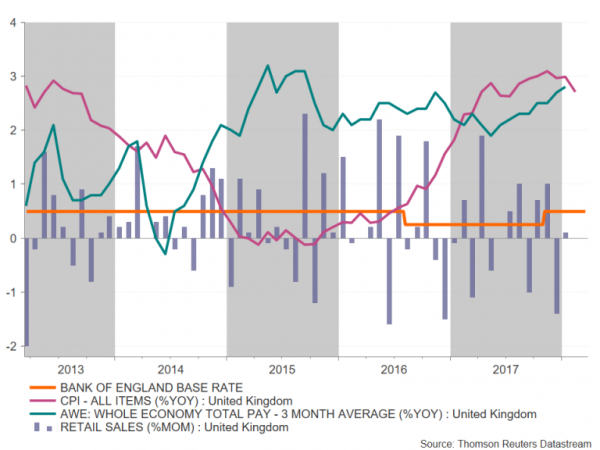

Annual inflation in the UK moderated by slightly more than forecast to 2.7% in February from 3.0% in January, according to data released on Tuesday. This suggests the spike in inflation generated by the plunge in sterling after the Brexit vote is now starting to drop out of the calculations. Consequently, this is raising some eyebrows among some market analysts about the BoE’s overly hawkish inflation outlook.

The Bank’s main worry is that the limited slack available in the economy and the tightening labour market will keep inflation above its 2% target without some gradual rate increases over the next 2-3 years. However, wage growth remains muted by historical standards even after firming to 2.8% in the three months to January, as per Wednesday’s data. The decline in the number of EU migrants heading to the UK since the Brexit vote may be accentuating the upside risks to wages at a time when the jobless rate is running at a four-decade low (4.3% in January). But like in the United States, there is yet to be any convincing evidence of a more sustained pick-up in wages.

The final piece of data the Monetary Policy Committee (MPC) will have to analyse before their policy decision on Thursday will be the retail sales figures for February. After slumping by 1.5% in December and stalling in January, sales are expected to have rebounded in February, rising by 0.4% over the month. A worse-than-expected figure could weaken the MPC’s growth outlook in the medium term given that private consumption accounts for about 65% of UK GDP, while a stronger rebound would underscore the Bank’s view that the economy should continue expanding at a moderate rate.

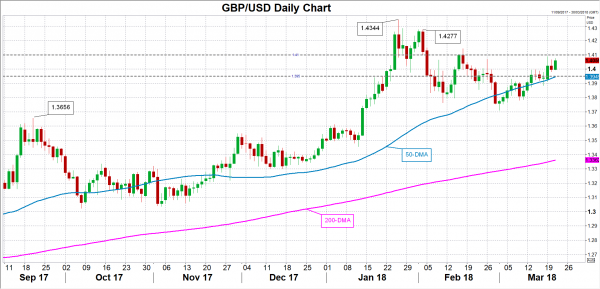

Sterling, which rallied to a one-month high after Monday’s announcement of a transition deal but met resistance just below the $1.41 level, could break above the aforementioned key handle if the BoE confidently flags a rate hike at its next meeting in May. A climb above $1.41 would bring into scope the February peak of $1.4277. However, should the Bank opt for a more cautious stance and fail to clearly signal a Spring move, the pound could drop back below the $1.40 level towards the 50-day moving average around $1.3950.

Many analysts think the BoE has backed itself into a corner by communicating a rate hike path at a time when UK growth is lagging its European peers and when the Brexit negotiations are ongoing. Should the UK and the EU fail to reach a post-Brexit trade deal, the Bank may be forced to undo its rate hikes. But even in the event of a positive conclusion to the Brexit talks, many economists don’t see the need for monetary tightening at the current pace of economic expansion. In support of the Bank, however, is the improvement in real incomes. As earnings head for 3% annual growth and inflation falls towards 2%, rising real wages should drive consumption higher over the coming months, shifting the risks clearly to the upside