The Reserve Bank of New Zealand (RBNZ) will announce its rate decision on Wednesday at 2000 GMT, and policymakers are widely anticipated to stand pat. Given the lack of major developments recently, the Bank seems unlikely to alter its neutral tone, and the financial community appears to view this meeting as a “non-event”. With very few expecting the RBNZ to say anything new though, the Kiwi may be at risk as even small language changes could have a market impact, especially if the Bank flags increasing trade tensions as a key downside risk.

Developments since the RBNZ last met in February have been broadly mixed. On the positive side, business confidence rebounded off its recent lows, while the terms of trade were surprisingly strong in Q4, painting a rosier picture for exports. Meanwhile, gains in housing prices remained moderate, which is important as the Bank was previously worried that rapidly rising house prices posed risks to financial stability. On the downside, GDP for Q4 came in at 0.6% quarter-on-quarter, a touch softer than the RBNZ’s estimate of 0.7%. Moreover, the recent escalation in protectionist rhetoric from the US and the rising probability of a “trade war” will no doubt worry the Bank, as New Zealand is an export-focused economy.

While none of the above is significant enough at the moment to warrant a shift in the RBNZ’s neutral stance, there are two additional reasons for the Bank not to change tone: upcoming leadership and mandate changes. This will be the last gathering under current Governor Grant Spencer, before the new Governor Adrian Orr takes over later this month. As for the mandate, the RBNZ’s directive will soon be expanded to promote full employment in addition to price stability. Importantly though, the specific wording of the new mandate has not been revealed yet. Thus, policymakers are currently faced with a great deal of uncertainty, as the exact phrasing and details of the mandate could be crucial to their future decisions, implying they are unlikely to want to pre-commit to anything at this stage.

Therefore, everything points to a “steady as she goes” policy message from the RBNZ, not tipping the scale in either direction and maintaining a highly data-dependent approach regarding the timing of any rate hike in New Zealand. Still, there are risks in terms of market action. In a complacent environment where very few investors expect the RBNZ to say anything new, even minor changes to the policy statement can have a notable impact in the foreign exchange market, as they could come as surprises. For example, although it’s still early for the RBNZ to appear particularly worried about trade, given that there are so many unknowns, the Bank could still issue a preliminary warning that an intensification in these risks would likely have implications for policy.

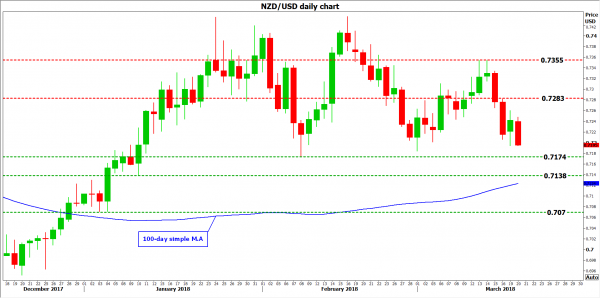

At the time of writing, markets see a 25% probability for the RBNZ to hike rates this year. A worried message by the Bank – one that conveys anxiety about increased protectionism for instance – could push that probability lower, and the Kiwi down with it. Kiwi/dollar may break back below the February low of 0.7174, and aim for a test of the 0.7138 zone, marked by the January 10 troughs. Even steeper declines after that could encounter support around the 0.7070 barrier, marked by the January 4 lows.

Conversely, a more upbeat policy message that is interpreted as making a rate hike this year more likely, could spell good news for New Zealand’s currency. In this case, kiwi/dollar may edge higher and test the 0.7283 barrier, identified by the highs of March 2 and the inside swing low on March 12. An upside break of that area could set the stage for further advances towards the peak of March 14, at 0.7355.