Global markets tumbled on concern that US President Donald Trump is finally starting the steps towards a full blown trade war with China. DOW ended down -0.68%, or -171.58 pts at 25007.03. S&P 500 also lost -0.64%, or -17.71 pts to 2765.31. NASDAQ, which reached a new record high at 7637.27, reversed and closed down -1.02%, or -77.31 pts at 7511.01. Asian markets follow with Nikkei trading down -0.7%, HK HSI down -1.3% and China SSE down -0.5% at the time of writing.

In the currency markets, Dollar is under broad based pressure today, it’s trading as the second weakest for the week, just next to Canadian Dollar. Sterling is the strongest one for the week, followed by Swiss Franc.

Trump clearing the way on measures to push back China threats

Trump fired Secretary of State Rex Tillerson after some clashes, and replaced him by Mike Pompeo, Director of the CIA. That’s less than a week after departure of White House economic advisor Gary Cohn. Both Tillerson and Cohn are seen as the globalists in Trump’s team. And their departure, is another step in the protectionist direction. Also, Pompeo is known for endorsing “pushing back against the Chinese threat”.

Separately, it’s reported that Trump is preparing a new package targeted at China, on trade and investments. There could be as much as USD 60b tariffs on Chinese goods. The tariffs, associated with a “Section 301” intellectual property investigation, under the 1974 US Trade Act begun in August last year, could come in the very near future.

And, White House blocked semi-conductor manufacturer Broadcom’s bid for the semiconductor maker. Trump declared earlier in the week that the proposed US$117B deal was prohibited on national security grounds. He noted that “there is credible evidence” that Broadcom through control of Qualcomm “might take action that threatens to impair the national security of the United States”. Indeed, it is believe that the key reason behind is the US concern over Broadcom’s business practice of cost reduction. It is concerned that the company would reduce investment and weaken Qualcom’s 5G development roadmap, thus weakening US position in the technology and giving way to China to take the lead.

BoJ Kuroda repeated his message: Long way from meeting inflation target

BoJ Governor Haruhiko Kuroda repeated his rhetorics that Japan is still long way from meeting the 2% inflation target. Therefore, it’s too early to talk about stimulus exit. But he assured the parliament that the central bank has the tools to smoothly exit from the ultra-loose monetary policy when needed. Kuroda added that “by combining various tools, it’s possible to shrink the BoJ’s balance sheet at an appropriate pace while keeping markets stable.” Meanwhile, he also hailed that while keeping long term yield low with the policy, BoJ also managed to maintain markets’ trust in JGBs. He noted “If market trust over Japan’s debt is eroded, it will be difficult for us to keep interest rates low with our yield curve control policy.”

Release earlier, minutes of BoJ January meeting showed that some board members were concerned with the impact of the loose monetary policy, especially on banks. The minutes showed “some members said it was important to continue to monitor and assess the positive impacts and side-effects of the current monetary easing policy, including its effects on Japan’s banking system.” Some member suggested to raised the yield target as economy improves. But another member (obviously Goushi Kataoka), called for ramping up the stimulus.

Canadian Dollar tumbles as markets interpreted Poloz as dovish

BoC Governor Stephen Polo sounded quite balanced on the labor market in his speech overnight. But markets looked at the dovish side of it. Poloz said there are untapped potential in the economy, including workforce by youth, women, indigenous peoples, Canadians with disabilities and recent immigrants to Canada. And, he added “it is not much of a stretch to imagine that Canada’s labour force could expand by another half a million workers.” On the other hand, he noted that participation rate usually declines during recessions and rebounds on recovery. But “that has yet to occur for young Canadians”. He over tone suggested there could be larger slack in the labor market and the economy could handle more growth without inflation. The markets interpreted that as a warning that tightening may not happen as fast as they expected. But after all, to us, NAFTA renegotiation is the most critical factor for BoC ahead.

On the data front

New Zealand current account deficit narrowed to NZD -2.77b in Q4. Australia Westpac consumer confidence rose 0.2% in March. Japan machine orders rose 8.2% mom in January. China retail sales rose 9.7% yoy in February, industrial production rose 7.2%, fixed assets investment rose 7.9% yoy.

Looking ahead, German CPI, Eurozone industrial production and employment will be featured in European session. US retail sales, PPI and business inventories will be featured later in the day.

EUR/USD Daily Outlook

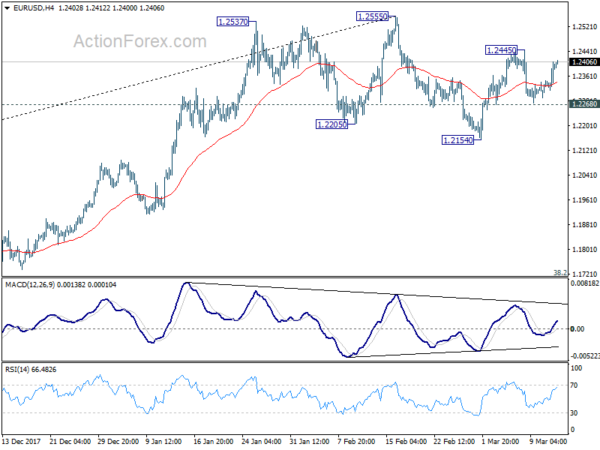

Daily Pivots: (S1) 1.2334; (P) 1.2370 (R1) 1.2427; More….

EUR/USD’s rebound continues today. While intraday bias remains neutral, focus is back on 1.2445. Break there will turn bias back to the upside for 1.2555 high. Decisive break there will carry larger bullish implication. But again, break of 1.2268 will argue that fall from 1.2555 is likely resuming. And intraday bias will be turned back to the downside for 1.2154 support and below.

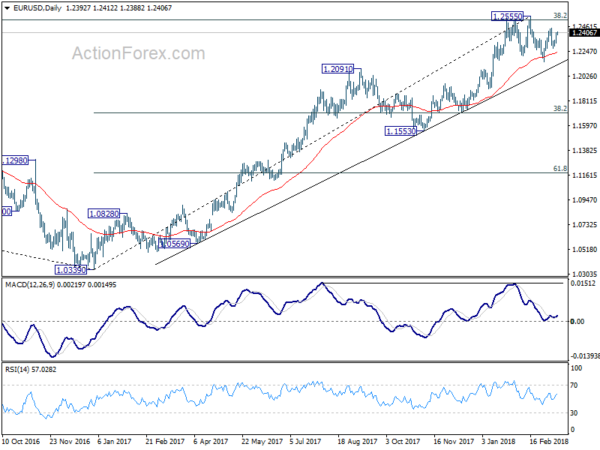

In the bigger picture, key fibonacci level at 38.2% retracement of 1.6039 (2008 high) to 1.0339 (2017 low) at 1.2516 remains intact despite attempts to break. Hence, rise from 1.0339 medium term bottom is still seen as a corrective move for the moment. Rejection from 1.2516 will maintain long term bearish outlook and keep the case for retesting 1.0039 alive. Firm break of 1.1553 support will add more medium term bearishness. However, sustained break of 1.2516 will carry larger bullish implication and target 61.8% retracement of 1.6039 to 1.0339 at 1.3862.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 21:45 | NZD | Current Account (NZD) Q4 | -2.77B | -2.45B | -4.68B | -4.83B |

| 23:30 | AUD | Westpac Consumer Confidence Mar | 0.20% | -2.30% | ||

| 23:50 | JPY | BOJ Minutes of Policy Meeting | ||||

| 23:50 | JPY | Machine Orders M/M Jan | 8.20% | 5.20% | -11.90% | -9.30% |

| 2:00 | CNY | Retail Sales Y/Y Feb | 9.70% | 10.00% | 9.40% | |

| 2:00 | CNY | Industrial Production Y/Y Feb | 7.20% | 6.30% | 6.20% | |

| 2:00 | CNY | Fixed Assets Ex Rural Y/Y Feb | 7.90% | 7.00% | 7.20% | |

| 7:00 | EUR | German CPI M/M Feb F | 0.50% | 0.50% | ||

| 7:00 | EUR | German CPI Y/Y Feb F | 1.40% | 1.40% | ||

| 10:00 | EUR | Eurozone Industrial Production M/M Jan | -0.40% | 0.40% | ||

| 10:00 | EUR | Eurozone Employment Q/Q Q4 | 0.30% | 0.40% | ||

| 12:30 | USD | Retail Sales Advance M/M Feb | 0.30% | -0.30% | ||

| 12:30 | USD | Retail Sales Ex Auto M/M Feb | 0.40% | 0.00% | ||

| 12:30 | USD | PPI M/M Feb | 0.10% | 0.40% | ||

| 12:30 | USD | PPI Y/Y Feb | 2.80% | 2.70% | ||

| 12:30 | USD | PPI Core M/M Feb | 0.20% | 0.40% | ||

| 12:30 | USD | PPI Core Y/Y Feb | 2.60% | 2.20% | ||

| 14:00 | USD | Business Inventories Jan | 0.60% | 0.40% | ||

| 14:30 | USD | Crude Oil Inventories | 2.4M |